2016

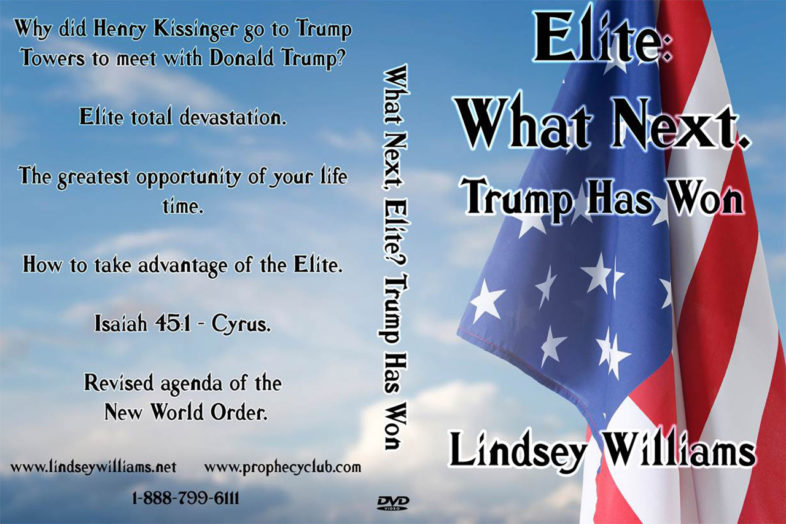

Elite What Next? Trump Has Won (2016)

Elite What Next? Trump Has Won:

* Why did Henry Kissinger go to Trump Towers to meet with Donald Trump?

* Elite total devastation

* The greatest opportunity of your lifetime

* How to take advantage of the Elite

* Isaiah 45:1 – Cyrus

* Revised agenda of the New World Order

*** You have to get gold and silver, immediately! You must hold it in your hand. You can buy Gold and Silver Coins and Bars at Wholesale prices and with Free Shipping on Orders over $199, through our Recommended Gold and Silver Dealer. Check out the special gold and silver offers here.

*** If you have an IRA or 401k you need to rollover your Retirement Account into Gold and Silver Bullion as soon as possible! Time is short! You can find out more about the process of turning your paper assets into Physical Gold and Silver by Clicking Here and talking to this Gold and Silver IRA Specialist.

This DVD was released on December 12th, 2016. It's more poignant now than it ever was. Prepare immediately!

This presentation of Elite What Next? Trump Has Won from Chaplain Lindsey Williams is required viewing by all Americans. Please share this presentation with everyone you know.

Elite Plans For 2016: Take Immediate Action!

Pastor Lindsey Williams shares the Elite Plans for 2016 and warns to take immediate action:

* Who will be the next president of the U.S.?

* Why no financial collapse in 2015?

* Hear from someone in contact with the Elite.

* Political Correctness.

* Five firearms every American should own.

* Is war inevitable?

*** You have to get gold and silver, immediately! You must hold it in your hand. You can buy Gold and Silver Coins and Bars at Wholesale prices and with Free Shipping on Orders over $199, through our Recommended Gold and Silver Dealer. Check out the special gold and silver offers here.

*** If you have an IRA or 401k you need to rollover your Retirement Account into Gold and Silver Bullion as soon as possible! Time is short! You can find out more about the process of turning your paper assets into Physical Gold and Silver by Clicking Here and talking to this Gold and Silver IRA Specialist.

This DVD was released on January 27th, 2016. It's more poignant now than it ever was. Prepare immediately!

This presentation of Elite Plans For 2016 from Chaplain Lindsey Williams is required viewing by all Americans. Please share this presentation with everyone you know.

Latest News Articles – December 29, 2016

From James Harkin (Webmaster & Editor of LindseyWilliams.net). Here is a summary of articles of interest from around the world for this week. Please LIKE the Lindsey Williams Online Facebook Page to see stories posted daily regarding the current state of the economy around the world.

Lindsey Williams Online | Promote your Page too

Latest News From December 23, 2016 to December 29, 2016:

- The Big Theme for 2017: Global Cash Bans

The big theme for 2017 will be Cash… not a pro-deflationary “time to own cash” theme… but a “let’s ban it as quickly as possible” theme. Let’s review. In 2016: 1) Former Secretary of the Treasury, Larry Summers, called for the US to do away with the $100 bill. 2) Former Chief Economist for the IMF, Ken Rogoff, published his book The Curse of Cash. 3) The New York Times and Financial Times publicly endorse a ban on cash. 4) Fed Chair Janet Yellen, during a Q&A session said cash is “not a convenient store of value.” Of course the above items are simply propaganda and words. But 2016 also featured major actions as far as the War on Cash is concerned… The 7th largest country in the world by GDP (India) banned physical cash in denominations that comprise over 80% of all outstanding bills. The move was a political disaster… temporarily, but no one was forced out of office and the legislation remains in place. - David Collum: We've Got A Recession Coming – A bad one, at that

We've got a recession coming, one of the full-blown kind. And I don’t know what will happen. My prediction is that it is going to be a bad one. But what a lot of people don’t realize is that is when things start unwinding, counter party risk kicks in and faulty business models start showing up as bad and they start collapsing. All the accounting problems that built up behind the scenes so that the people cook the books to get their bonuses up and they made these crazy assumptions — under the protective cloak of a recession, CEOs can get away with announcing anything because they say Hey, don’t look at me. It’s a recession. So they write down huge blocks of cost. This actually exacerbates the downswing because people are dumping all their cooked books and getting all the fraud off their books so they don’t have to fess up to the fact that they cooked them. In actuality, they're getting ready to then start building up their stock options again from some bottom somewhere. - Santa’s cRaZy 2017 Survival Plan

I know it’s Christmas and you probably have a million things to do (I do too!) but I HAVE to tell you about this crazy little guy who showed up at my door today. He was short, about 4 feet tall. He also had weird shoes that curled at the toe. And even stranger, he had pointy ears. I asked him who he was and he said he was a messenger from Santa! Whoa. Apparently, Santa is getting concerned about the economic situation, and he was wondering how he might survive if things continue to go downhill. After all, he still wants to be able to deliver toys, but if he goes big, round belly-up over the course of the year, then he won’t be able to fulfill the wishes of children next Christmas. - Keiser Report: ‘We are all in Trump world now’

We review the year that was Donald Trump as markets rally the most since Herbert Hoover in 1928 but is a 1929 like crash in the cards? In the second half, Max interviews Karl Denninger of Market-Ticker.org about whether or not Trump is, indeed, ‘draining the swamp?’ Or is he repopulating it with bigger, more terrifying swamp creatures? - How Americans Spent Their Money In The Last 75 Years (In 1 Simple Chart)

Consumer spending makes up 70% of the United States economy. We all have bills to pay and mouths to feed, but where do Americans spend their money? Here is a breakdown of how Americans spent their money in the last 75 years… In the chart, spending is broken into 12 categories: Reading, alcohol, tobacco, education, personal care, miscellaneous, recreation & entertainment, healthcare, clothing, food, transportation and housing. Each category is further broken down into spending by year, from 1941 to 2014, and each category is given a unique color. The data were collected from the Bureau of Labor Statistics. The data is adjusted for inflation and measures median spending of all Americans. - Vladimir Putin’s Christmas Speech: Russian Leader Criticizes Western Countries for Abandoning Christian Roots

This one goes out to the democratic party, those Vlad haters out there this holiday season. If you've ever wondered why Putin appeals to so many stable minded people in the United States, look no further than this speech where the Russian leader lays into Euro-Atlantic nations for abandoning its Christian roots, placing homosexual relationships on the same level as families, fomenting an environment for paedophilia and creating an atmosphere which will eventually lead to the degradation of civility — leading to the loss of dignity. Powerful stuff. - The Italian Bank Run: Monte Paschi Capital Shortfall Surges 75% To €8.8Bn Due To “Rapid Liquidity Deterioration”

While the big news last week was that Italy's third largest bank, Monte Paschi, had been nationalized after JPM destroyed the bank's chances of securing a private-sector rescue, and that Italy would issue up to €20 billion in public debt to fund the bailout of this, and other insolvent Italian banks, it appears there may be more moving parts to the story. Recall that as we warned, the biggest danger for both Monte Paschi, and Italy's banking system in general, is that retail depositor confidence in the Siena bank is shaken enough to lead to a bank run either in the world's oldest bank, or worse, across the entire Italian banking sector, leading to a worst case probability outcome of falling bank dominoes as bank funding needs explode, resulting in even more deposit outflows, and so on in a toxic feedback loop. - As Mystery Of China's Multi-Billionaire Default Deepens, A New “Bond Scare” Emerges

