March 2016

Lindsey Williams: I feel a moral obligation to tell you the truth about Donald Trump

Lindsey Williams: I feel a moral obligation to tell you the truth about Donald Trump…

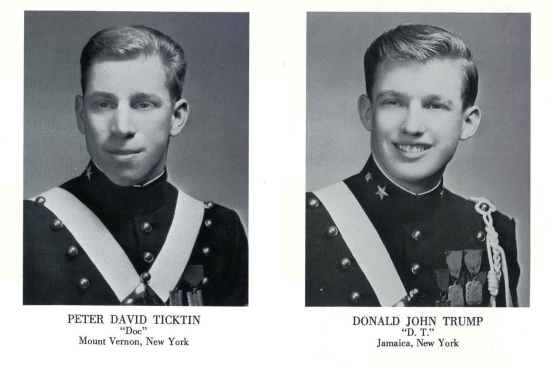

“VOTE AS YOU WISH, AND LET ME TELL YOU ABOUT TRUMP – – A personal note from Peter Ticktin who knows the guy from high school:

As a law firm, we at The Ticktin Law Group do not like to get involved in politics. As soon as we endorse one side, we risk alienating everyone on the other side. Also, our lawyers and staff are, themselves, on both sides. Politics is not our game. However, Justice is!

If you saw a guy get publicly smeared, and you knew him well from the days you were friends and seniors together in high school, if you knew him to be a decent and honest man, would you want to say something? This is why I need to share what I know.

I was aghast at watching last night's debate. It was a set-up. The moderators, Cruz, and Rubio were all like little alligators trying to take a bite out of Trump. Yes, Donald Trump has had some failures, but he has been exceedingly successful. None of this came out. Instead, there was a general attack. Rubio simply makes up lies. He pretends that Trump has small hands and makes fun of him for something which isn't even real. He pretends that Donald wets his pants, and makes fun of him, as though it was true, and then he calls Donald Trump a “Bully.”

I am not suggesting that you should vote or not vote for anyone. I just need to defend a former friend who is being smeared.

Like Donald Trump, I attended New York Military Academy (“NYMA”) for high school. In fact, in our senior year, together, Donald was my captain, and I was his 1st Platoon Sergeant. I sometimes joke that I ran his first company for him, Company “A.”

People don't really change much from the ages of 17 and 18, and I know this guy. I know him to be a good decent guy. We lived and breathed an Honor Code in those years. It wasn't just a rule. It was our way of life. Neither Donald, nor any other cadet who graduated with us would ever lie, cheat, or steal from a fellow cadet. These values became irreversibly intertwined in the fabric of our personalities, of who we are.

Of the 99 guys (no girls in those days) in our class, there is not one who I know who has a bad word to say about Donald Trump. Think of it. With all the jealousies which arise in high school and thereafter, with all the potential envy, not one of us has anything other than positive memories of this man. How could we? He was an “A” student, a top athlete, and as a leader, he was highly respected. We never feared him, yet we never wanted to disappoint him. He had our respect. He was never a bigot in any way, shape or form. He only hates those who hate. Of course he denounces the KKK.

As to the discussion with the New York Times, it is his choice to release the ‘off the record' remarks. However, if he does, it opens the door for all political opposition to make that demand for everyone, and that means that our press will never get those ‘off the record' remarks which help them to understand the realities of the campaign. Moreover, the idea that Donald Trump confessed some alternate theory of his position is preposterous. Can anyone believe that all those NY Times reporters are walking around knowing some deep dark nasty secret about a guy who is seeking an endorsement?

The Republican establishment is afraid of Donald Trump. Why? They are afraid that he will lose to Hillary. They don't hate Donald. They hate her. They are so fearful that they fail to see that by expanding the base of voters for Trump, he is more likely to win.

Watching the chorus of whiners, decriers, denigrators, and self-righteous put-down experts from so many directions, from Mit Romney, to Megyn Kelly, Little Mario, it has to make you wonder. Why? Why are so many people so angry with Donald Trump, that they are lying, name calling, ridiculing, and demeaning him as they do. Either they are afraid, or they know him to be evil.

This is why I feel the need to speak out at this time. I know this man. He is a lot of things, but he is not evil. He is a decent honest guy who loves this country, and who is willing to sacrifice so much of what is left of his life, because he knows that this country needs to be fixed, and that it is going to require someone who can do the job. He just doesn't see anything around him other than political hacks, so he is willing to take this huge responsibility.

I'm not saying that he is the only one who can do the job. My point is simply as to his motivation and his goodness.

This next decade is going to be one of major changes. We all see the climate changing, and the world food supply is getting lower. Our fish stock around the world is running low. Oil prices will cause countries to fail. The Middle East is beyond repair, and we have become weak and ineffective around the world. Donald Trump sees the issues and knows that he can assemble leaders who would have the best chance of fixing things. This is why he is running. He does not need it for his own aggrandizement. He doesn't need another big jet or to take up residence in the White House. He just wants things to be fixed, and he knows that the politicians won't fix anything.

I knew Donald Trump and was close to him in our senior year in high school. I just want you to know that there is nothing to fear from him. His character is as good as it gets. He is a patriot, taking on a heroic task, and being thanked by massive abuse.

If you want to see a true reflection of a man, look at his children. Need I say more?”

Source: https://www.facebook.com/Peter.Ticktin/posts/10205751789135961

Latest News Articles – March 31, 2016

From James Harkin (Webmaster & Editor of LindseyWilliams.net). Here is a summary of articles of interest from around the world for this week. Please LIKE the Lindsey Williams Online Facebook Page to see stories posted daily regarding the current state of the economy around the world.

Lindsey Williams Online | Promote your Page too

Latest News From March 25, 2016 to March 31, 2016:

- Negative Interest Rates: Causes, Consequences and Ramifications

Central Banks are under the mistaken belief that negative interest rates could be the magic kiss which turns their toad economics into Prince Charmings. Why exactly do they think this? What makes Draghi, Kuroda, and others think imposing negative interest rates will stimulate credit and lending in their respective economies? It is important to understand the logic behind this historic moment in global monetary history. Negative interest rates are unprecedented and show how far we have gone off course in terms of policy related to money and credit markets. They are already having a tremendous effect in several European countries and Japan, and they may eventually be coming to the US. Negative rates hold significant future implications for gold as well. - SunEdison shares tumble 55% on bankruptcy filing fears

Shares of renewable power firm SunEdison plummeted 55% Tuesday as it teetered on the edge of bankruptcy amid slumping oil prices and swirling questions over the company's accounting practices. SunEdison faces a “substantial risk” of bankruptcy, according to the U.S. Securities and Exchange Commission filing by a subsidiary, TerraForm Global. SunEdison develops, installs and operates alternative energy projects. - 23 Percent Of Americans In Their Prime Working Years Are Unemployed

Did you know that when you take the number of working age Americans that are officially unemployed (8.2 million) and add that number to the number of working age Americans that are considered to be “not in the labor force” (94.3 million), that gives us a grand total of 102.5 million working age Americans that do not have a job right now? I have written about this before, but today I want to focus just on Americans that are in their prime working years. When you look at only Americans that are from age 25 to age 54, 23.2 percent of them are unemployed right now. The following analysis and chart come from the Weekly Standard… - Dallas Fed Respondent Sums It Up: “Anyone Saying We're Not In Recession Is Peddling Fiction”

Headlines will crow of the seasonally-adjusted ‘beat' of expectations for the Dallas Fed survey (-13.6 vs -25.8 exp) but this is the 15th month in contraction (below 0) – something only seen in recession. Scratching below the surface we see employees, workweek, and capex all in contraction and forward expectations for new orders and employment tumbled. Perhaps that reality is what drove one respondent to rage, “anyone who says the economy is not in recession is peddling fiction.” - Q1 GDP Crashes To 0.6%: Latest Atlanta Fed Estimate

Earlier today we said that following the abysmal January spending data revision that “the Atlanta Fed will have no choice but to revise its Q1 “nowcast” to 1.0% or even lower, which would make the first quarter the lowest quarter since the “polar vortex” impacted Q1 of 2015, and the third worst GDP quarter since Q4 2012. It means one-third of already low Q1 GDP growth has just been wiped away.” It was “even lower.” - US Goods Trade Balance: Exports Stabilise at Low Levels

