A few days ago Pastor Williams received an email from his elite friend. He sent him a lengthy article indicating that this is what we can expect in the next several months. The article is called “When Shale Goes Subprime”. It was sent to Pastor Williams by his Elite friend personally, not a Wall Street friend. “This is what is expected to happen in the eminent future.”

The second article Pastor Williams shared this week was an article entitled “Deflation Strikes the Eurozone.” It is an important article since Pastor Williams Elite friend warned us what would happen if the Eurozone crashes, and the Eurozone is already worried by announcing Quantitative Easing of 60 billion euros a month with a total of 1.08 trillion euros.

Tom Fyler, one of Pastor Williams' Wall Street friends has also contributed an article, this month it is entitled “Patience, Foresight, and Courage” and says we are already in a “crashing.”

In light of all that is happening – Everyone needs “Special Events Scheduled for 2015”

Pastor Williams' Wall Street friend today also said “As you have warned for quite some time, markets and economies are unraveling—now at a quickening pace. People tend to wait until the last minute to do something—so hopefully the 2015 newsletters can prompt people to act ASAP!

I remember quite some time ago that you warned to watch for currency wars. And such might serve as a mechanism to quickly deteriorate the global financial/monetary system. And perhaps usher in a global currency. What type of feedback have you received on the recent Swiss central back action? Some speculate that it is a bold escalation of an already “boiling” currencies manipulations or battles.”…

When Shale Goes Subprime

Dave Gonigam

The 5 Min. Forecast

And so it begins.

“U.S. Steel Corp. said it will idle plants in Ohio and Texas and lay off 756 workers,” reports this morning’s Wall Street Journal, “becoming one of the first big U.S. industrial casualties of the recent collapse in global oil prices. Both factories make steel pipe and tube for energy exploration and drilling.”

Most of the jobs are being cut in Lorain, Ohio. “What appeared just a few short weeks ago as being a productive year, [with new hires in December and extra turns going on] has most abruptly turned sour,” said a letter from the president of the union local.

Overnight Brent crude prices slipped below $50 a barrel. They’ve recovered a bit since. Ditto for West Texas Intermediate, $48.38 as we write.

“The oil collapse is going to cause far more pain than most people seem to realize,” ventures our Chris Mayer.

“If history is any guide, there will be no quick recovery. And the effects will go well beyond just oil stocks.

“The oil bust will sting banks that lent freely to the oil patch.” That’s what happened three decades ago. Oklahoma’s Penn Square Bank failed in 1982… which snowballed into the 1984 failure of Continental Illinois, the biggest U.S. bank bust up until the Panic of 2008. (Indeed, the modern bailout got its start with Continental Illinois, as The 5 chronicled last year.)

This time around, “the latest energy boom needed a lot of money to build out infrastructure and drill wells,” Chris explains. “Lenders happily funded these efforts. Such loans were often made assuming $80 oil. Many of these loans were riskier high-yield bonds, or junk bonds. A JPMorgan analyst estimated if oil stayed below $65 a barrel, then 40% of all energy junk bonds could wind up in default.

“Most oil companies have hedges in place for 2015, meaning they’ve locked in higher oil prices. But even conservative energy companies will see their hedges expire in 2016 and could run into trouble.”

Vulnerable banks identified by SNL Financial include Comerica… International Bancshares… and ViewPoint Financial. “This makes for a good list of stocks to avoid,” says Chris, “or at least be careful about.

“It’s not just loans to energy firms that bite back,” Chris goes on.

Again the ’80s are instructive: “Oil patch banks got stuck with real estate debt that the oil boom supported,” he explains. “The same thing could happen again. Hotels, retailers and homebuilders with energy exposure could all suffer. KB Home, for instance, generates 30% of its sales from Texas.

