silver

2015 Elite Agenda

Pastor Williams tells us that 2015 will be the most eventful year you or I have ever lived. Everyone must understand the following: Cycles of seven, Elite riot control, Blood moons, Where the Elite hospital is (You Will Need It), How much time do we have?, Iraq – Jordan – Lebanon – Syria.

*** You have to get gold and silver, immediately! You must hold it in your hand. You can buy Gold and Silver Coins and Bars at Wholesale prices and with Free Shipping on Orders over $199, through our Recommended Gold and Silver Dealer. Check out the special gold and silver offers here.

*** If you have an IRA or 401k you need to rollover your Retirement Account into Gold and Silver Bullion as soon as possible! Time is short! You can find out more about the process of turning your paper assets into Physical Gold and Silver by Clicking Here and talking to this Gold and Silver IRA Specialist.

This DVD was released on July 14th, 2014. It's more poignant now than it ever was. Prepare immediately!

This presentation of the 2015 Elite Agenda from Pastor Lindsey Williams is required viewing by all Americans. Please share this presentation with everyone you know.

Confessions of an Elitist

Pastor Lindsey Williams shares the confessions of an elitist which was recorded on two audio CDs in 2010. These audio CDs have not been shared until now.

*** You have to get gold and silver, immediately! You must hold it in your hand. You can buy Gold and Silver Coins and Bars at Wholesale prices and with Free Shipping on Orders over $199, through our Recommended Gold and Silver Dealer. Check out the special gold and silver offers here.

*** If you have an IRA or 401k you need to rollover your Retirement Account into Gold and Silver Bullion as soon as possible! Time is short! You can find out more about the process of turning your paper assets into Physical Gold and Silver by Clicking Here and talking to this Gold and Silver IRA Specialist.

These two audio CDs were released in 2010 as an update and addition that came with the DVD set ‘The Elite Speak' which you can see here.

This presentation is more important now than it ever was. Prepare immediately!

This presentation of Confessions of an Elitist from Pastor Lindsey Williams is required viewing by all Americans. Please share this presentation with everyone you know.

This playlist contains the Two Original Audio CDs from Chaplain Lindsey Williams.

Tragedy Hope Reality

The Elite have altered their timeline and have established a two-year agenda.

- Tragedy: In this DVD, you will know how much time you have – What will happen in America over the next two years according to the Elites plans – It is called, “The Devils Messiah.” What does this term mean?

- Hope: This DVD is all about MONEY according to the Elite. You will be so poor you will not be able to rebel against the Elite. What the Elite have planned for gold and silver prices (Their Currency). When is war scheduled?

- Reality: Buzz words and how to listen to them. A forecast of scheduled events in chronological order. 2012 – Their plans. AMERICA'S ONLY HOPE – DIVINE INTERVENTION.

This presentation of Tragedy Hope Reality from Pastor Lindsey Williams was created by Stan Johnson of The Prophecy Club and is required viewing by all Americans. The information is still relevant now, even more so. Please share this presentation with everyone you know.

*** You have to get gold and silver, immediately! You must hold it in your hand. You can buy Gold and Silver Coins and Bars at Wholesale prices and with Free Shipping on Orders over $199, through our Recommended Gold and Silver Dealer. Check out the special gold and silver offers here.

*** If you have an IRA or 401k you need to rollover your Retirement Account into Gold and Silver Bullion as soon as possible! Time is short! You can find out more about the process of turning your paper assets into Physical Gold and Silver by Clicking Here and talking to this Gold and Silver IRA Specialist.

This playlist contains All Three Original DVDs from Chaplain Lindsey Williams.

The Secrets Of The Elite

You must know The Secrets of the Elite (Mindset) in order to survive the New World Order. Now you will hear the hidden Secrets of the Elite. See and hear a Wall Street Insider who appears on Lindsey Williams' DVD for the first time with his story. Four prominent professionals explain – Insider trading – Derivatives – What congressmen, judges, and some lawyers know that you are never told. Learn what the younger Elite are taught.

This presentation of The Secrets Of The Elite from Pastor Lindsey Williams, released in May 2012, is required viewing by all Americans. The information is still relevant now, even more so.

*** You have to get gold and silver, immediately! You must hold it in your hand. You can buy Gold and Silver Coins and Bars at Wholesale prices and with Free Shipping on Orders over $199, through our Recommended Gold and Silver Dealer. Check out the special gold and silver offers here.

*** If you have an IRA or 401k you need to rollover your Retirement Account into Gold and Silver Bullion as soon as possible! Time is short! You can find out more about the process of turning your paper assets into Physical Gold and Silver by Clicking Here and talking to this Gold and Silver IRA Specialist.

This playlist contains All Three Original DVDs from Chaplain Lindsey Williams.

[UPDATED] Lindsey Williams – Important Update! Trump and the Economy

UPDATE: Since I sent out this newsletter on Monday, 24th February 2020 the following events have taken place:

- Dow Jones Industrial Average: Down to 27,004.72. A fall of 2,546.7, which is 9%.

- S&P 500: Down to 3,116.39. A fall of 221.29, which is 6.8%.

- Oil is down from 51.43 on Monday to 48.06. A fall of 3.37, which is 6.7%.

- Gold went up to 1672.40 and is down to 1616.60. A fall of 1.4%.

- Silver went up to 18.87 and is down to 18.07. A fall of 4.3%.

- Bitcoin: Down to 8715.01. A fall of 18.3%.

- 10Y Treasury Bond yields down to a historic new low of 1.31. A fall of 37.7%.