Last week, in a largely “under the radar” event, one of China's wealthiest billionaires (if only on paper), Wu Ruilin, chairman of the Guangdong based telecom company Cosun Group, and whose personal fortune of 98.2 billion yuan ($14 billion) makes him wealthier than Baidu founder Robin Li who is ranked 8th on the Hurun Rich List 2016, shocked Chinese bond market watchers when he defaulted on a paltry 100 million yuan ($14 million) in bonds sold to retail investors through an Alibaba-backed online wealth management platform, citing “tight cash flow.” Needless to say, many were stunned that a billionaire for whom $14 million is pocket change, blamed “tight cash flow” for defaulting on mom and pop investors. In any case, as South China Morning Post reported, despite the founder's personal fortune, according to a notice put up by the Guangdong Equity Exchange on Tuesday, two subsidiaries of Cosun Group are each defaulting on seven batches of privately raised bonds they issued in 2014. According to the notice, “the issuer had sent over a notice on December 15, claiming not to be able to make the payments on the bonds on time, due to short-term capital crunch.” - Report: White House prepares to announce sanctions against Russia as punishment for election interference

The White House is preparing to announce diplomatic censure and economic sanctions against Russia as punishment for its alleged interference in the 2016 election, reports the Washington Post. That information comes from unnamed government officials who spoke with the media outlet. According to those individuals, the Obama administration is assessing the allowances and limitations set forth in the 2015 executive order regarding cyber attacks against the United States. - New Census Data Shows Why the Job Market is Still “Terrible” (as Trump said), but the Numbers Get Hushed up

When Donald Trump campaigned on how “terrible” the jobs situation was, while the Obama Administration touted the jobs growth since the employment bottom of the Great Recession in 2010, it sounded like they were talking about two entirely different economies at different ends of the world. But they weren’t. Statistically speaking, they were both right. Since 2011, the US economy created 14.6 million “nonfarm payrolls” as defined by the Bureau of Labor Statistics – whether or not they’re low-wage or less than full-time jobs. But for individuals, this job market, statistically speaking, looks almost as tough as it was during the Great Recession. - Jerusalem: About to Explode

PASTOR WILLIAMS just shared this link with me. He asked that ALL readers should read this. He said he agreed wit hit and it explains what is happening at the UN at this moment. It also gives the outcome. Please share your thoughts. Half of Jerusalem. “Behold, the day of the Lord cometh, and thy spoil shall be divided in the midst of thee” (Zechariah 14:1). The subject is the Day of the Lord—the end time. This whole book is focused on the latter days. “For I will gather all nations against Jerusalem to battle; and the city shall be taken, and the houses rifled, and the women ravished; and half of the city shall go forth into captivity, and the residue of the people shall not be cut off from the city” (verse 2). Christ prophesied that He would “gather all nations” to battle Him in Jerusalem. Then He makes what might appear to be a strange statement. One half of Jerusalem is to be taken captive. Notice how specific this prophecy is. East Jerusalem—one half of the city—will be conquered by the Palestinians! - A New Crisis Is Brewing in Spain – The government raided the state pension fund. And now what?

When the Rajoy administration took the reins of power at the end of 2011, at the height of Spain’s debt crisis, the country’s Social Security fund had a surplus of over €65 billion, the result of a gradual accumulation of funds since the end of the 1990s. That money was supposed to serve as a nationwide nest egg to help cover the growing needs of Spain’s burgeoning ranks of pensioners. Instead, it has been used by the government to fill some of its own massive fiscal gaps, with the result that now, five years later, the total surplus has shrunk by 75%, to €15 billion. Things have gotten so bad that in October the Spanish government was forced to admit to the European Commission that by the end of next year the surplus will have become a deficit, of around €2.6 billion. In other words, a fund that took 16 years to build up will have been plundered dry in less than half that time, at an average rate of around €11 billion a year. - India’s Demonetization Debacle Highlights the Dangers of Monetary Monopoly

As longtime readers know, I believe we are at the beginning stages of what will be historical paradigm level change across the planet. We sit on the precipice of the self-destruction of almost all the dominant institutions we’ve been accustomed to throughout our lifetimes. To borrow a bit of played out and painfully clichéd Silicon Valley lingo, everything is on the table for “disruption.” Naturally, this doesn’t necessarily mean the paradigm that follows the current one will be materially better, but I am personally optimistic about what will emerge following a period of considerable confusion, hardship and conflict. In order to tilt the scales toward a positive outcome, those of us who wish to usher in a world characterized by human freedom, decentralization, self-government and kindness, need to recognize the most likely avenues we have to get there. Technology is obviously extremely important, as a recent move by Whisper Systems to thwart censorship demonstrates. - How To Invest In The New World Order

In our latest Toward a New World Order, Part III we ended by promising to look closer at investment implications from the political and economic shift we currently find ourselves in; and that story must begin with the dollar. While known to the investing public for years, the Bank of International Settlements (BIS) recently acknowledge that the real risk-off / risk-on metric in global markets is the dollar and nothing else. In the chart below, which we recreated from an absolute brilliant presentation by Macro Intelligence 2 Partners via RealVision-TV, we see the potential scale of the coming “dollar-problem”. The dollar moves in cycles as most things. The lower extreme around 84, only broken when Bernanke pushed through QE2, means financial conditions for emerging markets and other commodity producing economies have gotten so out of hand that conventional risk-metrics finally lead investors to pull back. The trigger, as can be seen in the chart, is often policy driven, but the underlying structural imbalance has been building for years, if not decades, prior. - Israel Urges Jews To Leave France, Suspends “Working Ties” With Countries That Voted For UN Resolution

In an unexpected escalation that was not the result of Israel's angry response to Friday's UN vote which passed a resolution condemning the country's settlements on occupied Palestinian territory, and which the US refused to veto, Israeli Defense Minister Avigdor Lieberman on Monday called on French Jews to leave their country to protest a Paris-hosted conference planned for next month aimed at restarting Palestine-Israel peace talks, Israeli daily Yedioth Ahronoth has reported. According to Turkey's Anadolu news agency, the Israeli government has repeatedly stated in recent months that it would not participate in the conference, which is scheduled to be held on Jan. 15 with the participation of representatives from 70 countries. Speaking at a meeting of his right-wing Yisrael Beiteinu party, Lieberman reportedly said: “Perhaps it's time to tell the Jews of France, ‘This isn't your country, this isn't your land. Leave France and come to Israel’.” “That's the only response to this plot,” Lieberman added, in reference to the planned conference. - Obama Quietly Signs The “Countering Disinformation And Propaganda Act” Into Law

Late on Friday, with the US population embracing the upcoming holidays and oblivious of most news emerging from the administration, Obama quietly signed into law the 2017 National Defense Authorization Act (NDAA) which authorizes $611 billion for the military in 2017. In a statement, Obama said that: “Today, I have signed into law S. 2943, the “National Defense Authorization Act for Fiscal Year 2017.” This Act authorizes fiscal year 2017 appropriations principally for the Department of Defense and for Department of Energy national security programs, provides vital benefits for military personnel and their families, and includes authorities to facilitate ongoing operations around the globe. It continues many critical authorizations necessary to ensure that we are able to sustain our momentum in countering the threat posed by the Islamic State of Iraq and the Levant and to reassure our European allies, as well as many new authorizations that, among other things, provide the Departments of Defense and Energy more flexibility in countering cyber-attacks and our adversaries’ use of unmanned aerial vehicles.” Much of the balance of Obama's statement blamed the GOP for Guantanamo's continued operation and warned that “unless the Congress changes course, it will be judged harshly by history,” Obama said. Obama also said Congress failed to use the bill to reduce wasteful overhead (like perhaps massive F-35 cost overruns?) or modernize military health care, which he said would exacerbate budget pressures facing the military in the years ahead. - Bundesbank Hauls its Gold back from New York & Paris Faster than Planned