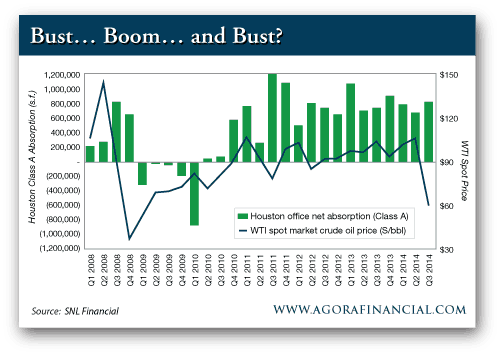

“Houston is at the center of this energy ecosystem. You can clearly see the impact of oil prices in its real estate statistics. Much like the tree rings of an oak, they mark the lean and flush years. Net absorption, for example, tells you how many square feet the market leases each year. The chart below gives you a look at office space. You can see the last time the price of oil fell a bunch — in 2008. Absorption went negative. Meaning the amount of empty space went up.

“Property companies with big exposure to Houston include: EastGroup Properties, Cousins Properties and Parkway Properties,” says Chris. “It’s going to be a tough 2015 for them unless oil makes a quick reversal.”

Footnote: Nearly 20% of the workers U.S. Steel is letting go are based in Houston.

It’s at this moment we pause to consider an uncomfortable thought: Perhaps the boom in America’s shale patch — a meaningful part of it, anyway — was a big hairball of malinvestment.

“Malinvestment”: Near as we can tell, this delicious English-language word was coined by the Austrian School economists of the 20th century — Mises, Hayek, Rothbard. Malinvestment is the flow of capital into places where no sane person would ordinarily put it — were it not for the stupidity of central bankers and their easy-money policies.

The Federal Reserve’s easy money delivered us the dot-com bubble in the late ’90s and the housing bubble of the mid-2000s. Malinvestment.

How much of the shale boom might have happened if the Federal Reserve hadn’t been keeping its thumb on interest rates the last six years? How much exploration and drilling took place simply because explorers and drillers could borrow cheaply?

Or to put it in more stark terms: Were $17-an-hour Wal-Mart greeters in North Dakota the embodiment of a newfound American prosperity… or a sign something was profoundly wrong?

We’re not prepared to say it’s an either-or proposition. No doubt good old American know-how played a role in the boom… and we won’t rule out connivance between Washington and the Saudi Arabian princes playing a role in the bust. But we’d be remiss to ignore the malinvestment question…

“The combination of easy money from the Fed with high oil prices (arguably caused by the former) led to massive malinvestment in the shale industry that now must be unwound,” asserts our acquaintance Erik Townsend — a hedge fund manager who trades oil futures.

Erik says much of the problem lies in the kind of trades shale producers used to hedge their production — called “three-way collars.”

If you want to dive into the details of how these trades work, check out today’s Overtime briefing, below. In the meantime, here’s the bottom line: “We needed $60 crude to hold to avoid an outright crisis in high-yield credit issued by shale drillers, and it didn’t. Now we’re going to have an outright bloodbath… I expect $40 Brent before this is over, and the risk of credit contagion on the scale of subprime mortgages is very real.”

Erik then picks up a theme we touched on Monday: “Shale drillers are going to lay down a LOT of rigs and stop drilling. This will lead to supply destruction. Then the price of oil will go to the moon and it will be time to restart the shale revolution.”

But the story doesn’t end there: “High-yield debt issues from shale drillers will have exactly the same connotation as ‘subprime-backed CDOs’ had in 2009,” Erik explains. “You won’t be able to sell the stuff for half what it’s worth just because of the stigma. Where’s the money going to come from to re-start the shale revolution?”

It won’t come from the banks; they’ll be too gun-shy to lend to the smaller players. So those smaller players will have to issue new shares if they want to raise money.

“That may occur in a significantly depressed equity environment compared with today,” says Erik. “The result — oil prices keep screaming higher, as the easy-money policies that enabled the last round of the shale ‘revolution’ aren’t there this time.”