All of these considerable changes in such a short period of time tell me that the market is now becoming much more volatile. a 9% fall in the DJIA in just 3 days. I had to think to myself, where did all the money go that got wiped from the market? Where is all that money sitting right now? Tax havens in cash?

What concerns me the most is Treasury Bond yields are down 37.7% in 3 days! This is extremely worrying because if that continues it will be yielding negative returns sooner.

Even Warren Buffett is concerned, he said that markets can drop ‘50% magnitude or even greater!'

Pastor Williams said the timing of this newsletter is perfect with what the stock market was doing on Monday. He said he agreed with what I wrote and to send the newsletter to everyone on his list. Therefore, this is going out to all subscribers.

Do what you can to protect yourself from a volatile financial market. Do it sooner than later. As Pastor Williams has said time and again, “Gold is the currency of the Elite!” and for good reason!

Hi, this is James Harkin, webmaster and editor at LindseyWilliams.net I am writing to you today with regards to updates from Pastor Williams. Pastor Williams has not released a new DVD in over a year and I know some of you are concerned. I messaged him at the beginning of February regarding the many messages I have received on his behalf from visitors to LindseyWilliams.net. He told me that he had also received many phone calls and emails from people begging for updates. I asked if I could send out a newsletter on his behalf and he agreed. Pastor Williams stated to me once again:

‘As long as President Trump is in office you are safe. Make it while you can because once Trump is no longer in office, you don’t want to know what is planned.

The Elite are really having a problem with President Trump, they can’t impeach him and God will not let them get rid of him.’

Pastor Williams also said that he will make an update as soon as he is positive he knows what he is saying is true. He said that he’d been right for forty years and he doesn’t want to be wrong now by guessing. This being said I believe we are definitely in a period of calm before the storm.

I have been watching the markets myself and I understand why many of you are asking Pastor Williams for updates, for the last few months there have been some interesting developments regarding liquidity in the financial markets. This is not to do with the Coronavirus as this downturn started prior to the outbreak, however, the lockdown of China will have some effects on the real economy and the manipulation will be evident as we get further into 2020. I am not a financial advisor and I recommend that you discuss with one before making any changes to your finances based upon the information I am going to share with you.

Virtual & Real Economy Out Of Balance

There is a split between the virtual and the real economy. The real economy is the production of real-world products and services. The virtual economy is the production of finance, stocks, bonds, and financial derivatives. This split comes as the virtual economy over-expands causing the restriction of the real economy. When the price of virtual assets rises sharply a lot of liquidity capital will flow from the real economy to the virtual economy which hinders the financing and development of the real economy. This is where we are right now.

New Stock Market Highs

Remember in June 2017 I shared a video from an analyst who said that the Dow Jones Industrial Average could rocket to 50,000. Well since June 2017 the Dow Jones has risen from 21,136.23 to 29,551.42 which is a rise of approximately 39.8%. However, since February 2009 the Dow Jones Industrial Average has risen approximately 244% from 8,588.52. In the S&P 500, there was a low on 13 March 2009 of 756.55 but that has ballooned to 3,380.16 earlier this week which shows a rise of approximately 346.7%. Analysts have said that the current growth of the S&P 500 is in direct correlation to the Fed’s Repo operations which means the stock market isn’t rising organically.

Job Losses

Companies all over the US such as Pfizer, JPMorgan Chase &Co, AT&T, General Motors, Kimberley-Clark, Comcast, Harley-Davidson, Walmart, Citibank, McDonald’s, Hewlett-Packard, Tenet Healthcare, Carrier, Tesla, Microsoft, Schneider Electric, Morgan Stanley, Coca-Cola, Boeing, and Dunkin’ Donuts have all cut jobs. All the while these companies are recording billions in profits. Boeing, for example, made a loss, its first loss in two decades and its stock price went up! In January alone Manufacturing lost 12,000 traditionally higher-wage jobs. 53% of the 225,000 jobs added in January 2020 were low-paying.

Retail Is Dying

Retail is decreasing at a rapid rate. Payless Shoes, Gymboree, Dress Barn, Charlotte Russe, Fred’s, Family Dollar, Shopko, Charming Charlie, Pier 1 Imports, Papyrus, Destination Maternity, Chico’s, Gap, Avenue, Walgreens, GameStop, Forever 21, Sears, Bose, LifeWay, Kmart, Earth Fare, Bed Bath & Beyond, The Kitchen Collection, Lucky’s Market, A.C. Moore, Performance Bicycles, Macy’s, Olympia Sports, CVS, Hallmark, JC Penney, and many more retailers have either closed stores or ceased trading altogether.

Reducing Capital Expenditure

Companies have cut back on capital expenditure and since August 2018 capital goods expenditure is down from 98 Billion to 79 Billion in December 2019. That’s a reduction in capital goods expenditure by 18% since August 2018. Since the tax breaks were put in by Trump 82% went to the 1%. This money did not go back into real economy capital expenditure it was put into formerly illegal stock market buy-backs, they were seen to be a form of insider trading, to prop up stock prices. The same way corporations have used leverage to increase their stock prices from all the virtually free money made available. Trump’s tax cuts will add approximately $2 Trillion to deficits over 10 years. The national debt is now $22 Trillion and the US Budget Deficit will be $1.1 Trillion in 2020. $576.4 Billion of that deficit went on Interest in 2019, that’s over 41%!

Global Real Economy

We can see global trade slowing, which is the real economy. In September 2019 the Baltic Dry Index was at a high of 2462 and it was down to 415 earlier this month, an 80% reduction since September 2019. The copper market, which Pastor Williams also follows is also down. In February 2019 it was 6394 and at the end of January 2020, it 5569 showing the demand for copper has fallen. Oil has fallen since the start of the year from 63.27 to as low as 49.57 earlier this month.