There was a small recovery in exports for February, which offers some hope that the sector has bottomed out. The latest US trade deficit for goods increased slightly to US$62.9bn for February, from a revised US$62.2bn the previous month and was slightly above the consensus US$62.4bn. Compared with February 2015, there was a widening of over US$7bn in the deficit. - Chinese Seizing Golden Opportunity; Gold Demand Surging

Generally speaking, rising prices tend to temper demand, but when it comes to gold in China, the recent price rally has created the opposite effect. As the Wall Street Journal put it, “Chinese investors see a golden opportunity.” Demand for gold has surged in China over the last several weeks, during a period generally considered out of season. And it’s not typical Chinese jewelry purchases driving the demand. Chinese investors are buying gold coins and bars. - Seven years after the Great Recession, some Chicago suburbs may never recover

Mitchell and Loria Versher say they were looking for one thing when they bought their first home in South suburban Markham: “Stability.” They might have been better off buying swampland in Florida. In retrospect, July 31, 2007, was a bad day to go shopping for property anywhere. But the modest 900-square-foot Cape Cod-style home the Vershers bought that day for $137,000, on the eve of the worldwide credit crunch, has fared especially badly, by any standard. - How They Brainwash Us — Paul Craig Roberts

Anyone who pays attention to American “news” can see how “news” is used to control our perceptions in order to ensure public acceptance of the Oligarchy’s agendas. For example, Bernie Sanders just won six of seven primaries, in some cases by as much as 70 and 82 percent of the vote, but Sanders’ victories went largely unreported. The reason is obvious. The Oligarchy doesn’t want any sign of Sanders gaining momentum that could threaten Hillary’s lead for the Democratic nomination. - Heidi Cruz: Her Evil Past Is Now Being Revealed

While I am aware that Heidi Nelson Cruz apparently does suffer from deep depression, just after Hillary Rodham Clinton, she is the next person to be feared the most in this presidential race for 2016. Yes, I believe in common decency, but I also stand for the dignity of women, which means that they must be respected and treated equally even if it requires the truth. In an article written by Jesse Byrnes for The Hill that was released today on March 25, 2016, under the title “Trump aide fulfills threat to ‘spill the beans' on Heidi Cruz,” he reports on the recent interview on MSNBC that Steve Kornacki had with Katrina Pierson who is an aide for Donald Trump. - Chemtrail Flu: Have You Got It Yet?

Pastor Williams: ‘There is a near epidemic going on in America.' ‘You’re sick. Your nose is stuffy. Your body aches, You’re sweaty, coughing, sneezing and you don’t have enough energy to get out of bed. It’s not the flu. It’s a conspiracy, according to Dr. Len Horowitz. His opinion is not based on conspiracy theory but on conspiracy fact. Over the past 10 years, Horowitz has become America’s most controversial medical authority. A university-trained medical researcher, Horowitz, 48, charges that elements of the United States government are conspiring with major pharmaceutical companies to make large segments of the population sick. The mainstream media is reporting that hospital emergency rooms are jammed with patients suffering from a bizarre upper respiratory infection that doesn't quite seem like a virus. They are reporting that it’s a “mystery” flu and that the flu vaccines are ineffective against it. “That’s all hogwash, bogus nonsense”, says Dr. Leonard Horowitz. - HARRY DENT: Civil unrest is coming to America

I made a confession to our Boom & Bust subscribers last month. While I generally advise against owning most real estate, I have a secluded property in the Caribbean. It's the only property I own (I rent my home in Tampa), and I know for a fact that its value will probably depreciate in the great real-estate shakeout I see ahead, though most likely by half as much as a high-end property in Florida. I own this property because I see rising chances for civil unrest in the inevitable downturn ahead, especially in the US. I want a place to go if things get really bad, and it looks increasingly likely that they will. The evidence for that is piling up in this year's presidential race. - Is This The Debt Jubilee?

Not so long ago the financial world viewed certain numbers as limits beyond which lay trouble. Interest rates near zero, for instance, were thought to risk destabilizing the banking system. And government fiscal deficits above 3% were considered so dangerous that exceeding this level was prohibited by the Maastricht treaty that all eurozone members were required to sign. Those numbers — 0% and 3% — are still considered bad. But now for the opposite reason: They’re insufficiently aggressive. A big part of the world, as everyone now knows, operates with negative interest rates. And prominent economists are urging even greater negativity as a way to make government debt profitable and get people borrowing and spending again. - Empty Buildings and Wasted Debt: The Chinese Economic “Miracle”

There’s no doubt that the Chinese economic miracle is real. When you move 500 million people from rural to urban settings, taking them from small farms and putting them in a specialized labor force, the economic dividend is massive. That’s how you keep GDP growing more than 7% for 25 years. But along the way, they wanted more. Beyond building factories and housing for new arrivals, local politicians started building massive, wasteful projects. Political meeting halls… Unused apartment buildings… Empty shopping malls… Part of it might have been poor economic planning, but a bigger, and more common, problem was at work. - Global Economy Dying Pig-No More Rate Hikes-Rob Kirby

Macroeconomic researcher Rob Kirby predicted the Federal Reserve’s interest rate increase late last year “would be one and done.” Kirby explains, “They had no business raising rates in the first place because the economy was not exhibiting enough strength to warrant any rate raises whatsoever, and there won’t be any more interest rate raises because the economy continues to roll over. Doctored economic data cannot make the sick pig that the global economy really is look any better. It doesn’t matter how much lipstick you put on that dying pig. It’s still a dying pig.” - Mitsui Sees First Loss Since 1947 Amid $2 Billion Writedown

Mitsui & Co., Japan’s second biggest trading house, forecast its first net loss since it was founded in its modern form in 1947 due to impairment charges on mining and energy projects from South America to Australia. The Tokyo-based trading house expects a net loss of 70 billion yen ($623 million) in the fiscal year ending March after booking impairment charges of 225 billion yen on assets including the Browse LNG project in Australia and the Caserones copper development in Chile, according to a statement Wednesday. Mitsui previously forecast net income of 190 billion yen. - This Game’s Almost Over: Central Banks Are Running Out Of Options

Going into last week’s Fed meeting, the general consensus was that they would not raise rates. When they hiked rates by a quarter point in December, they projected there would be four additional quarter-point raises in 2016. That’s starting to look fishy as we’re almost a quarter of the way through the year and there’s still no hike. Sure enough, the Fed left rates unchanged as expected last week, and revised their rate expectations lower through 2016. Now, they anticipate only hiking another half point by the end of the year. - The reserve currency curse

Is reserve currency status a blessing or a curse? The answer might seem obvious, as reserve currencies have been shown to confer lower borrowing costs on their issuers. But what of the borrower who, enticed by low interest rates, borrows more than they can pay back? Naturally the result will be a default. However, for the issuer of a reserve currency that is unbacked by a marketable commodity, such as gold, in the event that they borrow too much, they can just print more reserves. While this avoids default indefinitely, it also hollows out the economy, erodes the capital stock, reduces the potential growth rate and, eventually, leads to a dramatic devaluation of the currency and loss of reserve status. History has not been kind to countries that have followed this path, nor to their financial markets. In my view, the grave investment risks associated with the possible eventual loss of the dollar’s reserve status are not priced into financial markets. - Well That Didn’t Work

The Bank of Japan and European Central Bank eased recently, which is to say they stepped up their bond buying and/or pushed interest rates further into negative territory. These kinds of things are proxies for currency devaluation in the sense that money printing and lower interest rates generally cause the offending country’s currency to be seen as less valuable by traders and savers, sending its exchange rate down versus those of its trading partners. This was what the BoJ and ECB were hoping for — weaker currencies to boost their export industries and make their insanely-large debt burdens more manageable. - Belgium Terror Just the Beginning of Insecure World-Egon von Greyerz

Financial expert Egon von Greyerz (EvG) says terror attacks, like the one that just happened in Brussels, can destabilize the entire world. EvG, who lives in Switzerland, explains, “This is obviously a very sad day for our friends in Belgium, but at the same time, we know this is just the beginning, not only in Europe, but with the whole world. We are going to see a much more insecure world. It is worldwide. We know that the refugee problem has included a number of potential terrorists. . . . The problems that will be in the west were created by the U.S. and Europe. The problems that were created in the Middle East and North Africa will lead to more of this. There is anarchy in Libya. There is anarchy in Iraq, and the West has created this. So, they are paying us back, and I don’t think this is finished. We will see a less secure world, and it is not just Europe. The U.S. will see similar problems.” - Central Banks Move Into Crypto-Currencies As Part Of Cashless Society Hustle