What if the Federal Reserve resumes “quantitative easing” and steps on the monetary gas pedal? Erik won’t rule it out. “But investors who get nailed by the coming wave of high-yield defaults will still have the taste of blood in their mouths, and will still be reluctant to buy more debt issued by the shale patch.

“This all sets up for a MAJOR resurgence of inflation a couple years down the pike, led by an oil price spike.”

Deflation Strikes the Eurozone

Brad Hoppmann

Uncommon Wisdom Daily

Folks in the Eurozone can stop wondering if deflation will strike their economies. Deflation isn’t coming. It’s here.

Today, Eurostat confirmed that consumer prices in the common currency area dropped 0.2% in 2014. With fuel prices still dropping, experts expect more of the same in 2015.

We’re all familiar with inflation. We don’t know as much about deflation. Today, we’ll look at the difference.

Inflation is easy to understand; it means prices are generally rising. There might be exceptions here and there, but the cost of most goods and services is going up.

Deflation is the opposite condition, in which prices are generally falling.

Both inflation and deflation are actually symptoms of an underlying disease. The real problems are fractional reserve banking and monetary manipulation. While those are interesting subjects, today I want to think about the way deflation “feels.“

People and businesses usually respond to economic incentives. If the price of something you want is rising, you will probably buy it as soon as possible. If the price is falling, you will more likely wait.

Those simple, individual decisions can add up to economic chaos. Under deflation, a country’s economy will halt. No one wants to buy anything, even if he has money.

Sellers respond to low demand by reducing prices, which cuts their own income and reduces overall spending even further. This vicious cycle is painful for everyone.

One group does benefit from deflation, though. Lenders can prosper because they are receiving debt payments in a currency with more spending power than the one they originally loaned.

On the other hand, borrowers with no money might fall behind on payments. In that case, the lender’s incentive is to foreclose and seize collateral as soon as possible, before it loses even more of its value.

Europe has been dealing with deflation in a small way for several years. Now, it’s getting worse. The European Central Bank apparently wants to respond with quantitative easing, much like the Federal Reserve’s bond-buying program that ended last year.

People can argue whether QE helped the American economy. Even if it did, it still took years to make a difference.

So good luck, Europe. You’re going to need it.

Patience, Foresight, and Courage

By Tom Fyler

EssentialsInvesting.com

January 22, 2014

The following are a few thoughts for investors to consider when planning investment strategies for 2015 and beyond.

For those that have questioned government and Federal Reserve policies and strategies—and the legitimacy of various market and asset valuations, now just might be the time that your sense, analysis and insights are bearing fruition. Your perspective and foresight–prudently considered, meticulously planned and timely executed—with the benefit of experience and knowledge, might just provide you with an advantage in the coming years to generous opportunities in the management of your wealth.

It is possibly “Game On” now as you seek and find discounted values in the midst of the “rubble” of broken economies, fiscally sense-less governments, and manipulated markets and assets to which the “chickens have come home to roost.”

Waiting for “The” or “A” Crash

Don’t wait—we are in a “crashing”. In most cases, a crash is not a single event but rather a series of substantial assets devaluations that over time, when we look back, are viewed as a crash. The most recent asset to “crash” or significantly decline is oil. It has devalued by more than 57% in six months. Natural gas has declined 44% since May 2014. Silver has declined by 66% since 2011. How about the declines of other commodities: copper down over 17% in six months; sugar down 38% in eight months; nickel down 35% in seven months. Various countries’ equities have declined significantly: Brazil minus 56% since 2010; emerging markets minus 23% since 2011; Russia minus 54% since February 2013; Mexico minus 45% since March 2013. Based on a trend of these and other asset devaluations, there is certainly the possibility that other assets will follow. (Historical results or trends are not necessarily an indicator of future performance. Some of the cited asset performance information is approximate. Cited performance data was derived from: Oil as represented by WTI Crude Oil–New York Mercantile Exchange [NYMEX] @CL.1; Natural Gas—NYMEX: NGG15; Silver–iShares Silver Trust symbol SLV; Copper–Exchange-Traded Note [ETN]: JJC; Sugar–ETN: SGG; Nickel–ETN: JJN; Brazil–Exchange-Traded Fund [ETF]: EWZ; Russia–ETF: ERUS; Mexico–Closed-End Fund: MXF.)