What About Gold & Silver

Gold has been on the rise since its low of 1050.80 in December 2015. Now up to 1616.60 at its last close, that’s just 273.10 off the historical high of 1889.70 in 2011. It was approximately 1474.70 on 23 December and in the 60 days since it has risen 141.90 which is a 9.18% increase in 2 months. If things continue as they have these past few months, gold could surpass its 2011 historic high in the next 3 months.

Silver too is up. Silver's peak of $48.58 in 2011, and has risen significantly since its last low in December 2015 of $13.67 to a current high of $18.29 earlier this week. The market during Trump's first term has been relatively static. However, it seems that things may be moving. Some analysts have stated that silver is quite undervalued compared to gold and may rise 30% this year and others have said silver may outperform Bitcoin in 2020. Speaking of Bitcoin, its peak of $19,783.21 in November 2017 and has risen significantly since its last low since then in December 2018 of $3,194.96 to a current high of $10,474.20 earlier this week.

So there’s proof that the real economy is contracting while the virtual economy is expanding. This has created a bubble that has been propped up by the Federal Reserve with its injections of hundreds of billions of dollars into the Repo Market and Treasuries purchases.

The Repurchase (Repo) Market

Repo stands for Repurchase. The Repo Market is one of the places where banks get liquidity, usually overnight loans. It is popular among banks because the money in this market is cheap. The collateral of the loan is repurchased the next day and in exchange for this transaction, the lender gets a fee. Recently Repo Market started changing from only using the safest treasury securities as collateral and now they have started using riskier types of securities. The other type of Repo product is a tri-party repo which involves three parties, the borrower, the lender and an intermediary which is a clearing bank that makes it easier for investment banks to make deals. The problem is reputation. Many banks prior to the 2008 crash were using collateral in mortgage-backed securities and CDOs, which they still do. Banks started to back away from lending. Investment banks were not able to roll-over their debt the next day and those banks went bankrupt or were bailed out by the government, which means the taxpayer pays and it’s still going on today.

Fed’s Repo Intervention

The Federal Reserve has been subsidizing Investment banks with its ongoing repo operations because its rate is below the market’s rate. The Federal Reserve is no longer the lender of last resort. Repo interference by the Fed has kept the overnight rates artificially suppressed to meet the rising demand of banks for liquidity. This has been going on for a while, since September. It was said that JP Morgan Chase & Co withdrew $158 Billion from the Repo market through 2019 and was reluctant to lend out what it had left to other banks. As the base money began to shrink and the number of assets including mortgage-backed securities began to grow banks started to limit their exposure and the interest for repurchasing agreements went up. The Federal Reserve has pumped over $500 Billion into the Repo Market since October 2019. This has reduced the Overnight Repo Rate. The Repo rate had been steadily increasing since the beginning of 2016. Recently the Federal Reserve has said it would reduce its repurchase-agreement operations however banks still do not want to lend to each other, even overnight. This could cause problems for investment banks if they are not able to roll-over their debts and it’s likely the Fed will continue to intervene within the Repo market.

More Fed Interference

In October 2019 The Federal Reserve started purchasing $60 billion worth of Treasury bills every month to control its benchmark interest rate. Supposedly this will add additional capital to bank reserves and ease worries of bank liquidity. What has happened is as The Federal Reserve has been pumping all this liquidity into the financial system the stock market has been steadily going up. They refuse to call this Quantitative Easing although with what the Federal Reserve is doing the effects are similar. That being said the Federal Reserve now considering bailing out Hedge Funds too. All this money printing will bring about deflation. It is deflation and not inflation because taxation funds the deficits and that reduces disposable income. Deflation will bring about lower prices, reduced production and inventories get liquidated, demand drops and unemployment increases. The US will eventually have to devalue its currency just as Japan and the EU did. The US has been kicking the can down the street since Lehman and this is all coming to an end.

Negative Interest Rates

30 Year Bond Yield has reduced from 15% in 1981 to its lowest ever yield of 1.92% on February 21, 2020. Bond Yields have been steadily reducing in return for nearly 50 years. In Germany, the 10 Year Bond Yield is -0.43%. Yes, negative return. This goes the same for Japan, Switzerland, Sweden, Netherlands, and France. It’s been stated by an analyst that many US Pension schemes are the biggest buyer of negative-yielding EU bonds. Some analysts are projecting that by November bonds in the US will be yielding negative interest rates. However, they said the marker for this occurring will be the US entering recession. Negative interest rates mean wealth confiscation. Banks will charge you interest for keeping your money in their bank. This is the modern equivalent of gold confiscation! Pension schemes need a positive yield in order to pay out retirees. If they are buying negative-yielding bonds how are they going to pay retirees?

Pension schemes must delve into riskier investments and they have in the search for yield which increases the value of riskier investments. A lot of these schemes also own commercial property. With retail failing, that will mean a lot of premises left empty or yielding a lower rent. So, Pension schemes are going to be in trouble. But of course, they are covered by Federal Deposit Insurance, but only to a point. If many Pension schemes go bust at one time, what’s the likelihood that retirees will be covered if FDIC goes bust too? Of course, FDIC will be bailed out, but that is the taxpayer paying for financial recklessness once again! So with even more money printed, what about the value of the dollar?