Top UK Telegraph journo Ambrose Evans-Pritchard just wrote about this planned crypto-currency in what is either an incredibly stupid and uneducated article or pure propaganda… it was titled “Central banks beat Bitcoin at own game with rival supercurrency.” The article is horrible central bank happy-talk that reads like the Bank of England wrote it for him and starts off with a blatant lie only three words in… this new RScoin, put out by the central bank of England, has not BEAT bitcoin. It is worse in every imaginable way than bitcoin… right down to the name. RScoin… central banker types aren’t exactly the most creative. We’ll call it FiatCoin around here. - Lloyd's of London Takes `Massive Hit' From Low Returns

Lloyd’s of London reported a 30 percent drop of full-year profit as the world’s largest insurance market was hurt by continued pressure on pricing and the lowest investment returns since at least 2001. Earnings declined to 2.1 billion pounds ($3 billion) for 2015 as income from investments, primarily in fixed income, sank 60 percent to 400 million pounds with the majority earned in the first half of the year, according to the company’s annual report Wednesday. Weaker insurance pricing in 2015 is expected to continue this year, hurting profitability. “We’ve taken a double hit from reduced margins in underwriting and lower investment yield,” Chief Executive Officer Inga Beale said in an interview with Bloomberg Television Wednesday. “On the investment side we saw a dramatic reduction in 2015 that was a massive hit” to earnings. - Economic Collapse: Marc Faber Issues Dire Warning for America

U.S. on Verge of Economic Collapse, Says Marc Faber. Adding more emphasis on his belief that the U.S. is on the verge of an economic collapse, perma-bear investor Marc Faber advised retail investors not to put money in U.S. stocks; instead, according to Faber, investors should pour their funds into emerging market equities. The publisher of The Gloom, Boom & Doom Report newsletter told Bloomberg that U.S. stocks are highly priced by several measures, including price-to-sales, price-to-earnings, and market cap-to-gross domestic product (GDP) ratios, whereas emerging markets have corrected significantly since 2006 and 2011. - U.S. Mining Losses Last Year Wipe Out Profits From Past Eight Years

The U.S. mining industry—a sector that includes oil drillers—lost more money last year than it made in the previous eight. Mining corporations with assets of $50 million or more recorded a collective $227 billion after-tax loss last year, according to Commerce Department data released Monday. That loss essentially wipes out all the profits the industry had made since 2007. - Here We Go Again: Government Ramps Up Borrowing As Private Sector Slows

This morning, US existing home sales plunged and the Chicago Fed’s national activity index turned negative. Both are obvious signs of a slowing economy. Anticipating this kind of news, Credit Bubble Bulletin’s Doug Noland in his most recent column analyzed the Federal Reserve’s quarterly Z.1 Report for signs of changing financial trends, and found something potentially serious. - Michael Hudson on Debt Deflation, the Rentier Economy, and the Coming Financial Cold War

Michael Hudson has sent us the transcript of his newly-released interview with Justin Ritchie on

February 26 with XE Podcast - NIRP Is Absolutely Crushing Big Parts Of The Finance World

Savers are the obvious victims of the past few years’ plunge in interest rates. But there are other casualties, including money market funds, which have no reason for existing if their yield is negative, and insurance companies, which price their policies on the assumption that they’ll earn good returns on their bond portfolios. As bond yields plunge, the returns insurance companies can expect are also plunging, forcing them into huge write-offs and, soon, steep premium increases that will scare away customers. - US Military Increases South China Sea Presence; China Balks

In response to China’s assertive moves in the South China Sea, the U.S. State Department struck a deal with the government of the Philippines to permit American military forces to operate from five Philippine bases. The Chinese seem more annoyed than intimidated by the increased American military presence in the region. - Interest Rates Are Never Going Back to Normal

Let’s see… U.S. corporate earnings have been going down for three quarters in a row. The median household income is lower than it was 10 years ago. And now JPMorgan Chase has increased its estimated risk of a recession to about one in three. These things might make sober investors wonder: Is this a good time to pay some of the highest prices in history for U.S. stocks? Apparently, they don’t think about it… Last week U.S. stocks rose again, after the Fed announced that it would go easy on “normalizing” interest rates. The Dow rose 156 points on Thursday, putting it in positive territory for 2016. - The Government Wants to Give You Free Cash

Could the government start handing out free cash? It sounds crazy. But believe it or not, it’s a real possibility. In fact, an Ivy league economist just predicted it will happen within five years… If you’ve been reading the Dispatch, you know the Federal Reserve has used crazy monetary policies to “stimulate” the economy since the 2008 financial crisis. These policies have been huge failures. After seven years, the U.S. economy is barely growing. Yet, instead of acknowledging its failure, the government is preparing to double down. And its friends in the lapdog media think it’s time for “helicopter money.” - Gold and Gold Stocks – A Change in Market Character

Similar to many others, we have been waiting for some sort of correction in gold and gold stocks, but obviously, not much has happened in this respect so far. We have written quite a lot about gold and gold stocks between August 2015 and February 2016, because we felt a good opportunity was at hand – a short term trading opportunity at the very least, but one with the potential to become more than that. - NATO’s RAGE: Trump Questions America’s Role in ‘Nation-Building’ – Talks of Restoring Russian Ties

GOP presidential frontrunner Donald Trump unveiled his noninterventionist platform to The Washington Post’s editorial board and in the process – questioned America’s relationship with the North Atlantic Treaty Organization… - China Sends Fed A Warning: Devalues Yuan By Most In 2 Months

With the USD Index stretching to its longest winning streak of the year, jawboned by numerous Fed speakers explaining how April is ‘live' (and everyone misunderstood the dovishness of Yellen), it appears that The PBOC wanted to send a message to The Fed – Raise rates and we will unleash turmoil on your ‘wealth creation' plan. Large unexpected Yuan drops have rippled through markets in recent months spoiling the party for many and tonight, by devaluing the Yuan fix by the most since January 7th, China made it clear that it really does not want The Fed to hike rates and cause a liquidity suck-out again. - This map shows every country's major export

Bank of America Merrill Lynch is out with its “Transforming World Atlas” research note, which examines global economic trends through a series of maps. One particular map that stood out showed each country's major export, using data from the CIA World Factbook. Notably, many countries heavily rely on commodities as their primary source of foreign income. Consequently, one can use this as a map to see which country gets hit the hardest when commodities drop. For example, those in navy were hardest hit by the oil crash. - These are the fastest growing and shrinking counties in America

The American population is always changing in various ways. The Census Bureau recently released their annual estimates of population change in the 3,142 counties and county equivalents of the US, showing how populations grew and shrank between July 1, 2014, and July 1, 2015. Using those estimates, we made a map showing the total population change in each county. Red counties had a loss of population, and blue counties saw increases. As has been the overall trend for decades, the Northeast and Midwest tended to see a loss in population, while the big cities of the South and West, along with oil-rich regions in west Texas and North Dakota, saw big increases. - HEDGE FUND MANAGER: This is ‘no longer an investment market but a battlefield'

London-based hedge fund manager Crispin Odey, who runs $11 billion in assets, said this is “no longer an investment market but a battlefield.” In Odey's OEI Mac fund's February investment update, Odey slammed central banks for lowering or not raising interest rates. “Several years of watching central banks watching central banks responding to ever falling productivity numbers by reducing interest rates have shown that they can effect asset prices with their actions, but that not only do they have almost no effect on economic activity, but they positively damage it,” Odey said. This year has been brutal for Odey. The OEI Mac fund, which invests in Odey's flagship European fund, finished January up 8.3% before seeing all its gains wiped out after falling -10.6% in February. - Swiss National Bank Admits It Spent $470 Billion On Currency Manipulation Since 2010

By now it is common knowledge that when it comes to massive, taxpayer-backed hedge funds, few are quite as big as the Swiss National Bank, whose roughly $100 billion in equity holdings have been extensively profiled on these pages, including its woefully investments in Valeant and the spike in its buying of AAPL stock at its all time high. But while the SNB's stock holdings are updated every quarter courtesy of its informative SEC-filed 13F (we wish the Fed would also disclose the equities it holds courtesy of its Citadel proxy), getting a gllimpse of the flow is more problematic, and involves waiting for the hedge fund's, pardon central bank's annual report. Earlier today patience was rewarded when the SNB filed its 108th annual report, in which it disclosed that it spent CHF 86.1 billion or $88 billion, on current interventions last year, a measure of its efforts to shield the economy from deflation. - This Is One Of The Most Important Silver Charts Of 2016!