“In 2016, we brought back again substantially more gold to Germany than initially planned; by now, nearly half of the gold reserves are in Germany,” Bundesbank President Jens Weidmann told the German tabloid Bild in what has become an annual Christmas interview about gold – to soothe the nerves of his compatriots. Because they’d been frazzled, apparently, by this whole saga. The German Bundesbank, which is in charge of managing Germany’s gold hoard of 3,381 metric tons, the second largest in the world behind the US, got into hot water in 2012 when rumors were circulating that some or much of its 2,000 tons of gold stored in New York, London, and Paris might not be there anymore, that it might have been melted down, leased, or sold. - World Trade Falls to 2014 Level, just in Time for a “Trade War”

“If you get into a trade war with China, sooner or later we’ll have to come to grips with that,” Carl Icahn, now special advisor to President-Elect Trump, told CNBC on Thursday. “I remember the day something like that would really knock the hell out of the market.” A trade war with China surely would be another wall of worry for stocks to climb. Trump’s rhetoric against China, each morsel packaged into 140 characters or less, has already recreated much-needed turbulence [read… Trump Tweets about China, US Businesses Freak out]. “But maybe if you’re going to do it,” Icahn said about the looming trade war with China, “you should get it over with, right?” - As the Coup Against Trump Fails, the Threat Against His Life Rises — Paul Craig Roberts

The use of the presstitute media to deny Trump the Republican presidential nomination failed. The use of the presstitute media to deny Trump victory in the presidential election failed. The vote recount failed. The effort to sway the Electoral College failed. But the effort continues. The CIA report on Russia’s alleged interference in the US presidential election ordered by Obama is in process. Faked evidence is a hallmark of CIA operations. In their determination to seal Trump’s ears against environmental concerns, a group of environmentalists plan to disrupt the inauguration. This in itself is of little consequence, but chaos presents opportunity for assassination. - The Fed Admits The Good Old Days Are Never Coming Back

The dots that the FOMC members contribute to the plot indicate their expectations for the federal funds rate. Technically, it’s what they think rates should be, not a prediction of what rates will be on those dates. Is that a forecast? You can call it whatever you like. I think “forecast” is close enough. But before we analyze the whatever-you-call-it, let’s look back at the not-so-distant past. I’ve highlighted this fact before, but it’s worth mentioning again: In 2007, less than a decade ago, the fed funds rate was over 5%. So were the interest rates for Treasury bills, CDs, and money market funds. People were making 5% on their money, risk-free. It seems like ancient history now, but that year marked the end of a halcyon era of ample rates that most of us lived through. The chart below shows historical certificate of deposit rates—but remember, you could put your money in a money market fund and do better than the six-month certificate of deposit yield, back in 2007. - Trump May Be Inheriting A Market That’s Primed For Failure

The optimism that has followed the election of Donald Trump has pushed the Dow Jones Industrial Average to the threshold of 20,000, a level that will be both a nominal record and a symbolic milestone. Although this is not the way most observers had predicted that 2016 would play out, most on Wall Street have become extremely reluctant to look a gift horse in the mouth…or to even look at him at all. The impulse is to jump on and ride, and only ask questions if it pulls up lame. But if this year has proven one thing, it is that predictions made by the consensus should not be trusted. - Mole Reveals Terrorist Group’s Violent Plans For U.S. Inauguration Day

For anyone who hasn’t already heard, several different far-left activist groups including but not limited to Rising Tide North America, Showing up For Racial Justice, and of course the ever-popular Black Lives Matter are actively engaged at this very moment in various stages of planning for a violent uprising on Donald Trump's Inauguration Day. In a recent article that can be found at ipatriot.com, President-elect Trump’s close friend Roger Stone confirmed precisely what I’ve been warning about since at least this past June. Stone says that one of his undercover operatives was recently able to infiltrate a J-20 Committee planning session, which is the committee responsible for helping the #DisruptJ20 movement “create a sense of crisis” both in Washington D.C., and elsewhere around the country during the President-Elect's Inauguration. - Obama Just Positioned Israel and Entire Middle East For a Horribly Bloody War

Since the day he first took office, Barack Obama has thumbed his nose at virtually every long standing U.S. tradition, upended decades worth of foreign policy decisions that were paid for with the lives of thousands of our nation’s finest as well as trillions of dollars in American taxpayers’ money (back when they all still had jobs), has divided this country in a way unlike anything I’ve seen during my 40 years on this planet, and he’s done all of it with the full support of a grossly corrupt and dishonest mainstream media that didn’t tell Americans the truth about virtually any of it. Even with almost 100 million Americans out of work, our smallest military since the 1940’s, social unrest that’s reached critical mass and is poised to blow, because of how dishonest the media is, the overwhelming vast majority of Americans still have no any idea the extent of the destruction Obama has left in his wake, and they probably won’t know until it’s far too late. Many experts predicted that Obama would be more defiant than ever before during the closing days of presidency, but few thought Obama would go as far as he just did this past week. - Barack Obama’s All-Out Attack On Israel

During the very last month of his presidency, Barack Obama has decided to launch an all-out attack on Israel. On Friday, Barack Obama’s decision to allow UN Security Council resolution 2334 to pass without a veto was the greatest betrayal of Israel in modern American history, and now there are reports that the Obama administration is planning to introduce another resolution that would officially recognize a Palestinian state. Throughout his eight years in the White House, many have accused Obama of being the most anti-Israel president in our history, and now he is proving them right. Obama has also been accused of harboring sympathies for the agenda of the radical Islamic world, and at this point it is hard to argue that he doesn’t. Everyone always knew that Obama greatly disliked Israeli Prime Minister Benjamin Netanyahu, but the way that Obama is currently behaving goes way beyond just being vindictive. If it wasn’t for the election of Donald Trump, there would be little hope of salvaging U.S.-Israeli relations at this point. On Twitter, Newt Gingrich actually used the phrase “waging war” to describe what Obama is doing to Israel… - 10 Times That God Has Hit America With A Major Disaster After The U.S. Attempted To Divide The Land Of Israel

Because Barack Obama has cursed Israel at the United Nations, America is now under a curse. Friday’s stunning betrayal of Israel at the UN Security Council is making headlines all over the planet, but the truth is that what Obama has just done is far more serious than most people would dare to imagine. Over the past several decades, whenever the U.S. government has taken a major step toward the division of the land of Israel it has resulted in a major disaster hitting the United States. This keeps happening over and over again, and yet our leaders never seem to learn. And despite the fact that President-elect Donald Trump, Israeli Prime Minister Benjamin Netanyahu and prominent members of both parties in Congress strongly urged Obama to veto Security Council resolution 2334, he went ahead and let it pass anyway. Because the United States has veto power on the UN Security Council, nothing can get passed without our support. And it has been the policy of the U.S. government for decades to veto all anti-Israel resolutions that come before the Security Council. But this time around, it appears that the Obama administration was working very hard behind the scenes to get this resolution pushed through the Security Council before the end of Obama’s term. At least that is what Israeli Prime Minister Benjamin Netanyahu is claiming… - Breaking Report: John Kerry Is Working On Another UN Resolution That Would Officially Recognize A Palestinian State

Multiple media outlets are reporting that U.S. Secretary of State John Kerry is finalizing a document that the Obama administration hopes will form the basis for a UN Security Council resolution that officially recognizes a Palestinian state before the end of Barack Obama’s term on January 20th. This comes on the heels of the UN Security Council’s adoption of resolution 2334 on December 23rd. That resolution declared that all Israeli settlements in the West Bank are illegal, it stated that the Security Council recognizes the 1967 ceasefire lines as the border between Israel and “Palestine”, and it officially gave East Jerusalem to the Palestinians. But it stopped short of formally recognizing a Palestinian state. Resolution 2334 speaks of a Palestinian state in the future tense, but this new resolution that John Kerry is reportedly working on would give immediate and permanent UN Security Council recognition to a Palestinian state. If there is a UN Security Council resolution that officially establishes a Palestinian state prior to January 20th, there will be no question that it will represent “the dividing of the land of Israel” at the United Nations that so many of us have been watching for. According to the Times of Israel, Israeli Prime Minister Benjamin Netanyahu is anticipating precisely this kind of move at the UN, and he is reaching out to Donald Trump for assistance… - The UN Security Council Has Just Officially Given Every Inch Of East Jerusalem To The Palestinians