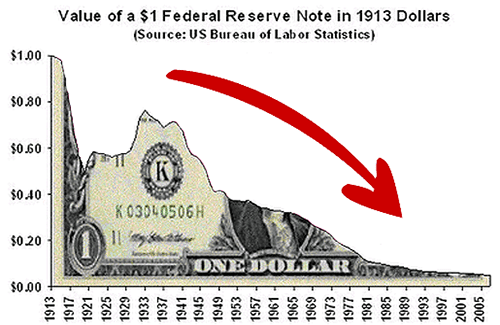

Your Purchasing Power

The purchasing power of the dollar is falling approximately 10% per year compounded. Since 1913 the value of $1 has fallen to $0.0387. Yes, just under 4 cents since the Federal Reserve was created. A 96.13% decrease in purchasing power. In the past 20 years since the turn of the millennium, the dollar has lost 35% of its purchasing power. That means $1 in 2000 is worth $0.65 today. What happens when the government continues to print money? The value of your money reduces causing inflation. However, if the price of goods starts to fall because people do not have the money to buy them deflation happens, which is what Pastor Williams means by ‘Getting ready for the biggest buying opportunity of your lifetime’, which is what happens during a recession.

End of the Free Money Tap

So long as the virtually free money tap is not turned off the stock market will continue to rise. Dow 30,000 is only days away if that. Will it hit 40,000, or 50,000 before a correction must happen. The market is considerably overvalued and according to some analysts, the crash that occurs could be 80% or more wiped from the markets, similar to what happened to the NASDAQ between 2000 and 2002 where 74% was wiped off the market! Will this happen in weeks, months, during Trump’s second term, or after? Pastor Williams has been told by his Elite friend so long as Donald Trump remains president of the United States of America you are safe. Therefore, you either have less than a year or four more years to prepare for the inevitable. We have to ask the question, how much of a correction will there be after 2025 or 2021 if Trump fails to be re-elected because of a recession in the last year of his first term? 80% fall? What if the Coronavirus was a manipulated outbreak in Trump’s last year of his first term to derail his chances at re-election by a real economy slowdown? Will all of this financial manipulation result in the Global Currency Reset Pastor Williams has told us about in his presentation ‘Global Currency Reset’?

Are you prepared?

I asked Pastor Williams about what he said in his 2013 DVD entitled ‘Elite Emergency Data’ where he reiterated you should buy every piece of gold and silver you can lay your hands on. He said I should echo his thoughts from this presentation which are still very much valid today. I wrote a 100-page book that I gave away for free to visitors to LindseyWilliams.net entitled ’10 Steps to Avoid the Crash’. This book has been downloaded over 20,000 times. It discusses the ten steps that Pastor Williams shared from his Elite friend that must be done in order to protect yourself from a volatile financial system. The steps are:

Buy every piece of gold you can lay your hands on, You have to get out of debt, Get out of paper, Pay off your house mortgage, Store food, water, and self-defense equipment, Get ready for the biggest buying opportunity of your lifetime, Get out of the city, Purchase everything you need, Sort out your medicine cabinet, & last but not least Get your spiritual house in order.

It is important for you to know that Pastor Williams has not changed his mind about this, these steps are as important today as they were when he first stated them. He has said in his recent DVDs ‘Make it while you can’ because Donald Trump is the President of the United States of America is slowing down the Elites plans for humanity and the world. This is giving you more time to prepare. Pastor Williams has stated that when President Trump is no longer in office it could be ‘devastating’ to the American people.

Remember, the Elite have not gone away they are biding their time and still working on their plan to dismantle the last superpower. I understand this because all manufacturing has gone away to other countries like China. The Coronavirus has proven that the global real economy is an integrated system and if you disable one part it can affect everything. If a manufacturer of automobiles such as General Motors has parts made in China and it cannot get its “Just-In-Time” manufactured parts delivered because the factory has been shut down because of the outbreak, this will stop the production of vehicles in the US. This then affects the sales of that manufacturer since they cannot sell their products without all the parts assembled. The real economy slowdown will come sooner than the inevitable virtual economy crash.

I wrote the book ‘10 Steps to Avoid the Crash’ in 2013 because I thought it was important for people to understand what was going on. I am currently writing an updated version of the book that will include several new chapters that you must know to protect yourself and your family from any type of crash. The new guide will include sections on finding new multiple-sources of income, bartering, budgeting, growing your own food even if you don’t have much land, as well as other ways in which you can survive and thrive in both a good or a horrible economy. The new book is nearly complete and I will be giving it away again for free to everyone who wants it. I will be sending out an email soon to all of the subscribers on Pastor Williams’ email list so you can get your copy.

In the meantime, my recommendation is to protect your purchasing power today with Gold, Silver & Bitcoin. Gold, Silver, and Bitcoin are valid investments and can be used in retirement portfolios including 401(k) and IRA. Start transitioning at least some of your investments away from the stock market, negative-yielding bonds and other risky investments into physical gold, silver as well as Bitcoin as a hedge from what is inevitable. However, please talk to precious metals and Bitcoin experts who know how to help you based upon your individual investment requirements.

I have been working with a gold dealer that can help you buy physical gold and silver that can be delivered to your home or business. It can be used in your retirement accounts including 401(k) and IRA as a hedge against financial instability. The company I suggest is GoldCo. I like this company because they take the time to understand your investment goals and objectives. They give you a detailed investment plan to build a precious metals portfolio to supplement your existing investments. GoldCo also has a great reputation built upon trust with its customers. They maintain 5-star ratings on consumer trust sites such as Consumer Affairs, Trustlink, TrustPilot, and the BBB. Please do not hesitate to check out the GoldCo website and leave your details for a precious metals expert to contact you. Or you can call them right now toll-free 1-877-414-1385.

Even at Davos, Switzerland the CEO of the largest hedge fund Bridgewater Ray Dalio is saying ‘cash is trash’ and advises to buy gold.