On the heels of gold and silver continuing to consolidate their gains from the early part of 2016, analyst David P. out of Europe sent King World News an extremely important chart of silver, along with a brief commentary. The following long-term silver chart and commentary was sent to KWN by analyst David P. out of Europe: “The silver chart looks incredibly bullish. The buy signal on the MACD has confirmed the upward move and just look at the setup.” - Desperate Chinese Investors Flood US, Canadian Housing Markets, But Real Numbers Are Taboo

Buying a home in the US or Canada has been an effective way for foreign residents to launder some money and get their wealth out of harm’s way. In the trophy markets on the US West Coast and in the Canadian cities of Vancouver and Toronto, rumors of a massive influx of Chinese money have swirled with growing intensity for years. The Chinese economic elite are worried about a devaluation of the yuan. They’re worried about getting rolled up by their own government. They’re worried about markets collapsing. They’re worried about pollution. They’re worried about a million things. They have one foot out the door. If push comes to shove, they’re ready to make the move. So capital flight from China has turned into a tsunami. And this money has to go somewhere. - Oman Gas Projects Could Undermine U.S. LNG Market Ambitions

Two separate projects in the sultanate of Oman are about to turn the tiny Gulf country into an important international liquefied natural gas (LNG) player that the U.S. will have to contend with in its ambition to become the leader of this market. The first one is an agreement with Iran for the construction of a 400-kilometer pipeline that will transport Iranian natural gas to be liquefied at the three-train processing facility of Oman LNG. - What Is Happening With GLD And Emerging Markets?

The following charts and commentary are from Jason Goepfert at SentimenTrader: ETF traders keep coming into gold. The GLD fund is seeing inflows even as the fund struggles to hold its gains. - BERNANKE: Here are some of the exotic tools the Fed could use if we see another slowdown

Although the U.S. economy appears to be on a positive trajectory, history suggests that at some time in the next few years we may again face a slowdown, with a weakening job market and possibly declining inflation. Given that the historically low level of short-term interest rates is likely to limit the scope for conventional rate cuts, how would the Federal Reserve respond? - Bank Earnings Get Mauled by “Leveraged Loan” Time Bomb

Banks have a few, let’s say, issues, among them: a source of big-fat investment banking fees is collapsing before their very eyes. S&P Capital IQ reported today that there was an improvement in the “distress ratio” of junk bonds, after nearly a year of brutal deterioration that had pushed it beyond where it had been right after Lehman’s bankruptcy. The recent surge in oil prices seems to have lifted all boats for a brief period. But not “leveraged loans.” Their distress ratio spiked to the highest levels since the Financial Crisis! - “The Greatest Crash Of Your Life Is Just Ahead…” – Harry Dent Warns

Harry Dent, best-selling author and economist, has warned that the stock bubble in the U.S. today is the biggest in history and that the “greatest crash of your life is just ahead…” Writing on his website EconomyandMarkets.com, Dent warned that ‘The story on Wall Street and CNBC continues to be that we’re in a correction and this is a buying opportunity. Even Warren Buffett joins the chorus of stock market cheerleaders for the skeptical public. Well, I agree with the skeptical public, not the experts here! The bull market from early 2009 into May 2015 looks just like every bubble in history, and I’m getting one sign after the next that we did indeed peak last May. - Keiser Report: Warnings from Confucius

In a double-Stacy episode, we look at the warnings from Confucius and Adam Smith. First, we look at the danger of those who think but do not learn; so ‘free trade’ deals are imposed because a ‘think tank’ believes it’s a great ideological idea but without looking at history to see what happens when wealth and hope are taken from an entire class of people. Then, in the second half, we look at the most important issue of 2016: creeping monopolization as oligopolies emerge in every major sector in America and across the world. - Top Advisor To Largest Sovereign Wealth Funds Exposes Fed Manipulation And Intervention

Michael Belkin on the Fed’s interventions and manipulations: “I’m utterly convinced that the Federal Reserve manipulates the stock market. I experienced this firsthand when I worked at a government securities dealer, Solomon Brothers, which was one of the top three investment banks back in the 1980s and early 1990s. And in the 1987 stock market crash, they (the Federal Reserve) came in through us and intervened in the markets to make the markets bounce back. Everybody on the desk knew that. They (at Solomon’s trading desk) watched the (Solomon Brothers) Vice Chairman start bidding for multiple huge blocks of stock with money that we didn’t have. At that point the trading desk was paralyzed and nobody knew what was going on. - This Oil Sector Hasn’t Crashed Yet… But It’s About to

Unlike the rest of the oil industry – which has been decimated by lower oil prices – U.S. oil refiners have marched on to new highs. But the five-year-long bull market for these companies is about to come crashing down. Let me explain… You can see the incredible uptrend in the following chart of refining giant Valero Energy (VLO). Its shares are trading near an all-time high… - Oil Prices Fall Fast On Huge Inventory Build

Two hundred and twenty-two years after Josiah G. Pierson patented the rivet machine, and the oil market remains as riveting as ever. (I’m here all week, folks). After yesterday’s API report gave a flourishing hat-tip towards a large build to crude stocks and a large draw to gasoline, oil is sliding amid a stronger dollar, while gasoline is pushing higher. Here are some things to consider today: Jumping straight into economic data, the most insights we’ve had overnight have come from Brazil. Its mid-month inflation print dropped into single digits (at +9.95 percent), but still close to a 12-year high. Meanwhile, its unemployment rate jumped to 8.2 percent, its highest level in nearly 7 years. - There has been ‘a perfect storm' on Wall Street

By now it should come as no surprise that first-quarter results will be pretty horrendous for Wall Street. Banks will begin reporting Q1 earnings in mid-April, and a chorus including Morgan Stanley's head of trading and the CEO of JPMorgan's investment bank has warned that it will be unusually weak. The data-analytics firm Dealogic's preliminary Q1 results for investment-banking fees show the worst first quarter since the dark post-financial-crisis days of 2009. - Gold, Silver & The Final Currency War

Andy Hoffman from Miles Franklin is back to help document the global economic collapse for the third week of March, 2016. Thanks for tuning in. And despite the horrific “terror attack” in Belgium today, March 22, 2016 [Google: 322 Skull and Bones], I hope you all have a great week. - Peter Schiff on gold, the Fed and the world’s addiction to stimulus

Peter Schiff is the CEO of Euro Pacific Capital Inc., and is an outspoken critic of the Fed’s stimulus and zero interest rate policies. He is the author of several New York Times bestsellers including Crash Proof, and most recently, The Real Crash. - More Confessions of an Economic Hit Man: This Time, They’re Coming for Your Democracy

Twelve years ago, John Perkins published his book, Confessions of an Economic Hit Man, and it rapidly rose up The New York Times’ best-seller list. In it, Perkins describes his career convincing heads of state to adopt economic policies that impoverished their countries and undermined democratic institutions. These policies helped to enrich tiny, local elite groups while padding the pockets of U.S.-based transnational corporations. - Japan Goes Full Krugman: Plans Un-Depositable, Non-Cash “Gift-Certificate” Money Drop To Young People

The Swiss, the Finns, and the Ontarians may get their ‘Universal Basic Income' but the Japanese are about to turn the Spinal Tap amplifier of extreme monetary experimentation to 11. Sankei reports, with no sourcing, that the Japanese government plans to unleash “vouchers” or “gift certificates” to low-income young people to stimulate the “conspicuous decline” in consumption among young people. The handouts may not be deposited, thus combining helicopter money (inflationary) and fully electronic currency (implicit capital controls and tracking of spending). - Durable-Goods Orders Weaken Amid Global Headwinds

A key measure of U.S. manufacturing health tipped back into decline last month, evidence that headwinds from weak global growth, low oil prices and financial volatility are weighing on company spending. New orders for durable goods—products designed to last at least three years, like dishwashers and aircraft—fell a seasonally adjusted 2.8% in February from a month earlier, the Commerce Department said Thursday. - The Initial Jobless Claims Mystery Continues

Still hovering near 43 year lows, initial jobless claims printed a better than expected 265k against expectations of 269k. Continuing claims also dropped from 2.218m to 2.179m – also back near 43 year lows. So, the mystery is – why is the ISM's composite manufacturing and services employment index collapsing to 6 year lows? - The labor market just did something that hadn't happened since the 1970s

Thursday's initial jobless claims came in stronger than expected, with 265,000 claims versus expectations of 269,000. But the truly historic part of the report actually came three weeks ago. “Today's release also includes revisions of both initial and continuing claims dating back to 2011,” Thomas Simons, senior economist at Jefferies, wrote. “Most of the changes were relatively modest, but the most notable aspect of the revisions is that claims for the week of March 5th (3 weeks ago) were revised down to 253,000 which is, as far as we can tell, the lowest weekly claims figure since November 24, 1973.”