Barack Obama has just made the worst decision of his entire presidency. On Friday, the UN Security Council adopted resolution 2334, and this never would have happened without the support and approval of Barack Obama. Since the United States has veto power on the Security Council, no resolution can ever pass unless the United States allows it to pass. For decades, it has been the policy of the U.S. government to veto all anti-Israel resolutions at the Security Council, and the Israeli government had been expecting that Barack Obama would not suddenly change that policy at the very end of his second term. Most of the news headlines about resolution 2334 refer to “Israeli settlements”, but the reality of the matter is that this resolution is about much more than that. The truth is that this resolution has established legally binding parameters for a “two-state solution” that Israel will never accept, and this includes giving every inch of East Jerusalem to the Palestinians. If you have not read it yet, you can find the full text of resolution 2334 right here. It is one of the most important documents of our time, so you need to take a few minutes to read it. In the excerpt below, you will see that this resolution clearly states that East Jerusalem is in “Palestinian territory” and that the Security Council says that it will recognize no changes to the pre-1967 borders except “those agreed by the parties through negotiations”… - Truck Killers will Cause EU to Vote Out Leaders, Trump Gets Ready for War, Merry Christmas

Terrorists have stuck again by using a truck to mow down Christmas shoppers. The latest attack was committed by an Islamic terrorist who is aligned with ISIS. This is one of the many reasons the status quo will be voted out of office in the 2017 elections in places like France and Germany. People have had enough with the PC culture, while people are slaughtered by terrorists on a regular basis. Donald Trump has picked his cabinet and looks like he is going to war with the oligarchs. He has former Marine generals posted as Secretary of Defense and managing Homeland Security after he takes office on January 20th. Another telling pick is former Chairman of the Federal Election Commission Don McGahn chosen as White House Counsel. Is Trump going to take on election and voter fraud that is running rampant? It sure looks that way. - Top Ex-White House Economist Admits 94% Of All New Jobs Under Obama Were Part-Time

Just over six years ago, in December of 2010, we wrote “Charting America's Transformation To A Part-Time Worker Society”, in which we predicted – and showed – that in light of the underlying changes resulting from the second great depression, whose full impacts remain masked by trillions in monetary stimulus and soon, perhaps fiscal, America is shifting from a traditional work force, one where the majority of new employment is retained on a full-time basis, to a “gig” economy, where workers are severely disenfranchised, and enjoy far less employment leverage, job stability and perks than their pre-crash peers. It also explains why despite the 4.5% unemployment rate, which the Fed has erroneously assumed is indicative of job market at “capacity”, wage growth not only refuses to materialize, but as we showed yesterday, the growth in real disposable personal income was the lowest since 2014. - Obama Betrays Israel At The United Nations – Is America’s Reprieve Now Over?

Barack Obama actually did it. Despite enormous pressure from the government of Israel, President-elect Donald Trump and members of his own party in Congress, Barack Obama decided to stick a knife in Israel’s back at the United Nations. On Friday, the UN Security Council adopted a resolution that calls for a “two-State solution based on the 1967 lines” and that shockingly states that “the establishment by Israel of settlements in the Palestinian territory occupied since 1967, including East Jerusalem, has no legal validity”. This resolution was approved by a vote of 14 to 0, and the U.S. abstained from voting. But essentially the outcome of the vote was going to be determined by Barack Obama. For decades, the U.S. veto power on the UN Security Council has shielded Israel from these types of resolutions, but this time around Obama decided to betray Israel by allowing this vote to pass. Needless to say, this vote is going to have enormous implications for Israel, for the United States, and for the entire globe. - Trumpocalypse? Suddenly Liberals Are The Ones Stockpiling Food, Guns And Emergency Supplies

Now that the shoe is on the other foot, many liberals all over America have suddenly become extremely interested in prepping. Fearing that a Trump presidency could rapidly evolve into a “Trumpocalypse”, a significant number of leftists are now stockpiling food, guns and emergency supplies. In fact, even though many had expected a sharp drop in gun sales following Trump’s victory, what actually happened is that fear of what is coming under Trump pushed background checks for gun sales to an all-time record high on Black Friday. The election of Donald Trump has awakened the left to a degree that we haven’t seen in decades, and some on the left are embracing hardcore survivalism without any apologies. That is ironic about all of this is that on the other end of the political spectrum interest in prepping is probably the lowest that it has ever been in the history of the modern prepper movement. A couple of weeks ago, I wrote an article about how it was like “a nuclear bomb went off in the prepping community“, and nothing has changed since that time. - European Banks agree $12.5bn in US fines

Deutsche Bank and Credit Suisse have agreed to pay $7.2bn (£5.9bn) and $5.3bn (£4.3bn) respectively in penalties relating to the collapse of the US housing market before the financial crisis. The Swiss lender announced it had reached a deal with the US Department of Justice hours after a similar move by Deutsche. While the German bank's sum is half the $14bn originally sought by investigators, it is more than $2bn above the amount analysts expected Europe's third-largest bank to shell out. Deutsche also warned the deal, following four months of negotiations, was subject to potential revision. Its share price rose more than 4% in early trading in Frankfurt. - Codex Nutrition Committee Condemns 90% of World to Poor Health

At the beginning of this week December 5-9, 2016, the Codex Committee on Nutrition and Foods for Special Dietary Uses (CCNFSDU) became the very thing that Codex Secretariat Tom Heilandt warned against in his opening speech there – “lazy monkeys.” For those unfamiliar with that term, it is loosely translated as “being lazy for no reason and not functioning properly.” On the debate over the daily Nutrient Reference Values (NRVs) for VitaminÍ D and Vitamin E, the bulk of the Committee weakly argued and agreed amongst themselves that the World’s population does not need adequate blood levels of either Vitamin D or Vitamin E. In particular, the CCNFSDU decided that 5-15 micrograms (200-600 IUs) /day of Vitamin D and 9 milligrams (13.5 IUs)/day of Vitamin E are all that humanity needs. Lazy monkeys. As anyone with even a smidgen of nutritional knowledge knows, both Vitamin D and Vitamin E are critical for human health, and at far greater amounts than first thought. Long gone are the days when rational nutritionists and researchers thought that 400 IUs per day (10 mcg/day) of Vitamin D would sustain optimal health. And for those who live in that fairy-tale land where 13.5 IUs per day (9 mg/day) of Vitamin E will support normal fertility and childbirth, or health at any level, a very special place in Hell is reserved. Or else on a delegation at a Codex committee. - Italy Joins the “Bail-In” Bunch

Italy has now joined the “bail-in” crowd. ‘Monte dei Paschi di Siena is to be rescued by the Italian state using a new €20bn bailout package, as a last-gasp private sector rescue plan for the world’s oldest bank looked set to fail, forcing losses on bondholders. The government rescue, which had long been resisted in Rome, is designed to draw a line under the slow-burn crisis in Italian banking that has alarmed investors and become the main source of concern for European financial regulators.' In this particular case, the bail-in will use bondholders’ money. But depositors will be on the hook in future cases in Europe. - College Student Earns 4.0 GPA, Then Drops Out: “You Are Being Scammed!”

Billy Williams just finished his first college semester and did so with the all-impressive 4.0 GPA. Instead of celebrating his accomplishments with friends and family, he decided to drop out of college entirely. Billy made a facebook post that is now going viral in which he explains his reasoning for dropping out. Billy is right too that the price of college continues to soar. - Baby Boomers Increasingly Having Social Security Checks Garnished To Cover Student Loan Payments

The government has collected about $1.1 billion from Social Security recipients of all ages to go toward unpaid student loans since 2001, including $171 million last year, the Government Accountability Office said Tuesday. Most affected recipients in fiscal year 2015—114,000—were age 50 or older and receiving disability benefits, with the typical borrower losing about $140 a month. About 38,000 were above age 64. The report highlights the sharp growth in baby boomers entering retirement with student debt, most of it borrowed years ago to cover their own educations but some used to pay for their children’s schooling. Overall, about seven million Americans age 50 and older owed about $205 billion in federal student debt last year. About 1 in 3 were in default, raising the likelihood that garnishments will increase as more boomers retire. “I believe this is the tip of the iceberg of what may be to come if we don’t work harder on this problem,” said Sen. Claire McCaskill of Missouri, the top Democrat on the Senate Special Committee on Aging. - Chinese Multibillionaire Defaults On Retail Bonds Due To “Severe Cash Crunch”

Italy's Monte Paschi isn't the only institutions that is about to soak retail investors who thought that two bailouts for Italy's third biggest bank in two years wouldn't be followed by a third nationalization in year #3. According to the South China Morning Post, a Chinese multi-billionaire businessman has defaulted on bonds worth a paltry 100 million yuan ($14.4 million) that he raised from retail investors, citing “tight cash flow”, according to reports. Wu Ruilin, chairman of the Guangdong based telecom company Cosun Group, has a personal fortune of 98.2 billion yuan, or just over $14 billion, China Business News (CBN) reported citing an audit by a third party. That makes Wu wealthier than Baidu’s founder Robin Li, who has 98 billion yuan and is ranked 8th on the Hurun Rich List 2016. And yet, despite the founder's personal fortune, according to a notice put up by the Guangdong Equity Exchange on Tuesday, two subsidiaries of Cosun Group are each defaulting on seven batches of privately raised bonds they issued in 2014. According to the notice, “the issuer had sent over a notice on December 15, claiming not to be able to make the payments on the bonds on time, due to short-term capital crunch.” - What the Heck’s Happening to Our Share Buyback Boom?

