February 2020

[UPDATED] Lindsey Williams – Important Update! Trump and the Economy

UPDATE: Since I sent out this newsletter on Monday, 24th February 2020 the following events have taken place:

- Dow Jones Industrial Average: Down to 27,004.72. A fall of 2,546.7, which is 9%.

- S&P 500: Down to 3,116.39. A fall of 221.29, which is 6.8%.

- Oil is down from 51.43 on Monday to 48.06. A fall of 3.37, which is 6.7%.

- Gold went up to 1672.40 and is down to 1616.60. A fall of 1.4%.

- Silver went up to 18.87 and is down to 18.07. A fall of 4.3%.

- Bitcoin: Down to 8715.01. A fall of 18.3%.

- 10Y Treasury Bond yields down to a historic new low of 1.31. A fall of 37.7%.

All of these considerable changes in such a short period of time tell me that the market is now becoming much more volatile. a 9% fall in the DJIA in just 3 days. I had to think to myself, where did all the money go that got wiped from the market? Where is all that money sitting right now? Tax havens in cash?

What concerns me the most is Treasury Bond yields are down 37.7% in 3 days! This is extremely worrying because if that continues it will be yielding negative returns sooner.

Even Warren Buffett is concerned, he said that markets can drop ‘50% magnitude or even greater!'

Pastor Williams said the timing of this newsletter is perfect with what the stock market was doing on Monday. He said he agreed with what I wrote and to send the newsletter to everyone on his list. Therefore, this is going out to all subscribers.

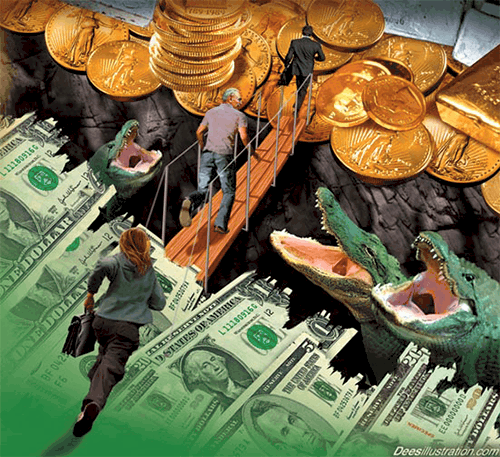

Do what you can to protect yourself from a volatile financial market. Do it sooner than later. As Pastor Williams has said time and again, “Gold is the currency of the Elite!” and for good reason!

Hi, this is James Harkin, webmaster and editor at LindseyWilliams.net I am writing to you today with regards to updates from Pastor Williams. Pastor Williams has not released a new DVD in over a year and I know some of you are concerned. I messaged him at the beginning of February regarding the many messages I have received on his behalf from visitors to LindseyWilliams.net. He told me that he had also received many phone calls and emails from people begging for updates. I asked if I could send out a newsletter on his behalf and he agreed. Pastor Williams stated to me once again:

‘As long as President Trump is in office you are safe. Make it while you can because once Trump is no longer in office, you don’t want to know what is planned.

The Elite are really having a problem with President Trump, they can’t impeach him and God will not let them get rid of him.’

Pastor Williams also said that he will make an update as soon as he is positive he knows what he is saying is true. He said that he’d been right for forty years and he doesn’t want to be wrong now by guessing. This being said I believe we are definitely in a period of calm before the storm.

I have been watching the markets myself and I understand why many of you are asking Pastor Williams for updates, for the last few months there have been some interesting developments regarding liquidity in the financial markets. This is not to do with the Coronavirus as this downturn started prior to the outbreak, however, the lockdown of China will have some effects on the real economy and the manipulation will be evident as we get further into 2020. I am not a financial advisor and I recommend that you discuss with one before making any changes to your finances based upon the information I am going to share with you.

Virtual & Real Economy Out Of Balance

There is a split between the virtual and the real economy. The real economy is the production of real-world products and services. The virtual economy is the production of finance, stocks, bonds, and financial derivatives. This split comes as the virtual economy over-expands causing the restriction of the real economy. When the price of virtual assets rises sharply a lot of liquidity capital will flow from the real economy to the virtual economy which hinders the financing and development of the real economy. This is where we are right now.

New Stock Market Highs

Remember in June 2017 I shared a video from an analyst who said that the Dow Jones Industrial Average could rocket to 50,000. Well since June 2017 the Dow Jones has risen from 21,136.23 to 29,551.42 which is a rise of approximately 39.8%. However, since February 2009 the Dow Jones Industrial Average has risen approximately 244% from 8,588.52. In the S&P 500, there was a low on 13 March 2009 of 756.55 but that has ballooned to 3,380.16 earlier this week which shows a rise of approximately 346.7%. Analysts have said that the current growth of the S&P 500 is in direct correlation to the Fed’s Repo operations which means the stock market isn’t rising organically.

