December 2014

News from Two Wall Street Insiders & Pastor Williams

Pastor Williams has announced a regular monthly emailed newsletter that will be distributed to his email list at LindseyWilliams.net. The newsletter will feature articles from his two Wall Street insider friends Mark Johnson and Tom Fyler as well as articles by Pastor Williams himself.

This month features information from all three including information from Pastor Williams regarding the recent drop in oil prices. In this regard Pastor Williams has said “What our President has done could create some major problems. Almost sounds like the beginning of Ezekiel chapters 38-39 in the Bible.”

On the recent drop in oil prices Pastor Williams told me “You asked about oil prices. In the past my Elite friends have always told me before oil prices dropped. This time I did not know about the oil price drop before it happened because the Elite did not create the price decline.

President Obama sent John Kerry to Saudi Arabia (Without any authorization of the Elite) to negotiate the price decline. It was done because of Obama’s hatred of Putin. (Read the article that follows from F. William Engdahl, it is correct)

The Elite are so angry at Obama that words can’t describe it. There are some really big problems right now between Obama and the Elite.”

In light of all that is happening – Everyone needs “Special Events Scheduled for 2015”

Has Washington Just Shot Itself in the Oily Foot?

F. William Engdahl

By now even the New York Times is openly talking about the secret Obama Administration strategy of trying to bankrupt Russia by using its oil-bloated Bedouin bosom buddy, Saudi Arabia, to collapse the world price of oil. However, it’s beginning to look like the neo-conservative Russia-haters and Cold war wanna-be hawks around Barack Obama may have just shot themselves in their oily foot. As I referred to it in an earlier article, their oil price strategy is basically stupid. Stupid, as all consequences have not been taken into account. Take now the impact on US oil production as prices plummet.

The collapse in US oil prices since September may very soon collapse the US shale oil bubble and tear away the illusion that the United States will surpass Saudi Arabia and Russia as the world’s largest oil producer. That illusion, fostered by faked resource estimates issued by the US Department of Energy, has been a lynchpin of Obama geopolitical strategy.

Now the financial Ponzi scheme behind the increase of US domestic oil output the past several years is about to evaporate in a cloud of fictitious smoke. The basic economics of shale oil production are being ravaged by the 23% oil price drop since John Kerry and Saudi King Abdullah had their secret meeting near the Red Sea in early September to agree on the Saudi oil price war against Russia.

Wall Street bank analysts at Goldman Sachs just issued a 2015 forecast that US oil prices, measured by a benchmark called WTI (West Texas Intermediate) will fall to $70 a barrel. In September 2013, WTI was more than $106 a barrel. That translates into a sharp 34% price collapse in just a few months. Why is that critical to the US shale production? Unlike conventional crude oil deposits, shale oil or tight oil as industry calls it, depleted dramatically faster.

A comprehensive new analysis just issued by David Hughes, a Canadian oil geo-scientist with thirty years’ experience with the Geological Survey of Canada, using data from existing US shale oil production that has now become public for the first time (the shale oil story is very recent), shows dramatic rates of oil volume decline from US shale oil wells:

The three year average well decline rates for the seven shale oil basins measured for the report range from an astounding 60-percent to 91-percent. That means over those three years, the amount of oil coming out of the wells decreases by that percentage. This translates to 43-percent to 64-percent of their estimated ultimate recovery dug out during the first three years of the well’s existence. Four of the seven shale gas basins are already in terminal decline in terms of their well productivity: the Haynesville Shale, Fayetteville Shale, Woodford Shale and Barnett Shale.

A decrease in oil daily of between 60% and 91% for these best possible shale oil regions means the oil companies must drill deeper to even stay still with oil production, let alone increase total oil volume. That means the drillers must spend more money to drill deeper, a lot more. According to Hughes, the Obama administration Department of Energy has uncritically taken rosy forecast numbers given them by the companies that boost the US shale oil myth. His calculations show future US shale oil output only 10% that estimated for 2040 by the Energy Department.