Companies in the S&P 500 spent about $3 trillion since 2011 to buy back their own shares, often with borrowed money. It’s part of a noble magic called financial engineering, the simplest way to goose the all-important metric of earnings per share (by lowering the number of shares outstanding). And it creates buying pressure in the stock market that drives up share prices. With buybacks, you don’t need to sell one extra iPhone to boost your earnings per share. So the amounts have grown and grown. With ultra-cheap money available to borrow endlessly, companies take on debt and hollow out shareholder equity. It has worked like a charm. Stock prices have soared. Declining revenues and earnings, no problem. But something is happening that hasn’t happened since the Financial Crisis. - IPOs Have Worst Year since 2003, and the Dow is at 20,000?

Stock indices are frolicking in record territory. The S&P 500 is up almost 11% this year, though the gains came after the election. The Dow has been titillating the entire world, day after day, with the prospect of finally, finally hitting 20,000 after being just a hair shy of it for two weeks. So it would seem that the IPO market would be hot. But for IPOs, 2016 has turned out to be a fabulously terrible year. That makes two years in a row. Last year at this time, I wrote that the IPO market in 2015 had been the worst since the Financial Crisis. I quoted Sam Kendall, UBS global head of equity capital markets: “We all thought that we might finally get a year where we would be able to put four quarters together,” he said at the time. “If you looked at the pipeline and how people were thinking about the world, it just felt good. And then the wheels came off.” - Nightmare Before Christmas for Spanish Banks – The European Court of Justice refused to listen

The European Court of Justice just delivered a landmark ruling that could cost Spanish banks – or Spanish taxpayers, in case of another bailout – billions of euros: 40 out of Spain’s 42 banks will have to refund all the money they surreptitiously overcharged borrowers as a result of the so-called “mortgage floor-clauses” that were unleashed across the whole home mortgage sector in 2009. These floor clauses set a minimum interest rate, typically of between 3% and 4.5%, for variable-rate mortgages, which are a very common mortgage in Spain, even if the Euribor dropped far below that figure. In other words, the mortgages were only really variable in one direction: upwards! - In One of the Nation’s Unhealthiest Places, This Hospital Prescribes Fresh Food From Its Own Farm

Five years ago, when Lankenau Medical Center was confronted with evidence that it was serving the unhealthiest county in Pennsylvania, the hospital decided to embrace the findings with an unconventional approach: building a half-acre organic farm on its campus to provide fresh produce to patients. The teaching and research hospital just outside Philadelphia was in the midst of its own patient health needs assessment in 2011 when the Robert Wood Johnson Foundation released findings about health outcomes in Pennsylvania counties. Lankenau is officially located within Montgomery County, one of the state’s healthiest, taking into account factors including obesity rates and access to reliable sources of food. But the campus is adjacent to and receives many patients from Philadelphia County, ranked the least healthy of all 67 counties. - Generation Snowflake: Percentage Of Young Adults Living With Their Parents Hasn’t Been This High Since 1940

Have we failed this generation of young adults by not equipping them to be able to handle the harsh realities of the real world? According to the Wall Street Journal, the percentage of Americans in the 18 to 34-year-old age bracket that are currently living with their parents hasn’t been this high in 75 years. At this point nearly 40 percent of our young adults in that age range are living at home, and many are concerned that this could have some alarming implications for the future of our nation. In the United States today, more than 60 million people live in multi-generational households, and it is a good thing to have a tight family. But at some point young adults need to learn how to live their own independent lives, and in millions of cases this independence is being delayed or is never happening at all. There are many factors involved in this trend. First of all, there is truly a lack of good jobs despite what we are being told about an “economic recovery”. Millions of young adults are graduating from college only to discover that there is a very limited number of good jobs available for our college graduates. So some college graduates are able to secure the types of jobs that they were hoping for, but millions of others are not. - Associate of Paul Craig Roberts Says Stock Market May Be About To Go ‘Super Nova’

Today an associate of former Assistant U.S. Treasury Secretary official, Dr. Paul Craig Roberts, said the stock market may be about to go “Super Nova.” He also urged people to keep their eyes on the gold and silver markets. ETF flows tend to be a good contrary indicator when they become extreme, so the buying frenzy doesn’t bode well for U.S. equities. — David Santschi, CEO of TrimTabs. Dave Kranzler: If the Federal Reserve were a private corporation and did not have a money tree, it would be technically insolvent – i.e. bankrupt. As of its latest balance sheet the Fed was reporting a book value (net worth) of $40.4 billion. But the Fed does not have to mark to market its assets. Given the recent 100+ basis point move in the 10-yr Treasury, if the Fed were forced to mark to market its $3.8 trillion Treasuries and mortgages, it would be forced to reduce the holding value by close to $400 billion, taking the Fed’s net worth to negative $360 billion… - Look At The Shocking Difference Between When Ronald Reagan Took Office vs Donald Trump

With the Dow near 20,000 and the U.S. Dollar Index above 103, and the Electoral College finally confirming our 45th President, look at the startling differences between when Reagan entered office vs Donald Trump. Trump: From Zero to Hero? Gold And The Illusion Of Monetary ValueThis time last year, we were expecting the US dollar to depreciate drastically since we regarded the then held opinion of four interest rate hikes in 2016 as defying implementation. At first, this assessment turned out to be the right call. The US dollar experienced a trend reversal, with the gold price recording a fantastic first half of the year. However, the BREXIT put an end to this development, and Trump’s victory turned the development by 180 degrees. - Italy to bailout Monte dei Paschi di Siena bank with €20bn rescue fund

A €20bn (£17bn) rescue fund for Italy’s banking sector has been approved by the country’s parliament, heralding a bailout of the world’s oldest bank, Monte dei Paschi di Siena (MPS). The bank said late on Wednesday that it had failed to secure an anchor investor – the Qatar sovereign wealth fund – for a €5bn offer of new shares. Despite announcing on Wednesday night that a debt-for-equity swap offer raised slightly over €2bn – part of a complex fundraising exercise intended to bolster the strength of the bank – the failure to persuade a major investor to contribute €1bn meant the rescue plan would not succeed before it closed at 2pm on Thursday. - U.S. Economic Confidence Surges To The Highest Level That Gallup Has Ever Recorded

Gallup’s U.S. Economic Confidence Index has never been higher than it is today. The “Trumphoria” that has gripped the nation ever since Donald Trump’s miraculous victory on election night shows no signs of letting up. Tens of millions of Americans that were deeply troubled by Barack Obama’s policies over the last eight years are feeling optimistic about the future for the first time in a very long time. And it is hard to blame them, because what we have already seen happen since November 8th is nothing short of extraordinary. The stock market keeps hitting record high after record high, the U.S. dollar is now the strongest that it has been in 14 years, and CEOs are personally promising Trump that they will bring jobs back to the United States. These are things worth getting excited about, and so it makes perfect sense that Gallup’s U.S. Economic Confidence Index has now risen to the highest level that Gallup has ever seen… - Pastor Lindsey Williams introduces Pastor David Bowen – December 22, 2016

Pastor Lindsey Williams introduces Pastor David Bowen with his regular short weekly video for readers of Pastor Williams’ weekly newsletter.