Job Losses

Companies all over the US such as Pfizer, JPMorgan Chase &Co, AT&T, General Motors, Kimberley-Clark, Comcast, Harley-Davidson, Walmart, Citibank, McDonald’s, Hewlett-Packard, Tenet Healthcare, Carrier, Tesla, Microsoft, Schneider Electric, Morgan Stanley, Coca-Cola, Boeing, and Dunkin’ Donuts have all cut jobs. All the while these companies are recording billions in profits. Boeing, for example, made a loss, its first loss in two decades and its stock price went up! In January alone Manufacturing lost 12,000 traditionally higher-wage jobs. 53% of the 225,000 jobs added in January 2020 were low-paying.

Retail Is Dying

Retail is decreasing at a rapid rate. Payless Shoes, Gymboree, Dress Barn, Charlotte Russe, Fred’s, Family Dollar, Shopko, Charming Charlie, Pier 1 Imports, Papyrus, Destination Maternity, Chico’s, Gap, Avenue, Walgreens, GameStop, Forever 21, Sears, Bose, LifeWay, Kmart, Earth Fare, Bed Bath & Beyond, The Kitchen Collection, Lucky’s Market, A.C. Moore, Performance Bicycles, Macy’s, Olympia Sports, CVS, Hallmark, JC Penney, and many more retailers have either closed stores or ceased trading altogether.

Reducing Capital Expenditure

Companies have cut back on capital expenditure and since August 2018 capital goods expenditure is down from 98 Billion to 79 Billion in December 2019. That’s a reduction in capital goods expenditure by 18% since August 2018. Since the tax breaks were put in by Trump 82% went to the 1%. This money did not go back into real economy capital expenditure it was put into formerly illegal stock market buy-backs, they were seen to be a form of insider trading, to prop up stock prices. The same way corporations have used leverage to increase their stock prices from all the virtually free money made available. Trump’s tax cuts will add approximately $2 Trillion to deficits over 10 years. The national debt is now $22 Trillion and the US Budget Deficit will be $1.1 Trillion in 2020. $576.4 Billion of that deficit went on Interest in 2019, that’s over 41%!

Global Real Economy

We can see global trade slowing, which is the real economy. In September 2019 the Baltic Dry Index was at a high of 2462 and it was down to 415 earlier this month, an 80% reduction since September 2019. The copper market, which Pastor Williams also follows is also down. In February 2019 it was 6394 and at the end of January 2020, it 5569 showing the demand for copper has fallen. Oil has fallen since the start of the year from 63.27 to as low as 49.57 earlier this month.

What About Gold & Silver

Gold has been on the rise since its low of 1050.80 in December 2015. Now up to 1616.60 at its last close, that’s just 273.10 off the historical high of 1889.70 in 2011. It was approximately 1474.70 on 23 December and in the 60 days since it has risen 141.90 which is a 9.18% increase in 2 months. If things continue as they have these past few months, gold could surpass its 2011 historic high in the next 3 months.

Silver too is up. Silver's peak of $48.58 in 2011, and has risen significantly since its last low in December 2015 of $13.67 to a current high of $18.29 earlier this week. The market during Trump's first term has been relatively static. However, it seems that things may be moving. Some analysts have stated that silver is quite undervalued compared to gold and may rise 30% this year and others have said silver may outperform Bitcoin in 2020. Speaking of Bitcoin, its peak of $19,783.21 in November 2017 and has risen significantly since its last low since then in December 2018 of $3,194.96 to a current high of $10,474.20 earlier this week.

So there’s proof that the real economy is contracting while the virtual economy is expanding. This has created a bubble that has been propped up by the Federal Reserve with its injections of hundreds of billions of dollars into the Repo Market and Treasuries purchases.

The Repurchase (Repo) Market

Repo stands for Repurchase. The Repo Market is one of the places where banks get liquidity, usually overnight loans. It is popular among banks because the money in this market is cheap. The collateral of the loan is repurchased the next day and in exchange for this transaction, the lender gets a fee. Recently Repo Market started changing from only using the safest treasury securities as collateral and now they have started using riskier types of securities. The other type of Repo product is a tri-party repo which involves three parties, the borrower, the lender and an intermediary which is a clearing bank that makes it easier for investment banks to make deals. The problem is reputation. Many banks prior to the 2008 crash were using collateral in mortgage-backed securities and CDOs, which they still do. Banks started to back away from lending. Investment banks were not able to roll-over their debt the next day and those banks went bankrupt or were bailed out by the government, which means the taxpayer pays and it’s still going on today.