Buying REALLY Low

Conventional wisdom suggests that the best time to buy is when an asset’s value is low—i.e. “Buy Low, Sell High.” But an asset looks the worst when it is low. And the bottom is never known without or until the benefit of hindsight. So low may be low, but still not near a bottom. Investing in an asset when it is “ugly” in performance is a scary and a risky proposition for investors. So it takes courage and foresight to buy low. It also takes a measured and prudent plan when buying declining assets that is designed to help mitigate the risk of an uncertain asset bottom value. Such a strategy should be only used for an appropriate limited portion of an investment portfolio. And it normally takes time and patience for these assets to substantially appreciate. But the wait—in many historical instances, has been worth it more times than not. For example, the recent decline in oil price brings to mind a previous period when oil declined substantially in 2008 and 2009. As measured by the ETF: OIL, it hit a low in March 2009 and two years and one month later it had risen 66%. (Some investment strategies may not be appropriate for all investors. There is no guarantee that any investment strategy or plan will result in a gain and may result in a loss.)

Commodities Don’t Lie

The great characteristic of commodities is their valuation relationship to “supply and demand.” We all learned in school that as demand increases against low supply, the asset’s valuation will increase. And as demand decreases against high supply, the asset’s valuation will decrease. In the end, this dynamic more times than not will prevail. Thus, the trend or movement of the value of commodity assets will eventually be reflected in the trend or movement of the values in any goods or services underlayed or impacted by a commodity—which is virtually most goods and services. And it is of course goods and services that are produced or provided by companies, and the valuation of these goods and services—influenced by commodity valuations, that will eventually reflect these companies’ equity or stock valuations. Economies and equity markets rise and fall on commodity valuations. To the contrary, asset valuation strategies or policies such as Fed stimulus, stock buybacks, manipulation of interest rates, currency devaluations, excessive government spending and debt, are all manipulated asset valuation “lies.” Thus, the negative performance or trend of commodity valuations many times may serve as the “Canary in the Coal Mine” warning of other assets devaluations to come. Learn to be a “Commodities Whisperer”, or at least know one.

“Crash Strategy” Recommendations—Investment industry regulations do not allow specific investing strategies to be recommended in public information. Interest in strategies appropriate to personal circumstances and risk sensitivity, or any questions, may be directed to Tom Fyler at email address fyler@tiac.net.

Mr. Fyler is President of Commodities & Securities, Inc., a firm registered as a Commodity Trading Advisor with the Commodity Futures Trading Commission (CFTC) and a Member of the National Futures Association (NFA), and a Registered Investment Advisor. Mr. Fyler is also licensed in real estate.

Risk Disclosure: This communication is for informational purposes only and should not be construed as containing or providing specific investment or financial advice. Information provided in this communication should be understood as the analysis and/or opinion of the author. Readers should be aware that there is risk of loss of some or all funds when investing in stocks, bonds, mutual funds, ETFs, real estate, commodities and/or currencies, any of which may not be appropriate for all investors. Readers should consult directly with financial professionals for advice appropriate to personal financial circumstances.