THE FINAL BUBBLE! Pastor Williams says the information shared by this economist is outstanding and correct. What he says will happen. >>> CLICK HERE TO WATCH THE VIDEO (This video is being shared because the information within it is truly good and correct. Half way through the video it turns into a sales pitch to sell a book and related products. Pastor Williams has asked me to state that Pastor Williams and LindseyWilliams.net do not endorse this book).

Latest News Articles – December 22, 2016

From James Harkin (Webmaster & Editor of LindseyWilliams.net). Here is a summary of articles of interest from around the world for this week. Please LIKE the Lindsey Williams Online Facebook Page to see stories posted daily regarding the current state of the economy around the world.

Lindsey Williams Online | Promote your Page too

Latest News From December 16, 2016 to December 22, 2016:

- Why Trump's “Border Tax Proposal” Is The “Most Important Thing Nobody Is Talking About”

While the market, and various pundits and economists have been mostly focused on the still to be disclosed details of Trump's infrastructure spending aspects of his fiscal plan, “one of the least talked about but possibly most important tax shifts in the history of the United States” is, according to DB, House Speaker Paul Ryan’s and President-elect Trump’s “border tax adjustment” proposal. This is part of the “Better Way” reform package and also figures prominently in the writings of senior Trump administration officials. What is it? Put simply, the proposal would tax US imports at the corporate income tax rate, while exempting income earned from exports from any taxation. The reform would closely mirror tax border adjustments in economies with consumption-based VAT tax systems. If enacted, the plan will likely be extremely bullish for the US dollar. What’s more, it would have a transformational impact on the US trade relationship with the rest of the world. - Early 2017 Record Scam Stock Market Going to Blow Up-Michael Pento

Money manager Michael Pento says don’t get too comfortable with the record highs in the stock market. Pento warns, “In December of 2015, the Fed raised rates. It was the first time in a decade. From the middle of December to the end of December (2015), it was nirvana. They raised rates. There was no problem, and then came January. The first trading day of January, boom, and we had the worst January in the history of all Januarys in the stock market. I think the very same thing is going to happen in 2017, but I think it’s going to be worse. Not only are we going to fall, I think there is going to be a huge tremor in China and in the emerging markets. That’s early in 2017, and when that occurs, Janet Yellen (Fed Head) can forget about three rate hikes. I think she will not get more than one rate hike out of the way before this whole thing unwinds and unfolds. Then, you are going to get a reversal of those rate hikes. You are going to go back into QE (quantitative easing or money printing) in 2017.” - Italian Government To Meet At 7:30PM CET To Approve Monte Paschi Nationalization

Having failed to secure a private sector rescue after its anchor investor Qatar balked at sinking another $1 billion into the perpetually insolvent bank, Italy's Monte Paschi is set to be nationalized as soon as 7:30pm CET today when the Italian cabinet is expected to meet and decide on a bank decree. The EU is said to have approved the Italian bank decree. As Bloomberg notes, the Italian government set to intervene soon after expected failure of Monte Paschi recapitalization plan, says senior Italian official who asked not be named before cabinet discusses banks’ decree. The decree would set up a €20 billion fund which would intervene when recaps by banks are not supported by market. Paschi and other troubled lenders will not be named in the decree, but it will apply to them. While shareholders will be hit, something which is obvious by the market cap of the company which is now below €500 million, the aim is to limit losses for stock and bondholders. The cabinet is also expected to announce a 6-month extension for popolari banks. - Tis The Season For Credit Card Debt: This Christmas Americans Will Spend An Average Of 422 Dollars Per Child

For many Americans, the quality of Christmas is determined by the quality of the presents. This is especially true for our children, and some of them literally spend months anticipating their haul on Christmas morning. I know that when I was growing up Christmas was all about the presents. Yes, adults would give lip service to the other elements of Christmas, but all of the other holiday activities could have faded away and it still would have been Christmas as long as presents were under that tree on the morning of December 25th. Perhaps things are different in your family, but it is undeniable that for our society as a whole gifts are the central feature of the holiday season. And that is why so many parents feel such immense pressure to spend a tremendous amount of money on gifts for their children each year. Of course this pressure that they feel is constantly being reinforced by television ads and big Hollywood movies that continuously hammer home what a “good Christmas” should look like. - Fed's Yellen trumpets education in changing economy

Changing technologies and globalization have put a premium on completing a college education in order to get and keep higher-paying jobs, Federal Reserve Chair Janet Yellen said on Monday. “The drivers of this increasing demand for those with college and graduate degrees are likely to continue to be important,” Yellen said in prepared remarks to a University of Baltimore commencement ceremony at which she was due to receive an honorary degree. She did not mention monetary policy in her speech, which was solely focused on the world of work, but did note those graduating were entering the strongest jobs market in nearly a decade. - Car-tastrophe – GM, Fiat Chrysler Idle 7 Plants; Over 10,000 Workers Affected

Just weeks after Ford idled four plants “due to slowing sales”, GM and Fiat Chrysler announced today that they will idle seven plants across Canada and US as they work to reduce near-record high inventories amid weakening sales. With an inventories-to-sales ratio above historical peaks (only beaten by huge spike in 2008 when sales stopped), the pain for automakers has only just begun… For example, GM's inventory of vehicles on dealer lots at the end of November stood at 874,162, up 26.5% from the same time a year ago. - Obama takes some blame for staggering Democratic losses during presidency

Looking back at a Democratic Party that has been shattered nationwide under his leadership, President Obama is accepting blame for building an organization that benefited mainly himself. The president said Monday that he and his political team didn’t pay enough attention to local Democratic candidates after he came into office in 2009 with a recession and two wars to handle. “We were just putting out fires,” Mr. Obama said in an exit interview with NPR. “We were in a huge crisis situation. And so a lot of the organizing work that we did during the campaign, we started to see right away didn’t immediately translate to, wasn’t immediately transferable to, congressional candidates. And more work would have needed to be done to just build up that structure.” - Column: Raising the minimum wage lowers employment for teens and low-skill workers

A report by the National Employment Law Project estimates that American workers will gain $62 billion in wage increases due to state and local minimum wage increases advocated by the Fight for $15 movement. Where did it get that number? Although calls and emails to NELP to get the methodology behind its figures went unanswered, it’s clear that the study made a number of assumptions. NELP states in the report that, “Total income increase estimates [were] derived by multiplying the number of workers affected, by the per-worker income increase at the end of the phase-in period.” In other words, NELP estimated the number of workers at different wage levels in areas that passed minimum wage increases, calculated the difference in their former incomes and new incomes under the new minimum wage when that wage was completely phased in and added those increases to get to $62 billion. - China Cuts Offering Size Of 3, 7 Year Bonds By 40% Over Concerns Of More Failed Auctions

The danger signs are building up for the Chinese bond market. First, last Thursday, Chinese bond futures crashed by the most on record forcing China's regulator to briefly halt trading in the security until the panic fades. Then, on Friday, a Chinese bill auction technically “failed” when it was unable to find enough buyers for the total amount offered for sale. At the same time, interbank lending among Chinese banks effectively froze when, as a result of the spike in overnight lending rates, the PBOC was forced to intervene by providing a “massive” amount of liquidity . The PBOC tapped an emergency lending facility it created in 2014 to extend 394 billion yuan ($56.7 billion) in six-month and one-year loans to 19 banks. That pushed the net amount extended through the facility to 721.5 billion yuan so far in December, a monthly record, according to Beijing-based research firm NSBO. The central bank also injected a net 45 billion yuan into the money market on Friday, following a net 145 billion yuan cash infusion on Thursday. The PBOC also ordered a few large banks to extend longer-term loans to nonbank financial institutions, while China’s securities regulator asked brokers tasked with making a market in bonds to continue trading and not shut any companies out of the market, according to Mr. Zheng of Dongxing Securities. - “Demonetization Has Achieved Nothing” – India's Rapidly Plunging Toward A Police State

India’s Prime Minister, Narendra Modi, announced on 8th November 2016 that Rs 500 (~$7.50) and Rs 1,000 (~$15) banknotes would no longer be legal tender. Linked are Part-I, Part-II, Part-III, Part-IV, and Part-V, which provide updates on the demonetization saga and how Modi is acting as a catalyst to hasten the rapid degradation of India and what remains of its institutions. As the deadline of 31st December 2016 approaches, Gresham’s law has been turned upside down. When they needed to be converted, the banned currency notes were trading for a 20% discount to their face value. In the meantime, the discount has disappeared and the banned notes are trading at a premium of 10%. The mafia which deals in the banned notes could not possibly be happier — it promises to be a big supporter of Modi going forward. - Judge orders unsealing of search warrant in Clinton email probe