Thank you for your time in reading this article. I hope you understand why it’s taken me quite some time to write. I will continue to update you with anything Pastor Williams sends me.

Regards

James Harkin

Editor & Webmaster

On behalf of LindseyWilliams.net and LindseyWilliamsOnline.com

Precious Metals Are The Only Lifeboat!

The price of gold is down about 11 per cent in 2015 and nearly 45 per cent from its September 2011 nominal peak. Commodity prices are collapsing around the globe amid an economic slowdown. By the Federal Reserve raising rates, it may or may not strike another blow against the gold trade. But, don't tell the gold bugs. The US Mint said it sold 97,000 ounces of American Eagle gold coins in November, marking a 185 per cent monthly jump and a 62 per cent gain from the same period in 2014, Reuters reported. Silver coin demand also surged and already has broken the record it set last year.

Peter Schiff said “The demand is there. It's growing. It's even greater outside the US than domestically … The reality is that there's never been a better time where people should be buying gold than now. Currencies are being intentionally and deliberately debased around the globe, interest rates are at absurdly low levels and likely to stay there for the indefinite future.” He also thinks buying gold and silver is a great way to profit from the coming crises, and he explained that silver whilst having more volatility than gold there is more upside potential in silver relative to gold, given the ratio is very extreme in gold's favor against silver. He also said “I would look in this bull market, when the new bull market resumes, and if gold is $2,000, $3,000, $5,000, wherever it ends up maybe higher than that. I think the appreciation of silver on a percentage basis will be even higher…”

Rob Kirby, a macroeconomic analyst and expert in gold helps his ultra-wealthy clients attain gold by the ton. He says “They can't get enough of precious metals. They scour the earth looking for large amounts of metal … People that I work with represent money so large that they know they're going to end up in the very end game, that they are going to end up with a whole lot of dollars that are going to be worth nothing. They accept that, but in the meantime, they are going to convert as many of those dollars as they can into things that are tangible and are going to maintain value once the world gets it and realizes the US dollar is tapioca and is worth nothing.” Kirby also said “… Gold has a derivative complex, futures and options connected to it where price discovery is nonexistent. People who have an interest in making the dollar look strong can sell paper contracts and keep the real price of gold suppressed.” Can the “powers that be” do this indefinitely? Kirby says, “Not a chance in a finite world. You see, to keep the game running, they need an endless supply of physical precious metal which they don't have. When they run out of physical metal to back up the fraudulent paper exchange, the game runs out.”

Egon Von Greyerz, founder and managing partner of Matterhorn Asset Management AG (MAM) says this about the tight supply of gold and silver “As I have discussed many times, the physical market for gold and silver is very tight. Bullion banks have low stock levels and central banks have leased or sold a major part of their gold. But since they refuse to be properly audited, they are desperately trying to hide the real position. China and India are continuing to buy more than the annual production of gold by the miners. And the supply situation from the refiners is tight with delivery delays for bigger orders.” He also says this about the strength of the US dollar “Gold seems very weak, but that is only in US dollars. In virtually every other currency gold is holding well. That includes the Euro, the Pound, the Canadian dollar, the Australian dollar, the Yen, even the Swiss Franc and of course weaker currencies like the Ruble as well as most others. The dollar is on its last swansong. The strength could last a bit longer but the reserve currency of the world is living on borrowed time. The technical picture for gold is indicating misplaced optimism for the dollar bulls. And fundamentally the most indebted country in the world will soon realize that the road to prosperity cannot be built with printed pieces of paper. No economy that runs budget deficits for over 50 years and current accounts deficits for over 40 years can survive. Retail sales are declining and the major retailers trading is under real pressure. Industrial production is weak and so is housing. Freight and trade is declining fast and these are important advance indicators of economic activity.” On the intrinsic value of paper gold he says “But just like the paper money printing will fail so will the creation of paper gold. It makes absolutely no sense that unlimited supply of paper gold should have any value. I don’t believe that we are far from the point when the paper gold holders will realise that the intrinsic value of their paper is ZERO. The geopolitical situation in the world is also looking very grim. Sadly the war industry is likely to prosper greatly in coming years. And investors in the bubble assets of stocks, bonds and property will see a wealth destruction that they could never have imagined whilst holders of physical gold and silver (held outside the banking system) will maintain their purchasing power and preserve wealth.”

Von Greyerz also said “Gold should not be bought for speculation or for a short term investment. Instead, for the privileged few that have savings, gold should be bought as insurance against a rotten financial system and in order to preserve wealth. But remember it must be held in physical form and stored outside the banking system. When we advised investors in 2002 to put an important percentage of financial assets into gold at $300, our target was $10,000 in today’s money. We still stand by that target as a minimum. The problem for the world is that we are unlikely to have today’s money for very much longer because soon all central banks will print unlimited amounts of money to try save the world financial system from collapsing. But sadly, solving a problem using the same method that caused it will not work and eventually we will see a deflationary implosion of the financial system. But before that we will have a brief period of hyperinflation that in nominal terms could take gold to $100,000 or $100 million.”

38% of all gold in Hong Kong Comex warehouse left on November 13. Roughly 21 tonnes, or 685,652 troy ounces of gold in .999 fine kilo bars, was withdrawn, net of a small deposit of 27,328 ounces, from the Brinks warehouse in Hong Kong. To put that into some perspective, that is the same amount of all gold in the entire JPM warehouse in the US. And that is a potentially dangerous development, especially with respect to a commodity that is being traded at a leverage in excess of 300:1. And in the face of shrinking inventories of gold available for delivery at current prices in both New York and London. And if people should choose to stand for physical delivery given the relative scarcity, how much of a price adjustment might be required if they could even find any to be had without an onerous delay and in sufficient numbers?