Hughes describes the current deadly dilemma of the shale oil companies as a “drilling treadmill.” They must drill more and more wells just to keep production levels flat. The oil companies have already gone after the most promising shale oil areas, so-called “sweet spots,” to maximize their production. Now as production begins to decline terminally, they must start drilling in spaces with less rich oil and gas returns. He adds, “if the future of U.S. oil and natural gas production depends on resources in the country’s deep shale deposits…we are in for a big disappointment.”

Oil price collapse

What Hughes describes was the state of shale oil before the start of the Kerry-Abdullah Saudi oil price war. Now US WTI oil prices have dropped a catastrophic 25% in six weeks, and still falling. Other large oil producers like Russia and Iran are in turn flooding the world market with their oil to increase revenue for their state budgets, adding to a global oil supply glut. That in turn pressures prices more.

The shale oil and gas bonanza of the past five years in the USA has been built on a foundation of zero Federal Reserve interest rates and huge speculative investment by hungry Wall Street firms and funds. Because of the ultra-rapid oil well depletion, when market oil prices collapse, the entire economics of lending to the shale oil drillers collapses as well. Money suddenly vanishes and debt-strapped oil companies begin real problems.

According to Philip Verleger, former head of President Carter’s Office of Energy Policy and now an energy consultant, in North Dakota’s Bakken shale, one of the most important new shale oil regions, oil at $70 a barrel could cut production 28 percent to 800,000 barrels a day by February from 1.1 million barrels a day in July. “The cash flow will go down as the prices go down, the amount of money advanced to these people to continue the drilling will dry up entirely, so you’ll see a marked slowdown in drilling,” said Verleger.

Myths, Lies and Oil Wars

The end of the shale oil bubble would deal a devastating blow to the US oil geopolitics. Today an estimated 55% of US oil production and all the production increase of the past several years comes from fracking for shale oil. With financing cut off because of economic risk amid falling oil prices, shale oil drillers will be forced to halt new drilling that is needed merely to maintain a steady oil output.

The aggressive US foreign policy in the Middle East—its war against Syria’s al-Assad regime, its hardball oil sanctions against Iran, its sanctions against Russian oil projects, its cynical toleration of ISIS in Iraqi oil regions, its refusal to intervene to stabilize the Libyan oil economy but instead to tolerate dis-order are all premised on a cocky view in Washington that the USA is once again the King of Oil in the world and can afford to play high-risk oil geopolitics. The official government agency responsible for advising the CIA, Department of Defense, State Department and White House on energy, the US Department of Energy, has issued projections of US shale oil growth based on myths and lies. That has led the Obama White House to launch oil wars based on those same myths and lies about the rosy prospects of shale oil.

This oily arrogance was epitomized in a speech by then Obama National Security Adviser Tom Donilon. In an April 2013 speech at Columbia University, Donilon, then Obama’s national security adviser, publicly expressed this: “America’s new energy posture allows us to engage from a position of greater strength. Increasing US energy supplies acts as a cushion that helps reduce our vulnerability to global supply disruptions and price shocks. It also affords us a stronger hand in pursuing and implementing our international security goals.”

The next three or so months in the US shale oil domain will be strategic.

William Engdahl is strategic risk consultant and lecturer, he holds a degree in politics from Princeton University and is a best-selling author on oil and geopolitics, exclusively for the online magazine “New Eastern Outlook”.

Peace in the midst of Chaos

By Mark Johnson

Chaos is a state of utter confusion. Listening to the noise in the world today there appears to be a lot of confusion. Questions abound with what is going to happen in the economy, government, markets, the future of our country and in a more narrow focus the direction of the price of gold and currencies.

When it comes to investing, a person with a sound mind does the right things, for the right reasons rather than acting out of fear.

Can there be peace in the midst of this chaos? It depends. If you think you have peace because you think you have it all figured out, think again. About the time you are confident that you have heard the latest insight, or the technical charts are in alignment or the newscasts are confirming your predications you are quickly humbled by the reality of the unpredictable markets and world events.