ELITE PLANS FOR 2016 – Take Immediate Action! – A New DVD From Pastor Lindsey Williams. Who will be the next president of the U.S.? Why no financial collapse in 2015? Hear from someone in contact with the Elite. Political Correctness. Five firearms every American should own. Is war inevitable? ORDER NOW online for shipment now. Or call Prophecy Club Toll-Free 1-888-799-6111.

Latest News Articles – March 24, 2016

From James Harkin (Webmaster & Editor of LindseyWilliams.net). Here is a summary of articles of interest from around the world for this week. Please LIKE the Lindsey Williams Online Facebook Page to see stories posted daily regarding the current state of the economy around the world.

Lindsey Williams Online | Promote your Page too

Latest News From March 18, 2016 to March 24, 2016:

- Connecticut Credit Risk Spikes To Record High

Amid cuts in aid and surging taxes, it appears the market remains less than impressed at Connecticut's debt sustainability. Following last week's disappointing bond auction, CT bond risk has spiked to 65bps over the benchmark – a record spread demanded by investors to take CT repayment risk. CT becomes the 4th riskiest US state after NJ, IL, and PA. - Humans need not apply: RBS to replace 550 roles with robots

Royal Bank of Scotland (RBS) plans to replace 550 of its face-to-face investment advisers with so-called robo-advisers. 220 investment advice roles and 200 protection advice jobs will be cut while face-to-face investment advice will be available only to customers with at least £250,000 in investment assets. - US Manufacturing PMI Misses By Most Since 2013, Presidential Election Blamed

Given the extraordinary jumps in several regional Fed surveys, hope was rife that US Manufacturing PMI's flash print would jump… it didn't. Hovering near multi-year lows at 51.4, PMI missed expectations of 51.9 by the most since Aug 2013. With record highs in wholesale inventories, Markit claims that “pre-production inventories decline at the steepest pace in over 2 years.” The blame for this plunge: dollar strength, weak global demand, and Trump. Not recovering… - Americans just had $176 million in wages garnished by the government due to unpaid student loans

Despite more programs available to federal student loan borrowers to manage their loans, borrowers are still struggling. In fact, between October 1 and December 31, 2015, private debt collection companies hired by the Department of Education garnished more than $176 million in wages from defaulted student loan borrowers in order to pay back their debts, according to data released last week. Though the government provides a variety of options to help student loan borrowers manage their payments, it also has extraordinary powers — including wage garnishment — to collect on the debt if a borrower defaults. - U.S. existing home sales tumble in warning sign for housing market

U.S. home resales fell sharply in February in a potentially troubling sign for America's economy which has otherwise looked resilient to the global economic slowdown. The National Association of Realtors said on Monday existing home sales dropped 7.1 percent to an annual rate of 5.08 million units, the lowest level since November. Sales have been volatile and prone to big swings up and down in recent months following the introduction in October of new mortgage regulations, which are intended to help homebuyers understand their loan options and shop around for loans best suited to their financial circumstances. - Fed's Lacker says he is confident inflation will return to 2 percent

U.S. inflation is likely to accelerate in coming years and move toward the Federal Reserve's 2 percent target, Richmond Fed President Jeffrey Lacker said on Monday, flagging upside risks to price growth. Inflation has been unusually sluggish since the 2007-2009 recession. The Fed has kept interest rates low in part to foster faster price gains and said last week it was likely to raise interest rates more slowly than policymakers had expected in December. - Share Buybacks Turn Toxic

Companies are still borrowing and spending billions on buying back their own shares – one of the big drivers behind the blistering stock market rally of the past few years. It worked wonderfully and without fail. But suddenly, it’s doing the opposite, and now the shares of the biggest buyback queens are getting hammered. Something broke in the gears of this financially engineered market! During the November-January period, 378 of the S&P 500 companies bought back their own shares, according to FactSet. Total buybacks in the quarter rose 5.2% from a year ago, to $136.6 billion. Over the trailing 12 months (TTM), buybacks totaled $568.9 billion. That’s an enormous amount of corporate cash that was dumped on the market! - It's Day 26 Of The Rally – Decision Time

In September/October 2015, the S&P 500 miraculously rallied just over 13% in 25 days amid falling earnings expectations, before collapsing back to fresh cycle lows. It has now been 25 days (and just over 13%) since the Mid-Feb lows (and earnings expectations are plumbing new lows)… The same but different? - Rich people are paying lawyers to get truthful stories deleted from the internet

Last week, Bloomberg, The Independent, Business Insider and a handful of other news organisations all deleted from their websites a story that a rich family did not want published. I can't tell you why it was deleted or who the story was about, because of a court order from a judge in London ruling that the facts be kept under seal. - January ‘Bounce' Dies As Fed's National Activity Index Tumbles Back Into Contraction Near 2-Year Lows

After January's hopeful spike to 6 month highs, Chicago Fed's National Activity Index plunged back into contraction (at -0.29) near 2 year lows. A shockingly large 58 of the 85 individual indiators within the index made negative contributions to the overall index which printed notably below the lowest economist's expectations. - Nanobot implants could give us ‘God-like' intelligence, but machines won't overtake us until they learn to love, scientist claims

The human brain could be enhanced by tiny robotic implants that connect to cloud-based computer networks to give us ‘God-like' abilities, according to a leading computer scientist. Ray Kurzweil, an author and inventor who describes himself as a futurist who works on Google's machine learning project, said such technology could be the next step in human evolution. He predicts that by the 2030s, humans will be using nanobots capable of tapping into our neocortex and connecting us directly to the world around us. However, he admitted that computers won't take over us until they learn to love and laugh. - Existing home sales plunge 7.1% to a 3-month low in February

Existing-home sales plummeted 7.1% in February, pointing to ongoing rockiness in a housing market struggling to find its footing. Sales ran at a seasonally adjusted annual rate of 5.08 million, the National Association of Realtors said Monday, well below the 5.3 million rate forecast by economists surveyed by MarketWatch. February’s decline followed a strong two months. Sales surged by the most ever in December, and followed with a sturdy reading in January when most economists had expected some giveback. - Federal Reserve Hot Air Pumped Up a Stock Market Bubble; 93% of Gains Due to Monetary Policy

The mainstream financial media is like a stopped clock. Every once in a while, it stumbles into being right. Last week, we had a veteran trader on CNBC Futures Now telling everybody to buy gold as long as central banks continue their expansionary monetary policy, all the while swearing he isn’t a “gold-bug.” - Legend Warns The Price Of Silver May Hit $660 As The World Financial System Melts Down

On the heels of wild start to the 2016 trading year, today the man who has become legendary for his predictions on QE, historic moves in currencies, and major global events, just warned that the price of silver may be headed to the stratospheric price of $660 as the world financial system melts down. Egon von Greyerz: “The Fed last Wednesday did what I had already forecast back in December and did not increase rates. They know that the real economic situation in the US and in the world is a lot worse than all the manipulated figures and propaganda. Therefore, we are now getting closer to Minsky Moment for the world economy… - Gerald Celente On Why People Are Buying Gold And Why The Price Is Headed Higher