10 STEPS TO AVOID THE CRASH

We have less than 9 months before September. We all need to prepare as much as possible so we can weather the coming storm. I wrote the FREE guide '10 Steps To Avoid The Crash' to help you survive and even thrive through the coming collapse, which is well under way. If you haven’t already downloaded a copy of the e-book, please do so because it covers ten steps you must carry out if you are to survive and even prosper during the collapse. It contains some great information relating to gold and how the gold market has been manipulated to stave off the crash of the American Dollar. This information is essential if you are considering buying gold and silver. The guide extensively talks about why you need to get out of debt, get out of paper assets as well as pay off your house mortgage. It also discusses why you need to store food, water and defensive equipment, why you need to get out of the city and purchase everything you need. The e-book also covers sorting out your medicine cabinet, which took many aspects of Pastor Williams’ DVD “Healing the Elite Way”, which is also essential viewing. Most importantly it talks about getting your spiritual house in order. Please print '10 Steps To Avoid The Crash' and share it with your friends and family.

In Celebration of Lindsey Williams 01/12/36 – 01/23/23

“I have fought a good fight, I have finished my course, I have kept the faith.” – Lindsey Williams In Celebration of LINDSEY WILLIAMS January 12, 1936 – January 23, 2023 On Saturday, April 1, 2023, at FBC Fountain Hills dba Cornerstone Family Church in Fountain Hills, Arizona, there was a special Memorial service in celebration of […]

Pastor Lindsey Williams – At Bio Care Hospital – Getting Over COVID

This is part 11 of a series of 12 informative videos on how to cope with all the damage COVID brings. Where Pastor Lindsey Williams interviews Rodrigo Rodriguez, MD, founder of BioCare Hospital and Wellness Center. Call BioCare Now: 1-800-262-0212 Website: International BioCare Hospital and Wellness Center Pastor Lindsey Williams Hi, this is Lindsey Williams. […]

Pastor Lindsey Williams – At Bio Care Hospital – COVID and Supplements

This is part 10 of a series of 12 informative videos on how to cope with all the damage COVID brings. Where Pastor Lindsey Williams interviews Rodrigo Rodriguez, MD, founder of BioCare Hospital and Wellness Center. Call BioCare Now: 1-800-262-0212 Website: International BioCare Hospital and Wellness Center Pastor Lindsey Williams Hi, this is Lindsey Williams. […]

De-Dollarization rolls on:

http://www.zerohedge.com/news/2015-02-18/de-dollarization-accelerates-russia-launches-swift-alternative-linking-91-entities

Elites can’t be too happy with a rival to SWIFT. It will be interesting to see how they counter it.

Side note, I’ve watched, “The New Elite In 2015” yesterday. I wish LW would say how the average person can monitor the derivative market.

Update: a news report just posted.

Greece is seeking a 6 month extension on their loan:

http://www.bbc.com/news/business-31517363

The extension timeframe brings it into September 2015. Knowing the elte they probably would have something to do with this request from Greece. Pastor is still on track with his information. A bit of a chilling ride though.

Jim Willie says Greece defaulting and leaving the Euro has catastrophic consequences. The deadline for Greece in accepting the ECB’s terms is March 1.

Banks in Switzerland are now refusing closure of bank accounts.

https://www.youtube.com/watch?v=TpNKtz0wCZs

Bank for International Settlements issues new report on global credit risks. Hint: they are still out there.

http://lonestarwhitehouse.blogspot.com/2015/02/bank-for-international-settlements.html

LW mentioned David Stockman as a voice for the Elite. Here is an article with quotes from David Stockman and it sure sounds like what LW has been saying for awhile:

http://www.zerohedge.com/news/2015-02-15/david-stockman-global-economy-has-entered-crack-phase

Anyone got any ideas about UK private pensions?

Got a new job with offer to sign up for a really good pension with final salary lump sum etc… looks so good you’d be a fall to say no… but I’m also an economic collapse follower and Lindsey has said for years all paper will become nothing… but does that apply to UK private pension funds? Aren’t they protected somehow? I want to say yes to it but my brain is saying no because of this sept event coming. Do i wait for the event then sign up while funds are cheap post crash or do i stay away from it forever and put money into tangibles each month to retire on one day?? Problem is obviously if I do that i miss out on company’s contribution and could be missing a real gem i may regret when i am old. I’m truly stuck. Any help advice? Thanks

Ps sorry for dodgy spelling above im shattered and falling asleep as i type this lol thanks for any help anyone can give

Hello Jake,

I was faced with a similar dilemma and decided to go with the pension.