300 paper contracts that never result in physical deliver. If the paper contracts were all considered fraudulent, gold would jump in value. $315,000 an ounce?

One of the world's top gold producers says market dynamics may well lead to shrinking gold supplies in the future. Randgold Resources Ltd. CEO Mark Bristow told Bloomberg that half the gold mined today is not viable at current prices. In other words, many mines aren't even hitting their break-even point on half of the gold they dig out of the ground. That means new supplies of gold could begin to dry up in the near future. Amplifying this problem is the fact that many companies have already mined the easily accessible ore on their claims, leaving only gold that will prove much more difficult and expensive to dig out of the ground, according to Bloomberg:

“Gold miners buffeted by the drop in prices are shortening the life of mines by focusing only on the best quality ore, a practice known as high grading, which will restrict future output and support higher prices, according to Bristow. He said in a presentation to bankers in Toronto that the industry life span is down to about five years because companies have been aggressively high grading at the expense of future production.”

The latest World Gold Council Report hints at the coming supply squeeze. Year-over-year quarterly mine production shrank by 1% to 828 tons in the third quarter of 2015.

“The long term indication is that supply will remain constrained as the mining industry continues to proactively manage costs and optimize its operational performance. The reductions in expenditure on activities such as exploration and development will likely have a detrimental effect on production levels in the future.”

Some experts even predict the world will soon reach what is known as peak gold. This means that the amount of gold being pulled out of the earth will begin to shrink every year, rather than increase, which has been the case since the 1970s.

Chuck Jeannes announced in September that he believes the world will reach “peak gold” either this year or next. Jeannes serves as the chief executive of the world's largest gold mining company, Goldcorp, so he certainly understands the dynamics of gold supply. And last April, Goldman Sachs analysts predicted gold production would peak in 2015, saying there are “only 20 years of known mineable reserves of gold and diamonds.”

Meanwhile, gold demand continues to surge. Global gold demand in the third quarter of this year grew a healthy 8%.

Given all the data, it appears the gold industry will soon enter a long-term and potentially irreversible period of tight supply, even as demand remains robust. Investors would be wise to take note of the fundamental dynamics on both supply and demand side of the gold market, and not just focus on the current economic data or most recent Federal Reserve pronouncements.

Asian countries are not only buying up gold, they also have a huge appetite for silver. Chinese imports for silver are on record-breaking pace this year, driven partly by strong demand for jewelry and industrial applications such as solar panels. According to the Wall Street Journal, based on the current trend, Chinese silver imports will top 3,000 tons in 2016, making it the best year since 2011.

“China which accounts for around one-fifth of global silver demand imported 282 tons of the precious metal in October, up 36% year-over-year. Its total imports of 2,678 tons in the first 10 months of the year are already around the same level as achieved in the whole of 2014.”

The Chinese aren't alone in their silver binge. Silver demand in India has remained robust after a record-breaking 2014. India accounts for another 10% of global silver demand.

The bottom line is Chinese and Indians value gold and silver. And once they get it, they are reluctant to let it go.

Right now it takes over 77 ounces of silver to buy one ounce of gold, the so-called gold/silver ratio. So far this century, on average, it has taken less than 60 ounces of silver to buy one ounce of gold. Just get back to that level silver would have to jump 30% higher than today's price. For all of the 20th century it took just 47 ounces of silver to buy one ounce of gold and historically that is 65% higher than today's prices. In 2011, when precious metals prices peaked, the ratio got down to 30/1. To be able to buy one ounce of gold would be 30 ounces of silver. That is 158% higher than it trades today. In 1980 it took just 17 ounces of silver to get one ounce of gold. It makes sense to hold a portion of your investments in physical silver.

China continued adding to its gold reserves and accelerated its pace in November. According to Bloomberg, the Chinese upped their stash of gold an estimated 21 tons in November, the largest increase in at least five months. China announced its gold holdings for the first time in six years in July. Since then, it has continued to buy gold, adding 14 tons in October, 15 tons in September, 16 tons in August, and 19 tons in July. Many analysts say the gold buying spree was part of China's strategy to stabilize the yuan as it pushed for inclusion in the IMF's benchmark currency basket. China isn't the only country growing its reserves of gold. Russia and Kazakhstan are also buying up gold. Central banks and other institutions boosted gold purchases to the second-highest level on record in the quarter to September, according to the World Gold Council. Central bankers recognize the value of gold as a stabilizing force and a traditional store of wealth. Wise investors will follow their lead and buy gold

Axel Merk from Newsmax says in his 2016 outlook to take an alternative look at your investments and diversify your portfolio with underlying assets that aren't highly correlated with one another. He says specifically to embrace gold since gold has been a profitable diversifier in each bear market since 1971, except for the one induced by Paul Volcker in 1980.

Investors around the world continue to wake up to the fact that the collapse of the World's Greatest Financial Ponzi Scheme in history is approaching faster than ever. We are seeing the demand for Global Gold Exchange Traded Funds (ETFs) decline 2011 to 2015 compared to the previous five years, it went negative by 21.2 million ounces. This was in stark contrast to the huge increase in demand for physical gold bars and coins of 208.8 million ounces during the same time period. The same trend is happening in the silver market where investors purchased 994.1 million ounces of physical silver bars and coins during the 2011 to 2015 period compared to 18.2 million ounces in the Global Silver ETFs.