Fed’s Repo Intervention

The Federal Reserve has been subsidizing Investment banks with its ongoing repo operations because its rate is below the market’s rate. The Federal Reserve is no longer the lender of last resort. Repo interference by the Fed has kept the overnight rates artificially suppressed to meet the rising demand of banks for liquidity. This has been going on for a while, since September. It was said that JP Morgan Chase & Co withdrew $158 Billion from the Repo market through 2019 and was reluctant to lend out what it had left to other banks. As the base money began to shrink and the number of assets including mortgage-backed securities began to grow banks started to limit their exposure and the interest for repurchasing agreements went up. The Federal Reserve has pumped over $500 Billion into the Repo Market since October 2019. This has reduced the Overnight Repo Rate. The Repo rate had been steadily increasing since the beginning of 2016. Recently the Federal Reserve has said it would reduce its repurchase-agreement operations however banks still do not want to lend to each other, even overnight. This could cause problems for investment banks if they are not able to roll-over their debts and it’s likely the Fed will continue to intervene within the Repo market.

More Fed Interference

In October 2019 The Federal Reserve started purchasing $60 billion worth of Treasury bills every month to control its benchmark interest rate. Supposedly this will add additional capital to bank reserves and ease worries of bank liquidity. What has happened is as The Federal Reserve has been pumping all this liquidity into the financial system the stock market has been steadily going up. They refuse to call this Quantitative Easing although with what the Federal Reserve is doing the effects are similar. That being said the Federal Reserve now considering bailing out Hedge Funds too. All this money printing will bring about deflation. It is deflation and not inflation because taxation funds the deficits and that reduces disposable income. Deflation will bring about lower prices, reduced production and inventories get liquidated, demand drops and unemployment increases. The US will eventually have to devalue its currency just as Japan and the EU did. The US has been kicking the can down the street since Lehman and this is all coming to an end.

Negative Interest Rates

30 Year Bond Yield has reduced from 15% in 1981 to its lowest ever yield of 1.92% on February 21, 2020. Bond Yields have been steadily reducing in return for nearly 50 years. In Germany, the 10 Year Bond Yield is -0.43%. Yes, negative return. This goes the same for Japan, Switzerland, Sweden, Netherlands, and France. It’s been stated by an analyst that many US Pension schemes are the biggest buyer of negative-yielding EU bonds. Some analysts are projecting that by November bonds in the US will be yielding negative interest rates. However, they said the marker for this occurring will be the US entering recession. Negative interest rates mean wealth confiscation. Banks will charge you interest for keeping your money in their bank. This is the modern equivalent of gold confiscation! Pension schemes need a positive yield in order to pay out retirees. If they are buying negative-yielding bonds how are they going to pay retirees?

Pension schemes must delve into riskier investments and they have in the search for yield which increases the value of riskier investments. A lot of these schemes also own commercial property. With retail failing, that will mean a lot of premises left empty or yielding a lower rent. So, Pension schemes are going to be in trouble. But of course, they are covered by Federal Deposit Insurance, but only to a point. If many Pension schemes go bust at one time, what’s the likelihood that retirees will be covered if FDIC goes bust too? Of course, FDIC will be bailed out, but that is the taxpayer paying for financial recklessness once again! So with even more money printed, what about the value of the dollar?

Your Purchasing Power

The purchasing power of the dollar is falling approximately 10% per year compounded. Since 1913 the value of $1 has fallen to $0.0387. Yes, just under 4 cents since the Federal Reserve was created. A 96.13% decrease in purchasing power. In the past 20 years since the turn of the millennium, the dollar has lost 35% of its purchasing power. That means $1 in 2000 is worth $0.65 today. What happens when the government continues to print money? The value of your money reduces causing inflation. However, if the price of goods starts to fall because people do not have the money to buy them deflation happens, which is what Pastor Williams means by ‘Getting ready for the biggest buying opportunity of your lifetime’, which is what happens during a recession.

