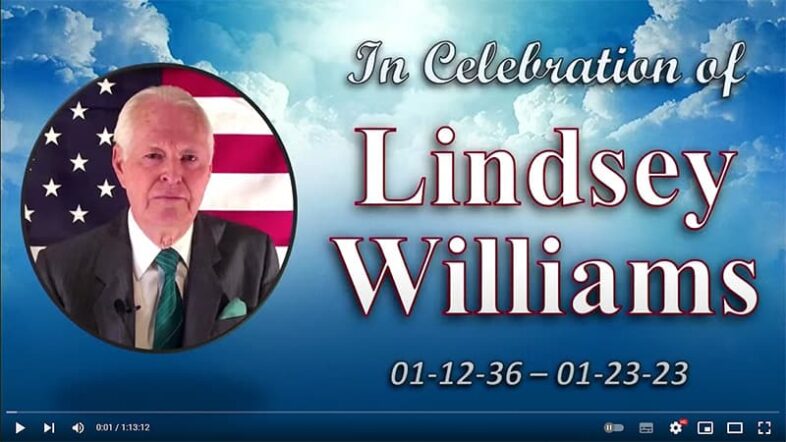

In Celebration of Lindsey Williams 01/12/36 – 01/23/23

“I have fought a good fight, I have finished my course, I have kept the faith.” – Lindsey Williams

In Celebration of

LINDSEY WILLIAMS

January 12, 1936 – January 23, 2023

On Saturday, April 1, 2023, at FBC Fountain Hills dba Cornerstone Family Church in Fountain Hills, Arizona, there was a special Memorial service in celebration of the life of Lindsey Williams.

The church provided a live video of the service for friends and family unable to attend in person.

Lindsey's wife Joanna has given permission for the followers of his work to watch the video of the service if they would like to know more about Lindsey's personal life.

The video includes a special personal testimony from Joanna.

You can watch the memorial service video below:

Please feel free to leave a message in the comments section of this post. Lindsey's family will read all of your messages.

In Loving Memory of Lindsey Williams (1936-2023)

“I have fought a good fight, I have finished my course, I have kept the faith.”

These are the words Lindsey Williams spoke shortly before his departure to be with The Lord forever. He felt that he had fulfilled his destiny.

In Loving Memory of

LINDSEY WILLIAMS

January 12, 1936 – January 23, 2023

It is with great sorrow that we inform you that Linsey Williams went home to be with the Lord on January 23, 2023. He is survived by his Wife, Joanna Williams, and children, Elizabeth, Daniel, and Joseph. He wore many hats in his lifetime; Pastor, Missionary, Father, Lecturer, Radio Personality, and Patriot. Many of you know him for his recent work, sharing updates on current events that affect individuals around the world.

This is the story of the extraordinary life of an extraordinary man, Lindsey Williams.

From a young age, the Lord had his hand on Lindsey. His mother recounts that when she was pregnant with Lindsey, she heard from the Lord that the baby she carried would preach His word. At 21 years old, Linsey graduated from bible college and went to Florida to start a church. He scraped together what money he could and rented a carpenter's union hall for his first worship service. It was a small group on the very first Sunday. Twelve years later, the church had grown to 450 members. Lindsey felt the Lord was calling him to Alaska to become an aviation missionary. This is where his life took a radical turn.

The year was 1973. Lindsey had just arrived in Alaska, answering the Lord's call to become an aviation missionary. Shortly after he arrived in Alaska, six oil companies announced that they would build the Trans-Alaska oil pipeline. This 800-mile-long pipeline would take three years to build and involve over 25,000 personnel in its construction. Lindsey thought, “25,000 of the roughest, cussedness, orneriest people on the face of the earth? They must need to hear about Jesus!” With this burden on him, Lindsey flew to meet with members of the oil companies to find out details about becoming a chaplain on the pipeline project. At first, they laughed at him, telling him they had never had a chaplain on any pipeline project in the world and that they could not pay him anything. But Lindsey was determined to get on that pipeline! He kept going back and back until finally; they said they would allow him to go to the seven northernmost work camps, Prudhoe Bay, down to Galbraith Lake. They said, “go see what good you can do.” They all gave him a matter of weeks before he left due to the conditions. However, six weeks later, they called him back and said, “Chaplin Williams, we had no idea how valuable it could be to have a chaplain on the pipeline. You are literally saving us thousands of dollars in counseling fees!” They then asked him if he would be willing to accept a management position on the board overseeing the project in an advisory capacity to help with the relationship between management and labor. He gladly took them up on the offer.