Bill Holter from JS Mineset says “The money worldwide is FAKE. Gold is, has been and always will be REAL money. Gold is God's money. That's what this is about. This is about forcing the population of the world to us FAKE money and the REAL money is being accumulated.” And in a world of increasingly worthless fiat Bill reminds us of one critical fact, “Silver is a no brainer. Silver is the cheapest ASSET on the planet.”

Hugo Salinas Price says “When push comes to shove, China, with 1.3 billion or more population, will take unorthodox measures. The pressure of the enormous population of China, made up of quite intelligent men and women, is going to force its government to stop adhering to international covenants. China will take whatever measures can offer hope to the Chinese. China will then say to the world: “We sell cheap. Very cheap. But, we sell for gold, for very little gold; and we pay with gold for what we buy – for very little gold, but we pay gold. You want our stuff, you find a way to pay us in gold. Or else, what do you have to offer us, in exchange for our stuff? You have something we want – we pay in gold. Rest of the world, do as you please.” The nations of the world are not going to flounder endlessly in the crisis that is upon us. Out of the huge crisis, China will break away and state its terms. And the terms will be: GOLD. The rest of the world will follow.”

Pastor Williams, myself and many financial analysts and reporters as well as Pastor Williams' Elite friend has suggested for some time that owning a significant amount of physical gold and silver. People across the world consider gold and silver money, including the Elite themselves. They have for thousands of years. If our governments eliminate paper currency, you won't be able to store wealth by keeping cash at home or in a vault. You'll have to store all your cash in digital form, at a bank, or another financial institution.

With gold and silver, you can store a portion of your wealth at home or in a vault, outside the banking system. And, unlike cash in a bank, reckless government printing and spending cannot destroy the value of gold and silver.

At $1050 its trading at less than cost of extraction and refinement. Therefore, not too long before gold vaults run dry. The current spot price for gold is no longer workable, we are going to start seeing some high mark-up prices going past peak gold. China is sucking up physical gold for their strategy of inclusion within the SDR and JPM and Comex Hong Kong are virtually empty. Ultimately WHEN, not IF the crash happens, there will not be enough life rafts for everyone. Its only a matter of time before the major crisis hits that will see the SDR unveiled. Those in the know are already cashing out of paper and into tangibles.

Pastor Williams pleaded with you to get prepared by September 15th, 2015. The reason was what has been said within this newsletter. Its time to get as much physical gold and silver as you possibly can. If you do not have a local dealer you already have a relationship with, I recommend GoldCo who are experts in transferring your paper into physical precious metals whether you have cash or a retirement account to convert into gold and silver. They can guarantee delivery within 7 business days. Call GoldCo NOW toll-free on 1-877-414-1385 before it is too late!

Lindsey Williams – K-Talk – Mills Crenshaw – July 2013

Lindsey Williams – K-Talk – Mills Crenshaw – July 2013

Lindsey Williams on K-Talk speaking with Mills Crenshaw on 22nd July 2013. A two-part show. First part talking about healthcare. Second part talking about the economy. Chaplain Williams also takes calls.

1st part: Pastor Williams and Dr. Rodrigo Rodriguez MD talking about healthcare. After January 1st 2014 healthcare system will never be the same again. The Obamacare bill was not a healthcare bill but the ultimate final control of the American people by the elite. The IBC Hospital & Health Center in Tijuana, Mexico is needed since 40% of healthcare professionals will leave. Pastor Williams talks about a list of doctors who have already closed their doors or have a date when they are closing their doors. He also talks about the gadget that the government is giving to all doctors that will tell them what they must prescribe for their patients, if they do not they can be jailed.

2nd part: Pastor Lindsey Williams discusses the economy. Silver up $1.04, Gold up $40 today (22nd July 2013). Pastor Williams says “they can't keep it down any longer”. Its intentionally manipulated. Don't sell gold or silver, the bottom has probably arrived. Gold is going to at least $3,000 an ounce. Silver is going to at least $75-$100 an ounce. Precious metals market is going back up, time to buy is now. Get out of paper. Also talks about trial run to crash all the currencies of the world and $441 Trillion in interest rate derivatives and banks gambling the security of nations while you sleep.

Pastor Williams also discusses his new DVD “Healing The Elite Way” which is the most important DVD he has ever made. It saved his life and this DVD may save yours. Available to order today.

Lindsey's other DVD is also mentioned within this radio show it is called “New Signs of The Elite” and is available for 70% off

In light of the new revelations, Pastor Williams recommends that you get out of paper as soon as possible. Get into ‘tangibles' such as gold, silver and other precious metals as well as land, seeds. Check out this exclusive article where Lindsey Williams and other reputable financial reporters tell us why the price of gold has been falling for several months and why its been manipulated

Pastor Lindsey Williams' book “The Energy Non-Crisis” is now available on Amazon Kindle.

Chaplain Lindsey Williams' book “To Seduce A Nation” is now available on Amazon Kindle.

Mills Crenshaw's show can be listened to at the K-Talk website.

Find out more about Lindsey Williams' DVDs

Lindsey Williams On Recent Lowering Gold Price

In recent weeks I (James Harkin, creator of LindseyWilliams.net) have been continuing to look at the price of gold and its fall from its all time high of $1,913 an ounce in August 2011 to its two year low on 15th April 2013 to $1,356 an ounce. So I asked Pastor Williams his thoughts on the situation, his response may be of interest to all existing and would be gold owners…

Please note: Myself and Chaplain Williams are not financial advisers and you should not take anything in this post as financial advice and I would suggest that you contact a registered financial adviser. Please see our Legal Disclaimer at the top of this page.