Though many attempt to bring order to the world in the ways of man, many believe there are two things that can bring order to a world of chaos and that is trusting in God and the Word of God. Only the Word of God is predictable, dependable and always true. The principles in the Bible work whether you believe them or not. God’s principles are beyond the limits of all possible experience and knowledge that we have undergone. Can you trust His Word? My experience says yes.

If you trust in God and His Word then you will have peace because now you are trusting God as your provider not in yourselves or the things of this world. He will guide you, direct you and provide for you.

The Bible is not going to tell you whether or not to buy a particular stock or what is the right price to buy gold. But it will provide sound investment principles that you can apply when making investment decisions.

Is God going to make you rich? He never promises that in His Word. He tells us in His Word that we should be content with whatever He provides for us. In contentment there is peace. Does that mean that we should not strive to do better financially? No, but we should not let it control us and we should have a purpose for the accumulation of our wealth.

The Bible tells us “For God has not given us a spirit of fear but of power and of love, and a sound mind.” 2 Tim 1:7

When it comes to investing a person of a sound mind does the right things, for the right reasons rather than acting out of fear. If you make decisions based on fear you will not make good decisions. If you do not have a sound mind you will let emotions drive your investment decisions rather than maintaining a disciplined approach to managing your finances.

To have a sound mind you must develop self-control and discipline, the exact opposite of chaos. Most people that have accumulated investable assets have a disciplined approach to managing their finances. So how do you develop and maintain a disciplined approach to managing your finances?

There are principles that are used and understood by successful investors. All of these successful principles come from the Bible. Most investors do not realize this because they have never thought of looking into the Bible for financial guidance. There are over 2300 verses in the Bible that talk about money. The Bible talks about money more than any other subject.

The following will explore six planning principles from the Bible that will help you bring order to managing your finances. And again remember that these principles will work whether you believe God’s Word or not.

We Own Nothing

The first principle is for us to understanding that we own nothing. We are just managers of what has been entrusted to us while we are on this earth. No matter how much you accumulate when you die you leave everything behind. The only control you have over these assets is that you get to name a new manager when you die. The Bible tells us that God owns it all and we are His managers or stewards. In the beginning God created everything, it is all His. It also says in Psalms 24, “The earth is the Lord’s and the fullness thereof; the world and they that dwell therein. Not only did he create the world but he also created each one of us for a special purpose. We are His and He loves us very much.

How would you feel if you hired a manager to manage your business and you came back after a few days and find out that he has been telling everyone that he is the owner and has taken over your business? He says that he is keeping all the money and he will not be giving you any profits because he is doing all the work. What would you do as the owner? You would start the process of taking back your business. The Bible tells us that God will not take back his business and assets but instead will hold each of us accountable for how we managed His business. Most people, believers and non-believers will continue to ignore God as owner and will continue to pretend that they own the business. If I understand that God owns it all and that I am going to be held accountable then I will want to know how the owner wants me to manage His affairs. The Bible is very clear on how He wants us to manage His resources that He has entrusted to us but I find very few people read His procedures manual, even believers.

Spend Less Than You Earn

The second principle is that you should spend less than you earn. Very few people are able to discipline themselves to do this. The general practice that I see the average person follow is the more you make the more you spend. I had two clients many years ago that were both doctors. One was originally from India and the other was born and raised in the United States. Both doctors each made $175,000 per year. One doctor spent $185,000 per year and the other doctor spent $40,000 per year and saved the rest. Which doctor saved and which doctor spent more than he made? No matter how much you make I challenge you to find a way to save a portion. This is the way you learn to discipline yourselves. Or you can be like the majority who are procrastinators who keep saying, “as soon as I make a little bit more then I will start saving.” But guess what, that day never comes. The more they make the more they spend. Spend less than you make and you will become an accumulator/investor.