A federal judge has ordered the unsealing of a search warrant that played a role in the controversial public renewal of the investigation into former Secretary of State Hillary Clinton's email just before the presidential election. The warrant was issued by a federal magistrate in late October, after the FBI requested permission to search emails contained on a laptop belonging to Anthony Weiner, the estranged husband of Clinton aide Huma Abedin. U.S. District Court Judge P. Kevin Castel issued an order Monday that the warrant linked to the Clinton probe and related records be unsealed at noon Tuesday, unless a higher court steps in. The judge acted after E. Randal Schoenberg, a California lawyer who mainly investigates art thefts, filed a suit seeking to force unsealing of the files. - Italy Seeks Authorization To Raise National Debt To Fund Bank Bailouts, As BMPS Rescue Plan In Jeopardy

While Italy scrambles to conclude a private sector rescue of ailing Monte Paschi, which hopes to raise €5 billion in the form a share sale to anchor and retail investors, while at the same time the bank is underoing a debt for equity swap, moments ago Reuters reported that Italy's cabinet will meet later on Monday to authorise an increase to the national debt to cover the cost of saving Monte dei Paschi di Siena, should a public bailout be unavoidable, as well as other ailing banks, government sources said cited by Reuters. As reported yesterday, Monte dei Paschi has launched a 5-billion-euro (4.2 billion pounds) capital increase and must raise the money by the end of the year or face being wound down. If it cannot find takers in the private sector, the government will be forced to step in. - Doing Business the Chinese Way: Facebook Develops A Censorship Tool

After seven years being banned in China, Facebook learned its lesson—Do business the Chinese way. According to the New York Times, Facebook has developed a censorship tool to restrict contents from appearing in feeds, hoping to re-enter the Chinese market, where many other tech companies including Google and Twitter failed in the past. It is likely Facebook would provide a third party with this censorship tool for monitoring posts, instead of censoring feeds itself. The company may partner with a Chinese firm, utilizing local expertise and connections in negotiating with Beijing. A Facebook spokeswoman said the company had not made decisions on its China re-entry plan. - “Everyone Is Nervous” – Chinese Bond Bloodbath Reawakens As Hong Kong Stocks Turn Red For 2016

After a brief respite, the bloodbath in Chinese bonds is back, with futures plunging back to lows overnight amid liquidity fears (short-term lending rates are inverted) and growing anxiety over China's almost unprecedented debtload. As The Wall Street Journal reports, a gradual tightening of short-term credit by China’s central bank – combined with rumors of liquidity squeezes at brokers – prompted a mini-rout in the country’s $8 trillion-plus bond market last week, forcing authorities to reverse course and inject some $86 billion in short- and medium-term funds. - Secret terrifying 13 FOOT ‘Avatar war' robot learns to walk and mimic human movements

Scientists have programmed a monster one-tonne robot that can walk and mimic human movements resembling something from Avatar. The METHOD-1 machine is four metres tall and when it stomps it leaves the ground “shaking”, according to designer Vitaly Bulgarov. The giant robot, built in South Korea, works by repeating the actions of its pilot sitting inside by moving its enormous arms and legs up and down. - Deutsche axes bonuses to pay toxic loans fine

Deutsche Bank is to axe bonuses for senior staff as part of its desperate efforts to pay for a potential $14bn (£11.2bn) legal settlement with American regulators. John Cryan, the German bank’s Yorkshire-born boss, warned top bankers this month that their bonuses would be seized to help foot the bill for the mis-selling of sub-prime mortgages. A handful of top-performing executives will receive “retention cheques” — much smaller sums that will be paid out over several years. Junior staff will still receive a bonus, but on a far smaller scale. - Deutsche Bank Shares Stumble As DoJ Settlement Looms

Deutsche Bank shares are sliding this morning after headlines from CNBC reporting a settlement is close with the US Justice Department over mortgage fraud. With analyst expectations/hopes in the $2 to $5 billion range (against the initial $14 billion fine), reports say the bank is set to pay “less than $14 billion” which has perhaps spooked investors with its uncertainty. As Bloomberg reports, Deutsche Bank will pay “far less” than the initial $14b settlement sought by the U.S. DOJ to resolve litigation over residential mortgage-backed securities, Reuters says, citing a person familiar with the matter. The source says there is a “good chance” the matter will be resolved this week, possibly as early as Wednesday. However, the deal is not finalized yet, and resolution could still be delayed. And for now the stock is fading… - Chinese Interbank Lending Freezes, Forcing Massive Intervention By China's Central Bank

China is finding itself in an increasingly more untenable situation, trapped on one hand by its sliding currency (and declining reserves), which as noted earlier it has manipulated higher by forcing overnight unsecured rates to spike, in the process punishing “speculators” and other shorts… and on the other, by a banking sector that finds itself desperately in need of liquidity, unable to endure the PBOC's monetary interventions, and on the verge of a liquidity crisis comparable to what Chinese banks suffered in the summer of 2013 when overnight rates briefly shot up above 20% as China pushed aggressively with a failed deleveraging campaign. - The War on Cash Rages On in India and Venezuela

Imagine you roll out of bed tomorrow to find out that US $100 and $50 bills were outlawed and deemed worthless? Hard as it is to believe, this is now taking place in both Venezuela and India. It’s a war on cash. And it’s coming soon to your doorstep. This past Sunday, President Maduro, the tyrannical leader of the socialist paradise of Venezuela gave a three day warning that he was eliminating his country’s 100 bolivar bank note. The official reasoning for the removal of these bills according to President Maduro’s statement on Venezuelan state-run TV: “There has been a scam and smuggling of the one hundred bills on the border with Colombia, we have tried the diplomatic way to deal with this problem with Colombia’s government; there are huge mafias.” The 100 bolivar note was the country’s largest currency denomination left in circulation and was equivalent in value to $0.02 USD. - ALERT: A Major Warning Signal Was Just Triggered That Preceded The Last Collapse

With interest rates spiking and the dollar surging, a major warning signal was just triggered that preceded the last collapse. Major Danger Signal Just Triggered. From Jason Goepfert at SentimenTrader: “Homebuilders are giddy. While their stocks have been flat for several years, company officials are the most optimistic since the housing bubble years. In the past 30 years, they have been this positive on their industry only three times, and two of those coincided with peaks in their stocks… - How Deutsche Bank Sent Your Bullion to ISIS

In some strange way I have been led to this final chapter as laid out by Mark Anthony Taylor below. The paper trail goes back to WW1 and the alliance between Germany and Turkey. Central to this period in history was the Armenian genocide perpetrated by the Turks and with German observers. A similar brutality was repeated by Nazi Germany in WW2. 30 million Russians lost their lives in that war, along with 12 million Protestants and Orthodox Christians in Eastern Europe and 6 million Jews. - Prelude To Global Collapse And How Swiss Refiners Just Exposed The Big Lie In The Gold Market

With interest rates soaring, today the man who has become legendary for his predictions on QE, historic moves in currencies, spoke with King World News about the prelude to global collapse and how the Swiss refiners just exposed the big lie in the gold market. The Final Mania In Global Markets. Egon von Greyerz: “We are now approaching the final mania in markets. The Dow seems to be on its last swan song. Investors are determined to take it up to 20,000. Since there are only 160 points to go, this would not be hard to achieve. At the same time, U.S. Treasury bonds are crashing. The 10-year yield has gone from 1.4%, a low 1 1⁄2 years ago, to 2.6% today. Normally stock market investors would worry about higher interest rates but the market is currently in a euphoric mode so any bad news is ignored in this final crescendo… - James Turk – This Will Be One Of The Big Keys For 2017

As we kick off the final week of trading before Christmas, today James Turk spoke with King World News about what will be one of the big keys for 2017. James Turk: “There is a lot of cheerleading coming from stock market bulls and the mainstream media as the Dow Jones Industrials Average (DJIA) approaches 20,000, Eric. I find it interesting though that little attention is being paid to the Dow Jones Transportation Average. The Transports peaked earlier this month and have dropped steadily since then. In fact, even the DJIA now appears to be hesitating, which highlights its struggle to reach 20,000. - Italy Banking Crisis is Also a Huge Crime Scene – Toxic loans as a result of corruption, political kickbacks, fraud, and abuse