Being in this position allowed Chaplin Williams to hear and see things that no other person of his caliber would be able to know! Lindsey recalls one instance where an executive invited him to join him on a trip to see a new oil discovery on Gull Island! He recalls seeing a huge plume of black liquid rise into the sky as they released the oil to discover many technical aspects of the discovery. Lindsey and this executive then raced back to base camp to find out about the discovery. What they discovered was a pool of oil that (along with others in the area) could have made the United States energy independent for two hundred years or more. Everyone in the room was ecstatic. They all knew this discovery could change history!

However, Lindsey soon learned that what they discovered that day was ordered classified and never to be spoken of again! He was devastated, knowing that it could have rewritten the textbooks! Lindsey could not remain silent with this knowledge, and many other things learned from his time on the pipeline. He was encouraged by a good friend at the time to write a book detailing his experiences on the pipeline! This book, the Energy Non-Crisis, was the fuse to Lindsey's explosion into the world of insider information and knowledge about events worldwide.

He learned on the pipeline that there is a group of people who control the world. They control currencies, governments, wars, organized crime, and many other facets of society that affect our everyday lives. Many times, this Elite group tried to silence Lindsey, but he kept pushing forward in his attempts to expose them. After The Energy Non-Crisis became a best seller, Lindsey would write five more books dealing with subject issues with the Constitution, Health, and Governmental Control.

Throughout his life, Lindsey continued to have an enthusiasm for others hearing the Gospel message. When he became known worldwide, he used every opportunity to share the good news of Jesus Christ. He always gave God the glory for the opportunities he was given. Having spoken in every state except for Maine, he had many opportunities. Every speaking tour and radio show he went on, he went on the condition that he be allowed to share a salvation message. He never lost his zeal for sharing the same message that drove him to Alaska and the pipeline.

Shortly before Lindsey passed away, he expressed his life with the scripture, “I have fought a good fight, I have finished my course, I have kept the faith” (2 Timothy 4:7). He had a great desire in his final days to be with the Lord. He wished his gravestone read “a sinner saved by grace.” This is how he wanted to be remembered.

* This tribute was written by Lindsey's wife, Joanna Williams and his son Daniel Williams.

Please feel free to leave a message in the comments section of this post. Lindsey's family will read all of your messages.

Finding Healing and Hope: Joanna Williams’ Heartfelt Journey at IBC Hospital

Discover Healing Beyond Medicine: Joanna Williams’ Journey at IBC Hospital

Finding the right healthcare provider can often feel like searching for a needle in a haystack. Joanna Williams, the widow of the esteemed Pastor Lindsey Williams, knows this journey all too well. Since 2011, she and her late husband sought quality care, eventually discovering BioCare. Following Pastor Lindsey's passing in 2023, Joanna has continued to trust BioCare, finding exceptional medical attention and a compassionate community supporting her healing journey. For Joanna, BioCare is more than just a provider—it's a place of hope and holistic care.

A Holistic Approach to Health

Joanna was first introduced to BioCare by a friend who understood its unique approach to healthcare. From the moment she and Pastor Lindsey experienced their services, they were deeply impressed by the holistic philosophy that focuses on the connection between body, mind, and spirit. This comprehensive approach treats symptoms and tackles the root causes of health issues, providing a path to lasting wellness. Even after Pastor Lindsey's passing, Joanna values BioCare’s dedication to genuine, whole-person care.

Exceptional Care and Treatments

One of the standout features of IBC Hospital is its array of specialized treatments. Joanna recounts her journey through knee replacements and the ongoing management of her rheumatoid arthritis, crediting the expertise of medical professionals like Dr. Rodriguez and Dr. Vasquez. Their attentive care and profound knowledge have significantly impacted her quality of life.

In addition to these successes, IBC Hospital offers unique services, including specialized cancer treatments and live blood analysis. These advanced options are not widely available elsewhere, positioning IBC as a leader in innovative health solutions.

A Nurturing Environment

Walking into IBC Hospital, patients are greeted with medical care and an environment that fosters overall wellness. Joanna notes the exceptional meals and the compassionate nature of the staff, which creates a sense of comfort and belonging. “It feels less like a hospital and more like a nurturing home,” she explains, emphasizing the positive atmosphere surrounding every visit.

A Sense of Community

One of the most touching aspects of Joanna’s experience at IBC is the community that thrives within its walls. She describes a unique bond that forms among patients, where shared experiences lead to mutual support and encouragement. Many patients, Joanna included, feel they were guided to IBC by divine intervention, adding a spiritual dimension to their healing journeys.

Gratitude and Encouragement

Joanna’s journey has been one filled with profound gratitude. She often reflects on the care and support she and Pastor Lindsey received through BioCare and encourages others to experience the difference it can make. ‘If you’re looking for a place that truly prioritizes your overall well-being, BioCare is where you should be,' she shares passionately. Even after Pastor Lindsey’s passing, Joanna remains deeply thankful for the exceptional care and holistic approach that BioCare continues to provide.