Dishonest money dwindles away, but whoever gathers money little by little makes it grow. Proverbs 13:11

Avoid Debt

A third principle to follow is avoiding debt. If you are in debt you are working for someone else instead of yourselves. Sure you are paying for something that you now possess but there is a cost, it is called interest. This makes everything you purchase on debt more costly to own. Have you ever heard the merchant tell you there is a discount for cash? Well there is a premium for buying on credit. In addition you are in “bondage” to these big banks, credit card companies and in some cases the government.

“The rich rule over the poor, and the borrower is slave to the lender.” Proverbs 22:7

Build Reserves

A fourth principle is you should be building reserves. These reserves should be for short term, mid-term and long term. In the short term you need liquid cash reserves for emergencies. If the car breaks down and you have a $300 bill it is much better to be able to pay cash for it then to put it on the credit card, see above. What if you lose your job, how long could you cover your monthly expenses until you found a new job? Mid-term reserves may be money put aside for a vacation, college education for your children or for a house. A long term reserve could be for retirement. If you have been able to manage your money well and you have excess, that provides peace of mind in the midst of chaos.

Go to the ant, thou sluggard; consider her ways, and be wise: which having no guide, overseer, or ruler, provideth her meat in the summer, and gathereth her food in the harvest. Prov. 6:6-8

Establish Written, Long Term Goals

A fifth principle is to have written long term goals. People today live for the immediate. They tend to buy spontaneously or what is being sold to them via glitzy marketing. “You deserve it, buy it today!” If you do not have a plan for your family then it is easy to spend the money because there is no reason to save. If you develop long term goals then there is an alternative choice. When the marketer tells you to buy today you have an alternative choice to evaluate your decision. Do I want this today or am I more committed to a comfortable retirement in the future? Without a long term goal there is no reason to save so I might as well spend today. Most people would rather satisfy their immediate desire then to make sacrifices today for their future long term security. I challenge you to be different. Planning for the future and preparing for it will help provide peace in the midst of chaos.

“Write the vision; make it plain on tablets, so he may run who reads it. 3 For still the vision awaits its appointed time; it hastens to the end—it will not lie. If it seems slow, wait for it; it will surely come; it will not delay. Hab 2:2-3

Be Generous

A sixth principle is to become generous. When people follow the previous principles there is a good chance that they will have more than enough to take care of themselves and their family. When this happens it is important to be generous with your excess. If God has blessed you with extra be a blessing to others who are less fortunate.

When we learn to become givers there is a peace in the midst of chaos because we go from trusting in things to trusting in God. If you can give away your things it means that you do not trust in them for you security. It frees you up to focus on others rather than yourself. When you die is it more important to be surrounded by your things or the people you love and have helped during your lifetime?

But just as you excel in everything — in faith, in speech, in knowledge, in complete earnestness and in your love for us — see that you also excel in this grace of giving. 2 Cor. 8:7

These are some principle that if applied in your life will help you to become a better manager or steward with what you have been entrusted by God. Do not bury your time, talents and treasures in the ground because you are fearful but instead trust in God for your every breath, your daily provisions and His direction in the midst of chaos. He will never leave you nor forsake you.

Let your conversation be without covetousness; and be content with such things as ye have: for he hath said, I will never leave thee, nor forsake thee. So that we may boldly say, The Lord is my helper, and I will not fear what man shall do unto me. Heb 13:5-6

Whether or not you believe in God, His salvation through His Son Jesus the Christ these principles will work. God’s Word is always true. Follow them and you will have peace in the midst of chaos.

We are all born selfish and throughout our lives God wants to move us to become givers by following His principles and His way of doing things. God was very generous to us in that He gave us life, He gives us the ability to get wealth, He gives us provision, and he offers the free gift of salvation for all who will believe for His Word tells us,

“But God demonstrates His love toward us, in that while we were yet sinners, Christ died for us. Romans 5:8

God so loved the world that He gave His only begotten Son that whosoever believes in Him should not perish, but have everlasting life. John 3:16

It is a gift from God; you do not have to work for your salvation, deliverance from spending eternity in hell. God is a giving God and His word encourages us to also to be givers.