Today the top trends forecaster in the world spoke with King World News about why the price of gold is going higher. Gerald Celente: “Why are people going into gold and why are gold prices going up? Listen to what former Fed president Richard Fischer said, ‘They (the central banks) are running out of ammunition.’ He also said, ‘We injected cocaine and heroin into the system,’ to basically keep the Ponzi scheme going. So why are people buying gold? Because it (the entire global financial system) is on a fake high. So that’s why gold is going up — it’s a fraudulent game. It’s not working. It’s a fake high. That’s why people are buying gold… - Radical Leftists Unleash Anti-Trump Riots Starting On March 19th

Many of the exact same groups that participated in Occupy Wall Street and helped organize protest rallies in Ferguson and Baltimore are now promising to bring us “the largest civil disobedience actions in a generation”. I recently wrote about the trouble that radical leftists have caused by attempting to disrupt Trump campaign events, but now there is a very organized effort to turn this into a national movement. On March 19th, thousands of angry protesters will descend on Trump Tower in New York City to denounce Donald Trump’s “fascist policies”, and on April 2nd dozens of leftist organizations will join together to launch “Democracy Spring” in Philadelphia. From there, large numbers of liberal activists will march to Washington D.C. where they will “risk arrest” during a “peaceful” sit-in at the U.S. Capitol from April 11th to April 18th. If the radical left is this freaked out about Donald Trump now, how bad will things get if he actually becomes the Republican nominee? - Why Investing In Silver Is Vastly Superior To Investing In Gold Right Now

When panic and fear dominate financial markets, gold and silver both tend to rapidly rise in price. We witnessed this during the last financial crisis, and it is starting to happen again. Because I am the publisher of a website called The Economic Collapse Blog, I am often asked about gold and silver when I do interviews. In fact, just a few days ago I was sitting right next to Jim Rickards during the taping of a television show when this topic came up. Jim expressed his belief that investing in gold is superior to investing in silver, but I had the exact opposite viewpoint. In this article, I would like to elaborate on why I believe that silver represents a historic investment opportunity right now. - Catalonia Nears Default, Threatens Spain’s Debt

When Catalonia’s regional government announced a road map to independence from Spain in November last year, Madrid’s response was to threaten to cut off the financial supply lines to the region. It was the equivalent of a declaration of economic war, riddled with risks, especially with an acutely cash-strapped Catalonia facing over €4.6 billion of bond redemptions in 2016. - China Hard Landing Hits Electricity Consumption

OK, we’ve heard the official story. China is transitioning from a manufacturing economy to a consumption-based economy. Consumers are king. They’re going to buy stuff. And that’s going to heat up the economy. Imports and exports have been plunging for months, but no big deal, Chinese consumers – and there are a lot of them – are going to pull the economy forward. That’s the official story. - A Strange Pattern Emerges When Trading The US Dollar In 2016

One of the more surprising market developments of 2016 has been the violent obliteration of those who had taken part in the biggest consensus trade of 2015, namely long the USD. As the Fed finally admitted earlier this week, the US economy is sputtering and is woefully incapable of handling 4 rate hikes, or 3 for that matter. In fact, the Fed will be lucky to push through even one more rate hike without the Chinese Yuan collapsing and unleashing even more capital outflows (which precipitated the major market swoons in the summer of 2015 and early 2016) arguably the main topic during the alleged Shanghai G-20 “central bank accord.” The result: this week saw the biggest two-day USD collapse against a basked of foreign currencies in years, and currently the DXY is trading at a lower level than a year ago. - January Mortgage Delinquencies up 6.6%; 98,000 Bad Mortgages Face Statute of Limitations in 3 States

The Mortgage Monitor for January (pdf) from Black Knight Financial Services (BKFS, formerly LPS) reported that there were 659,237 home mortgages, or 1.30% of all mortgages outstanding, remaining in the foreclosure process at the end of January. This was down from 688,672, or 1.37% of all active loans that were in foreclosure at the end of December, and down from 1.76% of all mortgages that were in foreclosure in January of last year. These are homeowners who had a foreclosure notice served but whose homes had not yet been seized, and the January “foreclosure inventory” is now showing the lowest percentage of homes that were in the foreclosure process since the fall of 2007. New foreclosure starts, which have been volatile from month to month, fell to 71,900 in January from 78,088 in December and from 93,280 in January a year ago, while they were still higher than the 66,626 foreclosure starts we saw in November, which had been the lowest since the crisis began. Over the past year, new foreclosure starts have remained in a range about one-third higher than number of new foreclosures we we seeing in the precrisis year of 2005. - “Don't Take The Public For Fools!”: China Hides Millions Of Layoffs, Jails Miners Protesting Unpaid Wages

When you look out across markets and across the increasingly fraught geopolitical landscape, there are plenty of black swans waiting in the wings (no pun intended). And quite a few of them are Chinese. China has, among other problems: a massive debt overhang that, all told, amounts to more than 250% of GDP; a decelerating economy that Beijing swears will be able to pull off a miracle and move away from the smokestack and away from export-led growth without slipping into recession; a currency crisis; a new property bubble in Tier-1 cities; and a burgeoning NPL problem in the banking sector. All of those issues are of course inextricably bound up with one another. They are set like dominoes and once the first one tips, the rest will too as sure as night follows day. - Life and Times During the Great Depression

The economy of the United States was destroyed almost overnight. More than 5,000 banks collapsed, and there were 12 million people out of work in America as factories, banks, and other shops closed. Many reasons have been supplied by the different economic camps for the cause of the Great Depression, which we reviewed in the first part of this series. Regardless of the causes, the combination of deflationary pressures and a collapsing economy created one of the most desperate and miserable eras of American history. The resulting aftermath was so bad, that almost every future Central Bank policy would be designed primarily to combat such deflation. - Goldman FX Head: “No Central Bank Conspiracy” To Crush The Dollar, “We Are Right, The Market Is Wrong”

Anyone having listened, and traded according to the recommendations of Goldman chief FX strategist Robin Brooks in the past 4 months, is most likely broke. First it was his call to go very short the EURUSD ahead of the December ECB meeting, which however led to the biggest EURUSD surge since the announcement of QE1. Then, two weeks ago, ahead of the ECB meeting he “doubled down” on calls to short the EUR ahead of the ECB, the result again was a EUR super surge, the biggest since December. And then, as we previously reported, ahead of the FOMC's uber-dovish meeting, Brooks released a note titled the “The Dollar Rally Is Far From Over” in which he said the following: “today brings the latest FOMC meeting. We expect the Fed to signal that it wants to continue normalizing policy, which means three hikes this year and four in 2017, with the statement referring to the risks as “nearly balanced,” reverting to phraseology used in October, just before December lift-off. Overall, our sense is that the outcome will be more hawkish than market pricing, in particular given that the FOMC may leave open the option of tightening at the April meeting.” - US Money Supply and Debt – Early Warning Signs Remain Operative

Year-end distortions have begun to slowly come out of the data, and while broad true US money supply growth remains fairly brisk, it has begun to slow again relative to January’s y/y growth rate, to 7.8% from 8.32%. So far it remains in the sideways channel (indicated by the blue lines below) between approx. 7.4% and 8.6%, in which it has meandered since mid 2013. We believe the next break “below the shelf” is likely to be a significant event. - The World Map of the U.S. Trade Deficit

The United States has now run an annual trade deficit for 40 years in a row. Last year was no exception, and in 2015 the U.S. had over $1.5 trillion in exports while importing $2.2 trillion of goods. The resulting trade deficit was -$735 billion. Today’s map from HowMuch.net, a cost information site, helps put this most recent information into perspective. Keep in mind that a trade deficit also means an outflow of domestic currency to foreign markets, as the U.S. is spending more money abroad than it is bringing in. - The Lego Movie Economy

After the February jobs report, President Obama said “America’s pretty darn great right now.” He then went on to disparage the “doomsday rhetoric” of the Republicans, which he said was pure “fantasy. I think that there is a good chance that this will enter the Hall of Fame of miss-timed statements, right up there with this jewel from Ben Bernanke in March 2007: “At this juncture, however, the impact on the broader economy and financial markets of the problems in the sub-prime market seems likely to be contained.” - Munich Re Gives The ECB The Middle Finger, Owns Almost 300,000 Ounces Of Gold