Why? I decided to go with the barbell investing philosophy as described in Nassim Taleb’s book “The Black Swan”.

You may wish to expose yourself to upside events as well as protect yourself from downside events.

After all, as Lindsey said himself, The elite don’t always get their way.

Thanks Hal

Yeah I just feel that yes this crash is coming but I do not believe (or CANNOT believe) it is the “end of all things financial” – all things simply rebound and go up again and a decent investment fund will simply go down in the crash and then you load up when it is down and it will soar again (like last time 2008-2015) and you make a killing. Ok if you can time it with this 7 year cycle idea then just hedge/pull out at the coming crash and re-enter after the explosion. Simple really.

Let me give you an example: I know a guy who laughs at conspiracy theories, doesn’t believe in any illuminati type idea, doesn’t even believe the markets are rigged one cent (!!) because he lives in a very big bubble protected by mainstream thoughts. He believes you take the medicine the doctor gives because it could never hurt you, and that a bank would never be allowed to ever rig a market, etc. OK, so this guy cannot and will not believe in the slightest truth or alternative media report. He believes the mainstream news on TV and in newspapers MUST be real and true else they wouldn’t be allowed to say what they say! If he heard one word from Lindsey’s mouth he would say “utter nonsense” and turn it off to switch on the latest reality TV show. You get the idea…, however, this same guy has made loads of profit from never understanding financial markets, manipulated crashes etc by simply putting away a slice of his wages every month in a simple basic tracker fund his bank offers. He has NO idea what a stock market really is, but he set it up when he was about 18 and it is worth a mint now. He has no say or control over it, he puts fresh wages into it each month and forgets about it. In 2008, yes it went down a bit, but no big deal, it simply added more shares to itself after the bottom was in and soared nicely. No matter how much it goes down, it just buys more. A simple, basic banking product. It is worth plenty of money right now. When the Sept crash hits, he won’t have a clue it is coming nor will he care, because it will dip, double down, and rebound with even more profit. Same old story.

We are being led to believe this coming crash will be apocalyptic in nature, but really all that will happen is markets will plunge worse than 08 then bounce back and the man on the street won’t be affected at all. McDonald’s will still be serving him lunch and the TV will still be entertaining him in the evenings. Work will pay the bills. The market news will be a big YAWN. That will be the typical man/woman during this crash, like 08.

I expect his fund will be soaring come 2016-17 onwards. If he has to change to a NWO world currency, he won’t care. What’s the difference between a Pound, Dollar or an NWO Currency? Nothing! It still buys cinema tickets and popcorn. The little guy will simply sail through this unhurt, like 2008. That’s my belief.

Any thoughts anyone?

PS my long reply is not representative completely of my opinions about this… I was talking from the perspective of the typical sheeple, like my friend I mentioned. I for one do not want any NWO anything, including single currency, and I can see where it is all going and it’s very bleak. My point is that unless markets literally disappear off of the planet forever, hey should go up again after the crash, which means any fund which doubles down after the crash will likely go on to make it all back plus more… UNLESS this coming crash is genuinely apocalyptic so much so that paper money goes to zero and we all starve to death like zombies in the street. In that case, ok yes it’s serious. But if it is just a bigger form of 2008 – no big deal, what goes down goes up again. Unless I’m missing something?

Jake

Legitimate points about your friend and makes a lot of sense. But what hasn’t been considered is the elite have made changes since 2008. The new danger with having a bank product is the likelihood of bail-ins. Bail-ins means depositers’ or customers’ paper funds or paper assets held with the bank will be transferred to bail out the bank in the event of collapse. I think the key with your friend’s situation is to determine if the product he holds with the bank comes under the classification of unsecured creditor. If it is, it will be lost if the bank fails.