If you would like to work with a financial advisor who tries to live by God’s principles and strives to incorporate them into his practice call me at 1-800-950-2109. You can view our website at www.FountainWealth.com or send me an email at mdjohnson@FountainWealth.com

Securities and Investment Advisory Services Offered Through FSC SECURITIES CORPORATION, Member FINRA/SIPC, and A Registered Investment Advisor.

Additional Investment Advisory Services Offered Through Fountain Financial Group. Inc. a Registered Investment Advisor not affiliated with FSC

Unfruitful Works of Evil

By Tom Fyler

The Peoples’ Republic of China is a government that brutally violates human and religious rights and persecutes Christians.

According to human and religious rights advocates, such as The United States Commission on International Religious Freedom (USIRF) and International Christian Concern (ICC), China’s government:

Forcibly removed over 200 crosses from Churches in Zhejiang, China. In Wenzhou City, over 100 government police removed the cross from Shangzhou Church. At least five Shangzhou congregants were hospitalized for defending their church cross. (Worthy News—August 2014);

Is harrassing many thousands of Christians who worship in private “underground” churches across China and subjecting them to public persecution. (International Christian Concern—May 2014);

Attempted to destroy a newly-constructed Church in Zhejiang Province. Several hundred police officers with bulldozers threatened to demolish it. Thousands of Chinese Christians formed a human shield around the Church to protect it. The standoff at the church reportedly began after a visiting Communist Party secretary said the church was too large. (International Christian Concern—April 2014);

Imprisons Christian pastors. Nanle County Church Pastor Shaojie Zhang was sentenced on July 4, 2014 to 12 years in prison in China over a dispute with the Chinese government about a plot of land to be used to build a church. Pastor Zhang was tried and charged with “fraud” and “gathering a crowd to disturb public order.” Concerning the charge of fraud, the prosecutor failed to produce a single witness against the pastor. (Worthy News—July 2014)

Such injustices and persecutions are propagated on a daily basis by the Peoples Republic of China.

Does this affect your money? Or, as faithful Christians believe, money that is God’s–His blessing to Christians to be used to be good and charitable to all people, especially to the Household of Faith—fellow Christians. And to help offer God’s Word of salvation through Jesus Christ.

Well, many Christians who invest in the stock market may not realize that some of God’s money may be invested in publicly-traded companies that benefit and are owned by The Peoples Republic of China. Their investments are unwittingly aiding China’s communist government in their violation of human and religious rights and persecution of Christians. Certainly not what Christians would want.

Good news. A group of Christian investment managers and investors are involved in a divestment effort against publicly traded companies that are state-owned by the government of the People's Republic of China. “Divest Persecution” is intended as an action against the Chinese government for the violation of human and religious rights and for the persecution of Christians.

This campaign is directed toward China’s government, not the wonderful Chinese citizenry. The people, country and economy of China offer many investment opportunities through non-state-owned publicly-traded companies and business ventures.

The violation of human and religious rights occurs every day throughout the world. The organizers of Divest Persecution encourage financial and other means of support to organizations that advocate on behalf of people impacted by these abuses.

If you would like to understand whether any of your investments are supporting the communist government of China, you may access www.DivestPersecution.com, and request a “screening” of your portfolio to help you direct your investments to “good ground.”

Tom Fyler is Managing Director of Fountain Wealth Associates, LLC, a consultant in wealth and natural resources management. Mr. Fyler is also President of Commodities & Securities, Inc., a Commodity Trading Advisor registered with the Commodity Futures Trading Commission (CFTC) and a Member of the National Futures Association (NFA), and a Registered Investment Advisor. Mr. Fyler may be contacted at email address: mfyler@tiac.net. Visit: EssentialsInvesting.com

Risk Disclosure: This communication is for informational purposes only and should not be construed as containing or providing specific investment or financial advice. Readers should be aware that there is risk of loss of some or all funds when investing in stocks, bonds, mutual funds, ETFs, real estate, commodities and/or currencies any of which may not be appropriate for all investors. Readers should consult directly with financial professionals for advice appropriate to personal financial circumstances.