Last week, we reported on the ECB’s decision to cut the interest rates and how Mario Draghi said ‘helicopter money’ is ‘an interesting concept that is being studied’. In the accompanying Q&A session, Draghi also said he did not expect the ECB would have to reduce the (already negative) interest rates even further which disappointed the markets. In fact, the disappointment was so big, the ECB already sent one of its members into the trenches to walk back on that statement. - Investors Buy Gold ETFs at Record Pace

What were the three most popular investments over the last month? If we’re judging by ETF inflows, the three areas that investors piled into were precious metals, government bonds, and low-volatility equities. Notably, it was gold ETFs that set a new record with their highest monthly inflows in eight years, as investors bought $7.9 billion of securities in February. This is according to the latest from market data company Markit, that also noted that inflows relative to assets under management (AUM) were equally as impressive. More specifically, last month’s buying represented an increase of 14.6% in terms of AUM. This is a level only surpassed once before during the heat of the Financial Crisis, when inflows relative to AUM hit 17.7% in February 2009. - World’s Second Largest Reinsurer Buys Gold, Hoards Cash To Counter Negative Interest Rates

The world’s second-largest reinsurer, German Munich Re which is roughly twice the size of Berkshire Hathaway Re, is boosting its gold reserves and buying gold in the face of the punishing negative interest rates from the European Central Bank, it announced today. As caught by Mark O'Byrne at GoldCore and reported by Thomson Reuters this afternoon, the world’s largest reinsurer is far from alone in seeking alternative investment strategies to counter the near-zero or negative interest rates that reduce the income insurers require to pay out on policies. Munich Re has held gold in its coffers for some time and recently added a cash sum in the two-digit million euros, Chief Executive Nikolaus von Bomhard told a news conference. - Your Money In The Bank Will Be Gone

The world is now starting the final phase of the failed experiment in creating wealth and prosperity for a select few and massive debt and misery for the masses. It all started with the creation of the Fed in 1913. This led to a global credit creation and money printing extravaganza of a magnitude that the world has never seen before. We have now reached the point when it makes no difference who becomes US president or what the Fed or the IMF will do. No, now we are at the point that von Mises so succinctly defined. - 12 Obamacare Insurance CO-OPs Fold After Getting $1.2 Bil from Govt.

More than half of the government-funded nonprofit health insurers created by Obamacare have failed, sticking taxpayers with a $1.2 billion tab and leaving hundreds of thousands of people in more than a dozen states scrambling for medical coverage, a new federal audit reveals. The nonprofit insurers are known as Consumer Operated and Oriented Plan Program (CO-OP) and the Department of Health and Human Services (HHS) has pumped $2.4 billion into them under the president’s hostile takeover of the nation’s healthcare system. - Is coercion ever justified?

Last week’s editorial asked the question: Can the Constitution be improved? We said that the American Constitution represented an new concept in history. It declared that the sovereign power of the state rightfully is derived from the people instead of the divine right of kings. We concluded that it was an amazingly successful beta model but that it was not perfect, because it contained undefined phrases, such as “the general welfare” clause, that left holes through which political predators eventually were able to enter and undermine original intent. - The Internet Of Things Will Be The World's Biggest Robot

The Internet of Things is the name given to the computerization of everything in our lives. Already you can buy Internet-enabled thermostats, light bulbs, refrigerators, and cars. Soon everything will be on the Internet: the things we own, the things we interact with in public, autonomous things that interact with each other. These “things” will have two separate parts. One part will be sensors that collect data about us and our environment. Already our smartphones know our location and, with their onboard accelerometers, track our movements. Things like our thermostats and light bulbs will know who is in the room. Internet-enabled street and highway sensors will know how many people are out and about—and eventually who they are. Sensors will collect environmental data from all over the world. - Smartphones to replace cards at bank machines

Here's another use for the smartphone as it invades daily life: in place of your debit card at your bank cash machine. The “cardless” automatic teller machine (ATM) is gaining ground in the US and around the world, with smartphone technology allowing for speedier and more secure transactions. Dozens of US banks are installing new ATMs or updating existing ones to allow customers to order cash on a mobile application and then scan a code to get their money without having to insert a bank card. US banking giants Wells Fargo, Bank of America and Chase are in the process of deploying the new ATMs, as are a number of regional banks and financial groups around the world. Makers of ATMs and financial software groups are ramping up to meet this demand. - The New New ‘Deal' – “Markets Are Too Important To Be Left To Investors”

Our story so far… In the second half of 2014, export volumes in every major economy on Earth began to decline, the result of divergent monetary policies that crystallized with the Fed’s announced tightening bias in the summer of 2014. This decline in trade activity – which is far more impactful than a decline in trade value, because it means that the global growth pie is structurally shrinking – accelerated in 2015 and 2016 as Europe and Japan intentionally devalued their currencies to protect their slices of the global trade pie. In game theoretic terms, Europe and Japan have been “free riders” on the global system, using currency devaluation to undercut the prices of competing US and Chinese products in a way that avoids domestic political pain. - Oil output rises even as US rig count falls to historic lows

The number of oil and gas drilling rigs in the US has fallen to the lowest level since data started being collected, although production remains near record highs. The number of rigs drilling in the US now stands at 94, three down on last week and the lowest rig count since the energy consultancy Baker Hughes starting tracking the figures back in 1948. The rig count has dropped by 63 per cent over the past year and is almost 90 per cent lower than peak levels five years ago when oil was in excess of $US110 a barrel. - Even Mainstream Economists Starting to Admit that “Free Trade Agreements” Are Anything But …

Trump and Sanders have whipped up a lot of popular support by opposing “free trade” agreements. But it’s not just politics and populism … mainstream experts are starting to reconsider their blind adherence to the dogma that more globalization and bigger free trade agreement are always good. - Trump is completely wrong about the U.S. trade deficit

Thomas Sowell once explained that economists visit the dentist so often because we gnash our teeth hearing so much “ignorant nonsense about the economy.” Thanks to the gibberish spewed almost daily about international trade, dentists must be having an especially busy year. Virtually all economists support free trade and oppose protectionism. For example, a 2014 University of Chicago survey found that 93% of the country's top economists agreed with the statement “Past major trade deals have benefited most Americans” and none disagreed (7% were uncertain). - The world's second biggest coal miner could be about to go bankrupt

Peabody Energy, one of the world's biggest producers of coal, has warned that it is at risk of going bankrupt in the very near future, thanks to a lack of “sufficient liquidity to sustain operations and to continue as a going concern” caused largely by the continuing downturn in the coal mining industry. In a regulatory filing on Wednesday, the US-based producer said: “There can be no assurance that our plan to improve our operating performance and financial position will be successful.” Peabody has undertaken a huge programme of cost-cutting in recent years to stave off a massive crash in the price of the commodity. - Richard Russell – The Key To The Bull Market In Gold & The Bear Market In Global Stock Markets

Late last year, Richard Russell gave us the key to the bull market in gold and the bear market in global stock markets. This is the second in a series of releases KWN will be publishing on the wisdom passed down from the Godfather of newsletter writers. From legendary Richard Russell: “I want to start this site off with a bow to Fred Hickey, who puts out The High Tech Strategist. Hickey is a prodigious worker and reads everything. Fred is a true believer in gold and I read his work carefully. Americans are scared to death and befuddled by the news of the day. They are well aware that their own lives and jobs have little to do with the nonsense that the Fed and the government is shoveling out to them. - Peter Boockvar – Fed Suspends Reality As The Rush To Gold Continues

On the heels of the Fed’s decision not to raise rates, today Peter Boockvar sent King World News a fantastic piece discussing the Fed’s decision and the subsequent surge in the gold market. Peter Boockvar: For the past few years the Fed has been chipping away at the concept that they are driving monetary policy dependent on the data that they see. We know that because they kept changing the rules of the game in that every time a goal was reached the goal was altered. Well, I believe it is safe to say that after yesterday’s FOMC statement, the Yellen press conference and what was said in them, the communication and structural strategy of ‘data dependency’ has been officially neutered. The Fed’s goal is now a perfect world. As we of course will never get there, the rest of us are left flying blind as to what to expect from monetary policy… - Why Global Debt Growth May Extend The Oil Glut