FOOD WARS!!!

DOCK WARS!!!

Ok so when this big one hits in Sep, does anyone know if what LW said years ago is still in place, that is, the Euro will go before the dollar and when you see the Euro go you have about 2 weeks to run from dollar.. remember Ken Frome told him that years ago… anyone remember?? Does that still stand do you think?

(ED: Just look what is happening in Greece right now. A similar situation is brewing in Spain and Italy. They are being crushed by their debt obligations and these new European austerity measures will merely ramp up the debt. Greece is insolvent! Ireland is insolvent! Zombie Banks are no longer seeking deposits or actively offering loans. Any institutional money put in the banks carries a negative interest rate, how long before retail customers are charged just to put their money in these banks? Put money into a bank now and it is no longer your money, its the banks asset. Besides, they don’t need retail money with all this zero interest ‘free’ austerity money being pumped into them so they can keep the stock market and derivatives bubble ticking over. We have Germany and France talking with the Russians. The euro is not looking healthy if Greece, Spain and Italy default and declare bankruptcy or leave the Eurozone. This may lead to banking insolvency and not just a liquidity issue. When these banks collapse your money is going to be used to pay their liabilities. Insurance will collapse since they only hold approximately $25 billion on approximately $10 trillion in commercial deposits. If just one major bank crashes, this will be wiped out! Bail-ins will see depositors get a haircut, this may be even bigger than Cyprus who stole 6.75% and 9.9% of INSURED depositors money! What can you expect? A banking crash much bigger than 2008? For certain! Your money is basically worthless! How close is this to happening? With all the banker deaths (mostly tied to banking risk departments) that have been happening over the past few years, its obvious that this Ponzi scheme is about to end and I think much sooner rather than later. If you have paper assets, dump them as quickly as possible and buy tangibles like gold and silver. Buy something you can hold and sell when all of this craziness is over.)

Elites solidifying around a child of a fellow Elite:

http://observer.com/2015/02/jeb-money-train-makes-two-more-nyc-stops/

A glimpse of the Elite’s plans after they gain control?

http://www.zerohedge.com/news/2015-02-10/top-01-loves-guaranteed-minimum-income-one-caveat

WHY in conmunications are we such a shadow of ourselves? Anyone know pho tog raphy? Why on earth would anyone want to hide the Light, especially in all communications? Is puzzling, yes, INDEED.

Dear James

I just read Greek leaders are meeting with European officials this week to discuss their debt. If Greece leaves the Eurozone which from al accounts it is likely to then this creates a major risk of a massive derivatives explosion the likes of which has never been seen – as Pastor has been telling us.

In view of this progressing Greek situation, could it be plausible the global crash may happen sooner rather than September 2015 as Pastor mentions in his last DVD? To be honest I feel quite ‘edgy’ right now . Any insight from you or the Pastor would be appreciated. Would the upcoming DVD to be released 16 Feb clear up the accelerating situation in Greece which severely impacts derivatives?

(ED: As far as I am aware the crash is still slated for September 2015. Things can change, but it is the most opportune time to do it based on their occult beliefs. I do not know what is in the new DVD other than what has been advertised. However, Pastor Williams has access to Elite contacts and I am sure he will have something to say that will help people more understand the current situation)

Thank you for your comments James. The elite’s occult beliefs is a good point. Greece’s debt situation is intriguing from the point of view as to how the elite would prevent collapse if the debt isn’t paid. I have a lot of the Pastor’s prior material and will think about his new release.

Dear James

Is it possible for Pastor Williams to make the latest DVD due for release on 16 Feb available as an online download. This is not only faster to obtain but hopefully more economical. The currency where I reside has devalued significantly against the USD and on top of that there are postage costs in USD. Buying USD items at the moment isn’t as easy.