Protect the Value of your U.S. Dollar Possessions and Assets

By Tom Fyler

In an article in October 2014 on Lindsey Williams.net, James Harkin masterfully described the issues surrounding a dramatically changing global currency system. It is essential that everyday Americans understand how this will impact the value of their wealth and how to protect and grow their assets in the midst of a prospective global currency reform and reset.

Countries, cartels and trade blocs throughout the world are decreasing the use of the U.S. Dollar (USD) in bilateral and in global trade of commodities and goods. This is as well the case with trading in oil as the petrodollar likewise suffers declining use. A search is on by powerful global institutions and geopolitical alliances to depose the USD as the world reserve currency. What does this mean to us?

With a decreasing demand globally, the USD will devalue substantially and thus depreciate the value of Americans’ assets and possessions such that our paychecks would purchase less—relegating Americans to a lower standard of living. I believe we are already heading down this road. High unemployment, food stamp usage, and a falling consumer capability are all symptoms of a mismanaged U.S. economy and weakening U.S. dollar.

Here’s the big problem that Americans face as the dollar is deposed as the world reserve currency. The huge demand for USD as the world’s reserve currency has enabled strong U.S. economic growth with low inflation. Unfortunately, the huge demand for USD and US Treasuries along with a lack of political financial discipline has also enabled a massive debt to be accumulated by the U.S. government—funded by a massive amount of so-called money printing. With a declining demand for USD as it loses its world reserve currency status, the U.S. can no longer afford either the massive money printing or its massive debt. Of course, the best course of action to strengthen the USD and protect the value of your assets would be for America to get on a path of fiscal discipline and eventually a balanced budget. Until then, as the USD is displaced as the world reserve currency and it weakens, the U.S. Federal Reserve is pressured to taper or reduce the money printing in an effort to support the dollar. The fear is of course that the money printing or the QE stimulus is the only force boosting the U.S. stock market, real estate and other assets and keeping interest rates down. If interest rates were to jolt higher in a volatile and uncontrolled manner, real estate prices and stock and bond values might tumble, and more ominously—in such a volatile interest rate environment, the derivatives system might literally unravel the entire financial system. Wall Street and politicians feared just such an event in 2008 and in the 1998 Long-Term Capital Management hedge fund melt down. The threat of the derivatives system collapsing the global financial system is still with us.

Some experts and forecasters believe that the international system is headed toward a complete “reset” or reform of the entire global monetary and currency system. The USD would no longer serve as the world’s reserve currency. They make the case that an initial phase of such a reformation is the consolidating of as many currencies as possible into a more manageable number to then more easily transition into an international currency system. The European Union and the consolidation of those many currencies into the Eurodollar is an example of this evolving process.

Just recently, according to some analysts, another consolidation has occurred of a significant group of countries that represent 40% of the world’s population and 20% of the global economy, in the continuing preparation for the New World Order and a currency reformation. This is referring to the recent announcement by the so-called BRICS countries establishment of a development bank and reserve currency pool. In our analysis, there has been mis-information and mis-direction surrounding this whole endeavor. The true objectives of this alliance are neither economic nor monetary.

Led by China and Russia—the epitome of authoritarian statists, this BRICS union will challenge Western and Japanese democracies’ leadership of the World Bank, the IMF and the United Nations. The BRICS alliance is thus more geo-ideologically purposed than financial. This BRICS alliance has already set its sights on Africa and Latin America as financially vulnerable and prone to dictatorial government rule for inclusion to their alliance.

It is impossible today to know what will happen as a result of these many changes and challenges. But we would say that it is prudent from the standpoint of risk management to understand that the attempted management of these unprecedented economic and monetary challenges and policies by the global powers, the Fed and U.S. politicians, might very well end up horribly BAD.