The Bank of Italy’s Target 2 liabilities towards other Eurozone central banks — one of the most important indicators of banking stress — has risen by €129 billion in the last 12 months through November to €358.6 billion. That’s well above the €289 billion peak reached in August 2012 at the height of Europe’s sovereign debt crisis. Foreign and local investors are dumping Italian government bonds and withdrawing their funding to Italian banks. The bank at the heart of Italy’s financial crisis, Monte dei Paschi di Siena (MPS), has bled €6 billion of “commercial direct deposits” between September 30 and December 13, €2 billion of which since December 4, the date of Italy’s constitutional referendum. - Wall Street Wrong, Put All Your Eggs in One Basket: Jim Rogers

Diversification is generally considered one of the basic tenets of investing and financial planning. Owning a mix of assets, ideally with a low correlation, including, stocks, bonds, real estate and gold, for example, is Investing 101. That is unless you’re one of the world’s most famous investors, Jim Rogers. Jim doesn’t buy into the cult of asset allocation. “I know that people are taught to diversify. But diversification is just that’s something that brokers came up with, so they don’t get sued,” Jim said. “If you want to get rich… You have to concentrate and focus,” he says. “The expression on Wall Street is, don’t put all of your eggs in one basket. Ha! You should put all of your eggs in one basket. But be sure you’ve got the right basket and make sure you watch the basket very, very carefully.” - Donald Trump Will Ruthlessly Decimate the CIA for Turning on Him

On Wednesday night, NBC released a report, in collusion with a myriad of anonymous sources reputed to be inside the CIA and other intelligence agencies, claiming that Vladimir Putin personally directed the destruction of Hillary Clinton via hacking hers and the DNC’s servers before the US presidential election. Via NBC: “U.S. intelligence officials now believe with “a high level of confidence” that Russian President Vladimir Putin became personally involved in the covert Russian campaign to interfere in the U.S. presidential election, senior U.S. intelligence officials told NBC News. Two senior officials with direct access to the information say new intelligence shows that Putin personally directed how hacked material from Democrats was leaked and otherwise used. The intelligence came from diplomatic sources and spies working for U.S. allies, the officials said.” The report does not cite any source by name for its information, other than incorrigible moron Micheal McFaul, one time US ambassador to Russia, as a cheerleader for the report. - Inflation, Stagflation, Hyperinflation & Deflation-All at the Same Time-Egon von Greyerz

Financial expert Egon von Greyerz (EvG) says, “Bond markets around the world are in the biggest bubble in history.” EvG thinks when it blows up, we are going to get hit with everything in the financial horror house. EvG explains, “We are guaranteed to have ‘flation.’ There will be inflation, stagflation, hyperinflation and deflation. We will have all of that. At the same time, a lot of prices will be inflationary or hyperinflationary, at some point, as they print more money. We will also have deflation of debt and deflation of more of the bubble assets that the credit bubble has created. Debt will implode and also property and stocks.” - Interest Rate Explosion, Russia Did NOT Hack Elections, Facebook Fake News Police?

The Federal Reserve just raised a key interest rate a quarter of a point. This was only the second time in 10 years the Fed raised rates, but the market had already beaten the Fed to the punch. In July, the interest rate for the 10-year Treasury was 1.46%. Five short months later, the same rate is now more that 1% higher. This is what it means when you hear the phrase “the Fed is behind the curve” on interest rates. Losses in the global bond markets are stacking up with the rising rates. Now, there are reports that China and other central banks are dumping U.S. debt at an alarming rate. More than $400 billion in U.S. government bonds was sold this year alone. Could rising interest rates knock Donald Trump’s plans for a loop? The answer, in a word, is yes. - The Real Reason Why America Has Been Given A Reprieve

This is one of the most important articles that I have written in a long time. The strange events of the past year and a half have befuddled and mystified many, and in this article I am going to explain why America has been given a temporary reprieve. If you go back to June 2015, I warned my readers that major financial problems were imminent, and sure enough in August 2015 we witnessed the greatest financial shaking that we had seen in seven years. I remember getting emails from my readers applauding me for absolutely nailing that prediction, but we were all concerned about what was coming next in September. If you will recall, there was more buzz about September 2015 than any other month that I can ever recall. That was the month of the last blood moon, the end of the Shemitah year and the Pope’s visit to the United States among other things. There was a tremendous amount of anticipation that the crisis that had begun in August 2015 would greatly accelerate in September and lead us into a period of cataclysmic global chaos. But that did not happen. Instead, U.S. financial markets calmed down and eventually recovered. There was a shift in the political realm as well, as the second half of 2015 marked the rise of Donald Trump. During those key months, Trump miraculously built a commanding lead in the race for the Republican nomination that none of his opponents were ever able to overcome. And now that Trump has won the election, an economic surge appears to be happening that is unlike anything that we have witnessed in many years. - Donald Trump Completes Final Lap, Electoral College, to White House

Republican electors in Texas vaulted Mr. Trump past the 270 mark, granting him all but two of their 38 ballots in a ceremony in the State Capitol in Austin. In the House chamber, where the electors met, the vote was greeted with a standing ovation by citizens and Republican officials who had come to witness the event. Outside, perhaps 100 protesters waved placards and chanted “Save our democracy” in a vain effort to persuade electors to reject the Republican nominee. Normally a political footnote, the electoral vote acquired an unexpected element of drama this winter after Mr. Trump’s upset of Hillary Clinton, who received 2.86 million more popular votes but won in states that totaled only 232 electoral votes. The states Mr. Trump won held 306 electoral votes. - Australian republicans claim majority of MPs oppose monarchy

A majority of Australian MPs want to break ties with the British monarchy, the nation's republican lobby claims. The Australian Republican Movement says 81 of 150 MPs and 40 of 76 senators favour the move, citing public statements from the politicians. Monarchists have disputed the figures, insisting more support the status quo. The numbers were revealed before an upcoming speech by Prime Minister Malcolm Turnbull to mark the republican movement's 25th anniversary. Mr Turnbull, who led a failed republic bid in 1999 before entering politics, will speak at Sydney University on Saturday. - Cuba offers rum to pay off $276m Czech debt

Cuba has come up with an unusual way to repay its multimillion dollar debt to the Czech Republic – bottles of its famous rum, officials in Prague say. The Czech finance ministry said Havana had raised this possibility during recent negotiations on the issue. Cuba owes the Czech authorities $276m (£222m), and if the offer is accepted the Czechs would have enough Cuban rum for more than a century. However, Prague said it preferred to get at least some of the money in cash. Havana's debt dates back from the Cold War era – when Cuba and what was at the time Czechoslovakia were part of the communist bloc. - Greece passes pension deal in defiance of bailout creditors

The Greek parliament has defied the international creditors providing Athens' bailout funds and voted through a one-off payment to pensioners. Plans for the €617m (£517m; $656m) pre-Christmas handout were opposed by European bodies negotiating Greece's financial lifeline. A deal agreed earlier this month to provide the next tranche of debt relief for Athens is now on hold. Prime Minister Alexis Tsipras said Greece would not be blackmailed. Athens said the pension payment would come out of a €1bn tax surplus but European creditors on Thursday said the Greek move raised “significant concerns on both process and substance” regarding the country's bailout obligations. - What Is The Real Purpose Behind “Fake News” Propaganda?

Here is the first problem with modern political discourse – too many people want to “win” arguments instead of getting to the greater truth of the matter. Discussions become brinkmanship. Opponents launch into immediate attacks instead of simply asking valid questions. They assert immediately that their position is the only valid position without verification. When confronted with rational responses and ample evidence, they dismiss everything instead of pondering what you have handed them. After this line is crossed, there is no point in continuing the debate. It will go on forever. This is one of the great tragedies of the Saul Alinsky method of political confrontation; it has bred entire generations of people who now believe that there is no objective truth. They think everything is relative. Because of this belief, they assume that there is no wrong or right side, no wrong or right goal. Instead, there are only goals that are MORE right than the goals of others. Everything boils down to a “lesser of two evils” mentality, and the ends therefore justify the means. Using dishonest measures to win the fight becomes acceptable. - Can OPEC Send Oil To $70?