End of the Free Money Tap

So long as the virtually free money tap is not turned off the stock market will continue to rise. Dow 30,000 is only days away if that. Will it hit 40,000, or 50,000 before a correction must happen. The market is considerably overvalued and according to some analysts, the crash that occurs could be 80% or more wiped from the markets, similar to what happened to the NASDAQ between 2000 and 2002 where 74% was wiped off the market! Will this happen in weeks, months, during Trump’s second term, or after? Pastor Williams has been told by his Elite friend so long as Donald Trump remains president of the United States of America you are safe. Therefore, you either have less than a year or four more years to prepare for the inevitable. We have to ask the question, how much of a correction will there be after 2025 or 2021 if Trump fails to be re-elected because of a recession in the last year of his first term? 80% fall? What if the Coronavirus was a manipulated outbreak in Trump’s last year of his first term to derail his chances at re-election by a real economy slowdown? Will all of this financial manipulation result in the Global Currency Reset Pastor Williams has told us about in his presentation ‘Global Currency Reset’?

Are you prepared?

I asked Pastor Williams about what he said in his 2013 DVD entitled ‘Elite Emergency Data’ where he reiterated you should buy every piece of gold and silver you can lay your hands on. He said I should echo his thoughts from this presentation which are still very much valid today. I wrote a 100-page book that I gave away for free to visitors to LindseyWilliams.net entitled ’10 Steps to Avoid the Crash’. This book has been downloaded over 20,000 times. It discusses the ten steps that Pastor Williams shared from his Elite friend that must be done in order to protect yourself from a volatile financial system. The steps are:

Buy every piece of gold you can lay your hands on, You have to get out of debt, Get out of paper, Pay off your house mortgage, Store food, water, and self-defense equipment, Get ready for the biggest buying opportunity of your lifetime, Get out of the city, Purchase everything you need, Sort out your medicine cabinet, & last but not least Get your spiritual house in order.

It is important for you to know that Pastor Williams has not changed his mind about this, these steps are as important today as they were when he first stated them. He has said in his recent DVDs ‘Make it while you can’ because Donald Trump is the President of the United States of America is slowing down the Elites plans for humanity and the world. This is giving you more time to prepare. Pastor Williams has stated that when President Trump is no longer in office it could be ‘devastating’ to the American people.

Remember, the Elite have not gone away they are biding their time and still working on their plan to dismantle the last superpower. I understand this because all manufacturing has gone away to other countries like China. The Coronavirus has proven that the global real economy is an integrated system and if you disable one part it can affect everything. If a manufacturer of automobiles such as General Motors has parts made in China and it cannot get its “Just-In-Time” manufactured parts delivered because the factory has been shut down because of the outbreak, this will stop the production of vehicles in the US. This then affects the sales of that manufacturer since they cannot sell their products without all the parts assembled. The real economy slowdown will come sooner than the inevitable virtual economy crash.

I wrote the book ‘10 Steps to Avoid the Crash’ in 2013 because I thought it was important for people to understand what was going on. I am currently writing an updated version of the book that will include several new chapters that you must know to protect yourself and your family from any type of crash. The new guide will include sections on finding new multiple-sources of income, bartering, budgeting, growing your own food even if you don’t have much land, as well as other ways in which you can survive and thrive in both a good or a horrible economy. The new book is nearly complete and I will be giving it away again for free to everyone who wants it. I will be sending out an email soon to all of the subscribers on Pastor Williams’ email list so you can get your copy.

In the meantime, my recommendation is to protect your purchasing power today with Gold, Silver & Bitcoin. Gold, Silver, and Bitcoin are valid investments and can be used in retirement portfolios including 401(k) and IRA. Start transitioning at least some of your investments away from the stock market, negative-yielding bonds and other risky investments into physical gold, silver as well as Bitcoin as a hedge from what is inevitable. However, please talk to precious metals and Bitcoin experts who know how to help you based upon your individual investment requirements.

I have been working with a gold dealer that can help you buy physical gold and silver that can be delivered to your home or business. It can be used in your retirement accounts including 401(k) and IRA as a hedge against financial instability. The company I suggest is Birch Gold. I like this company because they take the time to understand your investment goals and objectives. They give you a detailed investment plan to build a precious metals portfolio to supplement your existing investments. Birch Gold also has a great reputation built upon trust with its customers. They maintain 5-star ratings on consumer trust sites such as Consumer Affairs, Trustlink, TrustPilot, and the BBB. Please do not hesitate to check out the Birch Gold website and leave your details for a precious metals expert to contact you.

Even at Davos, Switzerland the CEO of the largest hedge fund Bridgewater Ray Dalio is saying ‘cash is trash’ and advises to buy gold.

Thank you for your time in reading this article. I hope you understand why it’s taken me quite some time to write. I will continue to update you with anything Pastor Williams sends me.

Regards

James Harkin

Editor & Webmaster

On behalf of LindseyWilliams.net and LindseyWilliamsOnline.com