Protecting the currency value of our assets has to be an important component of our investment strategy. This has not been the case in the past. Most investors are inexperienced in how to do this. As I have expressed many times, currencies are probably the most difficult asset to manage. There is never just “a” positioning that enables successful results. The currency system is designed to be fluid on a daily basis as hundreds of currencies (economies) compete against each other for value. Add to this the dynamic of international powers that desire to reform/change the financial and monetary system globally, and the challenge of currency management and protection increases. So a currency strategy that manages and risk protects the fluid currency dynamics is necessary.

There are ways to do this through currency ETFs, the futures market, direct investment in foreign currencies, and investment in foreign assets—all of which can offset depreciation in your USD-based valuables. I have got to say though that understanding the best way to use currency strategies for your specific circumstances is not easy. Without good professional counsel and management an attempt at a “self-help cure” may end up worse than the disease.

So I come back to the importance of a currency protection and management strategy for your assets. As a matter of fact, such a strategy might be the only thing between the preservation of your wealth and the BAD.

You may email any questions or comments to fyler@tiac.net. Visit: EssentialsInvesting.com

Tom Fyler is Managing Director of Fountain Wealth Associates, LLC, a consultant in Wealth & Natural Resources. Mr. Fyler is also President of Commodities & Securities, Inc., a Commodity Trading Advisor registered with the Commodity Futures Trading Commission (CFTC) and a Member of the National Futures Association (NFA), and a Registered Investment Advisor.

Risk Disclosure: This communication is for informational purposes only and should not be construed as containing or providing specific investment or financial advice. Readers should be aware that there is risk of loss of some or all funds when investing in stocks, bonds, mutual funds, ETFs, real estate, commodities and/or currencies any of which may not be appropriate for all investors. Readers should consult directly with financial professionals for advice appropriate to personal financial circumstances.

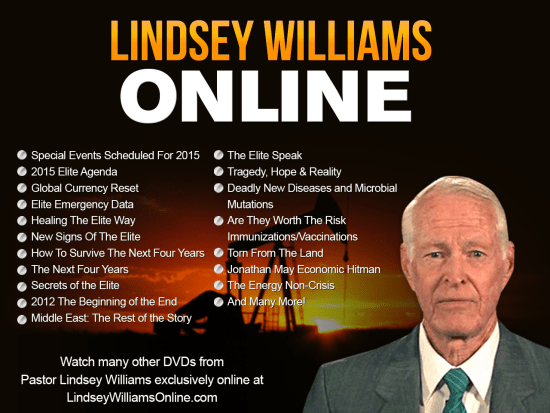

Lindsey Williams Online – DVDs Now Available Online!

Over 20+ Presentations Detailing 40 Years

Exposing The Elites Plan for Humanity and this Planet!

Available Online!

Over 46 Hours of Content Now Available to Watch & Listen To Instantly On Your Computer, Laptop, Tablet or Mobile Phone.

Every DVD and Presentation Produced by Pastor Lindsey Williams until the end of 2014 now available to view online, including: Exclusive content only available online at LindseyWilliamsOnline.com, content available without advertisements in Digital Streaming format and content Digitally Remastered from Original Recordings!

Including 3 Presentations Never Before Available Online!

All the DVDs, Videos & Presentations included in this Special Package… Available for Instant Streaming on your PC, Laptop, Tablet or Smart Phone…

Special Events Scheduled for 2015, 2015 – Elite Agenda, Global Currency Reset, Elite Emergency Data, Healing the Elite Way, New Signs of the Elite, The Next 4 Years & How to Survive the Next Four Years, Secrets of the Elite, 2012 The Beginning of the End, Middle East: The Rest of the Story, The Elite Speak, Tragedy/Hope/Reality, Confessions of an Elitist, Jonathan May Economic Hitman, Torn from the Land, Are They Worth the Risk Immunizations/Vaccinations, Deadly Diseases and Microbial Mutations, 3 Different Versions of The Energy Non-Crisis Presentation. All Included!