Pastor Williams has replied to several emails relating to the current price of gold and to one visitor to LindseyWilliams.net his response was as follows:

[testimonial] [tentry image=”” name=”Pastor Lindsey Williams” company=”Author of The Energy Non-Crisis”]

Two reasons.

1. To discourage people from owning gold as it is the only true

store of wealth.

2. The Elite are buying as much as possible themselves with the

price down.

[/tentry] [/testimonial]

Further information from Pastor Williams reveals that this lowering of the gold price is “all manipulation of the highest degree…”, even Trends Journal forecaster Gerald Celente agrees with this fact.

Lindsey Williams told me that “… Everything is selling off – commodities – copper – the global economy is weak…” and continued “… The Elite wish to discourage the average person about gold because gold is the only true value of wealth”, and that “the Elite are buying gold as fast as possible…”. It is important to understand that “Gold will go back up as soon as the powers that be have purchased what they want”. He also said that we should “watch commodities and the derivative market…”.

Those of you who are owners of gold, whatever you do, don't sell. Gold is a long term investment, it is a hedge against inflation. Lindsey Williams told us last year that the Federal Reserve was to initiate purchases of $40 billion of mortgage backed debt a month indefinitely. The US national debt is $16.8 trillion, do you really think that could ever be paid back? In 2011 the US paid just under $454.5 billion in interest on the national debt.

In 2008 Chaplain Williams told us “If people had ever bought precious metals in their entire lifetime they should buy every piece, every ounce, ever half ounce, every quarter ounce, every tenth ounce, I don't care what you buy, you should get your hands on every piece of gold and silver that you can possibly get … and get it as quick as you can … don't even wait until tomorrow, buy everything you can possibly buy. It is the only thing that is going to have any purchasing power or value when all of this is said and done”. This statement is still true today. Just last year, just after the re-election of Barack Obama he said “precious metals are going through the roof, you have never seen anything yet, if you think $1700 or $1800 gold is high priced, it is going to be dirt cheap by the end of this 4 year administration”. Gold is the currency of the Elite!

Fiat paper currency is not worth the paper its printed on. In fact its not even paper its digital dollars dumped into the system and according to Gerald Celente on the 16th April 2013 “Gold is being manipulated by the United States central bank, by the European central band and by the Japanese central bank, which continues to dump digital dollars into the system in form of their rigging the game by buying bonds, treasuries and mortgage backed securities”. In March Celente said that he “buys silver for his golden years” and that he is not a speculator. He goes on to say “China, Russia and Iran are getting together to try and kill the petro-dollar” and that “you are going to see the dollar crash like you have never seen it crash before…”. He also said that “they are never going to solve this problem … they can't save it, its impossible” and ended on a bombshell that “they are going to debase the currency”. If this happens inflation will become rampant and if anyone is still in paper assets, whether it is stocks and shares, derivatives or precious metals in exchange traded funds they will be worthless.

Those investors who have cash in their banks must look at what happened in Cyprus and the new EU banking legislation that anyone with more than the threshold of 100,000 euros in their bank could lose anything above that figure if the bank they hold their euros in is bailed out. This is theft on a magnitude you have never seen before. Don't kid yourself that it is not going to happen in the UK, USA or other nations. The Elite are already working towards a date for the collapse of ALL currencies. Events SIMILAR to what happened in Cyprus are planned for nation after nation.

This is real! You need to focus on protecting your family with the salvation of physical precious metals; Land that you own outright without liens or mortgages, especially land with natural spring water since major bottling corporations are looking at owning ALL drinking water; and I wholeheartedly suggest you also obtain heirloom seeds because GMO's are being rolled out worldwide; If you do not see this already being rolled out in front of your very own eyes, and have decided to protect yourself, then you have a very bleak future. If you do not act now, it will be you who will end up handing in your guns and begging to be chipped so you can get your food stamps for the genetically modified crud they call food.

If you really want to find out what is planned for you, please obtain a copy of Lindsey Williams' new EMERGENCY DVD “NEW SIGNS OF THE ELITE”. The New World Order is in it's final formation. This is a DVD you do not want to miss. Order it today from Prophecy Club Currently 70% off and is just $27.

Please, stop fooling yourselves, if you weren't already buying gold after the recent fall then you need to start looking at it. Gold, silver and other precious metals will go through the roof when all is said and done. It is the only way to secure your financial future. If you have an IRA, stocks, bonds or mutual funds then you can have it converted to physical gold. Many people are doing this, they see the signs and they are taking action.

Pastor Williams doesn't sell gold. However, I have asked him if I can link to a couple of companies that can help, not only to sell you gold and silver, but to offer help and advice to those wishing to convert their IRA or old 401(k) to physical precious metals. I have found a company, they specialise in precious metals IRA's and have several recommendations including ones that support an individual's retirement plan and offer the best return, stability against inflation, and protection against economic uncertainty. They only deal in physical gold, silver, platinum and palladium and have a 7 day delivery guarantee. The only problem is that this company only deals with investments over $3,500. There are many companies out there and I recommend looking at them all. Then go here and check out what they offer, read the up-to-date testimonials, then complete the enquiry form or call them at 1-877-414-1385, order their Gold IRA Rollover kit and talk with their advisers. The link to this company is also in the sidebar under the section entitled “Current Gold & Oil Prices“.

Whatever you do, get out of paper assets as soon as you can, remember what it says in the U.S. Constitution, Article 1, sections 8 & 10 “The Congress shall have the power to coin money, regulate the value thereof, and of foreign coin, and fix the standard of weights and measures; No state shall make any thing but gold and silver coin a tender in payment of debts”. Time is no longer on your side!

This article was written by James Harkin, creator of LindseyWilliams.net.