(ED: The latest DVD will only be available as a physical DVD. I have been told will not be available as an online download. However, all of Pastor Williams’ previous DVDs are available online for instant streaming from LindseyWilliamsOnline)

It seems like things are moving fast. Reading other blogs and news it sounds like the “near end” is just arond the corner.

I hope the Pastor can let us know, at least a warning, sometime soon if he happens to be told. Even a day warning is helpful.

God bless all believers when this hits. Trust in Jesus and be ready.

I wonder if the Elite will leverage Grexit to destroy the EURO? Hopefully we will get an update from the Pastor in Feb if things are still on schedule and rocking.

http://www.zerohedge.com/news/2015-02-08/alan-greenspan-greece-will-leave-eurozone-eurozone-wont-continue-its-current-form

This can trigger some CDS derivatives according Harvey Organ:

http://www.silverdoctors.com/harvey-organ-4-t-in-greek-derivatives-to-detonate-in-10-days-entire-financial-world-will-fall-like-dominoes/

But Euro crisis can force countries like Greece and even Germany out of the union and closer to BRICS, which I can’t see like something good for the western powers. Also, the euro is currently used mostly as an enslavement tool, so I think they will keep it until replaced. If some suicides start happening in Greece, we will know for sure :)…

New Cycles of seven hit 16 feb:

http://www.zerohedge.com/news/2015-02-06/eurogroup-gives-greece-10-day-ultimatum

I hope everyone on this site understands that when the current adminstration decides to take total control over the internet, they meaning the criminal elite, will take over the internet, by all means available, speech and knowledge, distorted, the spelling of the useful, written no longer, word destroyed.

New warning of massive world debt:

http://www.ft.com/intl/cms/s/0/2554931c-ac85-11e4-9d32-00144feab7de.html

who would of ever saw this coming? Did someone once say they would be last??

http://www.foxnews.com/world/2015/01/31/saudi-arabia-faces-isis-threats-during-transition-new-king/

how fast can they make this move oil up ?? 😉

we shall see. oh did they not also just approve a BIG pipeline. you might say; he has a veto pen though. I say get ready.

I John 5:1-7

Seems that PM of Greek wants to default on their debt. http://www.theguardian.com/business/2015/jan/30/greece-finance-minister-yanis-varoufakis-shun-officials-troika

They have refused to accept further regulations by the EU troika and have set them home.

There exists a paper in German, which is allegedly of PM Tsipras, which states that it is no longer advisable to “extend and pretend” the fact that Greek will never be able to pay back their debt.

http://info.kopp-verlag.de/hintergruende/europa/tyler-durden/alexis-tsipras-offener-brief-an-deutschland-was-ihnen-ueber-griechenland-verschwiegen-wurde.html

The problem is that the money will not help the Greek population at all, but the regulations according to the troika ruins the rest of the weak economy. Seems that he wants to default and start without the help of the EU. This could lead to a big crack…

two articles clearly explained what/why has happened and will happen.

http://www.alt-market.com/articles/2491-failing-stimulus-and-the-imfs-new-multilateral-world-order

http://www.alt-market.com/articles/2403-the-economic-end-game-explained

Well, all the information Lindsey has given out on how to survive,you got the info,so don’t blame anyone else but yourself if your not ready, but just remember as a Christian to keep your eyes on the Lord,if you have not studied any Bible prophecy,I feel sorry for you cause all will end in God winning.God provided Lindsey to prepare you,I hope you know the Bible tells all that is happening.

Jim Willie gives a prophecy: Germany will pull out of the Euro soon. Hear his statement beginning at 57 minutes.

https://www.youtube.com/watch?v=49R5KjzYG5Q#t=3420

Suddenly, everyone is criticizing central banks after the Swiss Bank fiasco. But are they preparing the public for the IMF to take over from national central banks because the problems are now too big now?

http://lonestarwhitehouse.blogspot.com/2015/01/central-banks-critics-showing-up.html

Are comments allowed again?