In this post I present some selected parameters I monitor which may help understand near term (2-3 years) oil price movements and levels. It has been my understanding for some time that the formulations of fiscal and monetary policies affect the commodities markets. Changes to total global debt has and will continue to affect consumers’/societies’ affordability and thus also the price formation of oil. - Political Turmoil Rages in Brazil, Puts Oil Industry On Edge

More than 3 million people protested in the streets of major cities across Brazil on March 13, numbers that may have exceeded even the massive rallies that took place at the end of the country’s military dictatorship in the mid-1980s. The population is fed up with corruption, fed up with the ruling party, and are seeking the ouster of President Dilma Rousseff. - The Terrible Oil News Nobody Noticed

A terrible bit of news went unnoticed in the commotion amid the rebound in oil prices over the past two weeks. While every news outlet shouted about Iran and OPEC, a U.S. energy icon quietly announced news that could potentially shatter the industry. As I’ve explained recently, many oil companies are teetering on the brink of bankruptcy. But news out of Alaska could lead to disaster. BP Prudhoe Bay Royalty Trust (BPT) – operated by the Alaskan division of oil giant British Petroleum (BP) – sells oil from the Prudhoe Bay oilfield. - The Wisdom Of Jesse Livermore As Gold And Silver Surge Strongly After Fed Decision

On the heels of the Fed’s decision not to raise rates, gold soared more than $30 and silver surged as well, and the U.S. dollar tumbled. But even with the recent positive action in the gold and silver markets, what some of the gold and silver community are struggling with at this point is exercising patience. Some have been selling positions and moving to the sidelines, waiting for the next shoe to drop. While there will be pullbacks, KWN readers around the world need to understand that you don’t want to give up your position at the beginning of a new bull market… - And this is When the Jobs “Recovery” Goes Kaboom

The future for employment looks bright. The gig economy is firing on all cylinders. The FOMC, in its statement concerning its interest rate decision today, was practically gleeful about employment and where it’s headed: A range of recent indicators, including strong job gains, points to additional strengthening of the labor market. The Committee currently expects that, with gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace and labor market indicators will continue to strengthen. - Fleckenstein – Silver May Be About To Scream Higher As People Lose Confidence In Idiot Central Bankers

With many people wondering what’s next for the markets, today Bill Fleckenstein warned silver may be about to scream higher as people lose confidence in idiot central bankers. Despite the Fed’s dovishness, overnight markets were mostly lower, though that did not seem to matter too much to the SPOOs or trading here, as the indices were not very far from unchanged through midday, with the Dow and the S&P slightly higher and the Nasdaq a touch lower. In the afternoon they all marched higher still. By day’s end the Dow/S&P gained about 0.75% (with the Nasdaq just up fractionally despite decent strength in lots of speculative names, especially chips)… - WTI Crude Slides Back Into Red For 2016 As The Fed And Oil Remain On Unsustainable Paths

Oil prices have increased 50 percent since the lows exhibited earlier this year, a rise that is largely linked to the positive market reaction to the OPEC output freeze. But WTI Crude has given up all its early morning “see oil is fixed” gains in a hurry as once again the algo ramps give way to the realization that, as OilPrice's Leonard Brecken notes, comes even as for all intents and purposes OPEC has nearly reached its production limits and Iran still plans in increasing output. - The Stunning Size Of China's Housing Bubble In One Chart

Over the past month we have documented the surreal reemergence of China's latest housing bubble (recall the first one burst in early 2014 which forced Beijing to reflate the stock market bubble, which also burst over a year later). But nothing does China's housing bubble justice quite like a simple chart showing what is going on right now with home prices in Shenzhen, which incidentally also puts the housing bubble in the context of China's recently burst stock market bubble. No comment necessary. - ALERT: Gerald Celente Issues Trend Forecast On Gold And The Fed

The top trends forecaster in the world just announced a trend alert for gold and the Fed! He also discusses the unprecedented moves by central banks. Gerald Celente – Once upon a time, in a pre-smartphone and Facebook Age, workers of the world with a little extra cash did what the millennial generation would never dream of and probably never heard of. They’d deposit their money in savings accounts or buy certificates of deposit… - Caterpillar cuts Q1 earnings, revenue guidance

Caterpillar on Thursday cut its first-quarter earnings and revenue guidance, but said it remains comfortable with its prior full-year forecast. Shares of Caterpillar fell more than 3 percent in premarket trading on the news. (Get the latest quote here.) The world's largest construction and mining equipment maker's giant said it expects quarterly adjusted earnings of 65 cents to 70 cents a share, sharply lower than Street expectations of 97 cents a share. Revenue was forecast at $9.3 billion to 9.4 billion for the quarter, below expectations of $10.4 billion. - U.S. current account deficit narrows in fourth quarter

The U.S. current account deficit narrowed in the fourth quarter, but the improvement is unlikely to be sustained as a strong dollar continues to undercut exports of goods. The Commerce Department said on Thursday the current account deficit, which measures the flow of goods, services and investments into and out of the country, fell 3.6 percent to $125.3 billion. The third-quarter deficit was revised up to $129.9 billion from $124.1 billion. Economists polled by Reuters had forecast the current account deficit falling to $118.9 billion in the fourth quarter. For 2015, it totaled $484.1 billion, the largest since 2008. - Is This Why Yellen Went Full-Dove: U.S. Hiring Plunges Most Since November 2008

While the BLS' JOLTs report usually gets a B-grade in terms of importance due to its one-month delayed look back (we just got the January report which is one month behind the most recent payrolls number) it serves an important function due to its breakdown of various labor components such a job openings, new hires, separations, quits and terminations, all of which make up Janet Yellen's “labor dashboard.” In fact, according to Yellen herself, the JOLTs data is as important, if not more so, than the BLS report. Which may explain why yesterday the Fed surprised as dovishly as it did. As a reminder, the key number most look for in the monthly JOLTs report is the number of Job Openings: for January the BLS reported a print of 5,541K, which modestly beat the expected 5,500K consensus number. - Luxury jeweler Tiffany's profit beats estimates as costs fall

Upscale jeweler Tiffany & Co (TIF.N) reported a better-than-expected profit for the holiday quarter as it raised prices and benefited from lower prices of diamonds, gold and silver. Shares of the company, which became a household name due to the 1961 Hollywood classic “Breakfast at Tiffany's”, rose as much as 4 percent in morning trading on Friday. Weakness in the global economy and a strong dollar have hurt Tiffany and other luxury retailers such as Nordstrom Inc (JWN.N), Neiman Marcus Group and Macy's Inc-owned (M.N) Bloomingdale's as tourists shy away from buying high-end items. - Consumer Sentiment Index Falls For Third Straight Month

Consumer sentiment unexpectedly fell for a third straight month in March, according to the latest University of Michigan survey, as Americans suspect that the era of cheap gas is ending. That’s a bad sign for consumer spending from Apple (AAPL) iPhones to Tiffany (TIF) jewelry. The Michigan sentiment index’s flash reading was 90, down 1.7 points from the February’s final reading of 91.7, January’s 92 and December’s 92.6. It’s the lowest reading since October. Wall Street expected a flash March reading on 92.2. The index hit 95.9 in April, the highest since January 2007, but quickly retreated to 87.2 in September. - The Economic Recovery: A Myth Built Upon a Myth

No matter how much data you point to showing the health of the US economy isn’t as good as advertised, you will inevitably hear the refrain, “But look at the jobs numbers!” Just the other day, Peter Schiff appeared on Fox Business and said the US economy is likely already in recession. Peter repeated his prediction that the Fed wasn’t going to raise rates again, but would instead drop them to zero. National Alliance Securities Global strategist Andy Brenner was having none of that. He insisted the Fed would raise rates at least two more times this year because the economy is doing OK. And what was his proof? You guessed it – jobs! Peter made mincemeat out of Brenner’s argument, pointing out that most of the new jobs in the February report were part-time and low paying.

ELITE PLANS FOR 2016 – Take Immediate Action! – A New DVD From Pastor Lindsey Williams. Who will be the next president of the U.S.? Why no financial collapse in 2015? Hear from someone in contact with the Elite. Political Correctness. Five firearms every American should own. Is war inevitable? ORDER NOW online for shipment now. Or call Prophecy Club Toll-Free 1-888-799-6111.

Latest News Articles – March 17, 2016