Experience the Blessings of IBC Hospital

If you or a loved one seek a healthcare facility that combines cutting-edge treatments with compassionate care and a supportive community, look no further than IBC Hospital. Just as Joanna and Pastor Lindsey discovered, your journey toward healing and wellness could begin here. Experience the blessings firsthand and take the first step toward a healthier, happier life.

Visit IBC Hospital’s website today to learn more about their services and how they can support your health journey. You may find the healing you’ve been looking for!

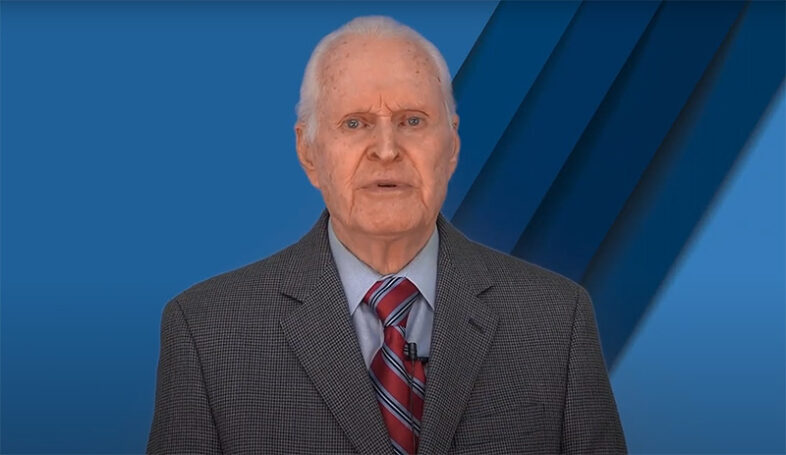

Pastor Lindsey Williams – At Bio Care Hospital – Getting Over COVID

This is part 11 of a series of 12 informative videos on how to cope with all the damage COVID brings. Where Pastor Lindsey Williams interviews Rodrigo Rodriguez, MD, founder of BioCare Hospital and Wellness Center.

Call BioCare Now: 1-800-262-0212

Website: International BioCare Hospital and Wellness Center

Pastor Lindsey Williams

Hi, this is Lindsey Williams. Standby for news of getting over COVID. After you have passed the contagious stage, that's just the beginning of overcoming COVID. If you have the same experience I did, I could not overcome the after-effects of COVID. No matter how hard I tried, I couldn't overcome my weakness. I didn't even want to put my feet on the floor in the mornings.

I was weak to the point that I could not have possibly carried on my everyday life. So many of my friends have had COVID, and getting over it was the most challenging part. I needed professional help. I needed BioCare Hospital and Wellness Centre, where Dr Rodrigo Rodriguez had developed the COVID Renewal Protocol just for people like you and me.

Please call BioCare Hospital and Wellness Center at 800-262-0212; the number is toll-free. Ask for a consultation with a doctor, and they will be glad to help you.

The BioCare Hospital and Wellness Center doctors know what to do to help you overcome COVID. I needed X-rays, an examination of my heart and an ophthalmologist to examine my eyes. While I was a patient at BioCare Hospital and Wellness Center, I received the right supplements daily to help get my strength back.

BioCare Hospital and Wellness Center can take care of several other things simultaneously. For example, you can get your dental work done. Have your eyes examined and change your glasses, if necessary and much more besides.

I had to ensure that COVID didn't damage my heart and lungs because so many people go on and find out months or years later that damage has occurred. It would be best if you had professional healthcare, and that's where BioCare Hospital and Wellness Centre comes in. Please give them a call toll-free at 800-262-0212.

I want to introduce Dr Rodrigo Rodriguez, the founder and director of BioCare. Hospital to talk to you about getting over COVID.

Dr Rodrigo Rodriguez

I think your point and question are perfect. Every time we have a conversation, I always learn things from you, and I know many people worldwide do.

Suppose we wanted to make a summary of everything conveyed. What do you do now if you have gone through COVID and are recovering but have all these symptoms?

What you're going to do first, I think that step number one is to give BioCare Hospital and Wellness Center a call. There are no strings attached. You won't need to pay anything. Call us and say I need to talk to one of the doctors. When you speak with them, you tell them you had COVID and then tell them how you feel and if they can help.

You might be doing reasonably well, and just a little good advice will be enough. Sometimes we might tell you to ask your doctor to check several things. But in general, doctors are excellent at treating acute diseases. However, they're not very open to discussing chronic or more specific things, which can be a big problem for us. For example, if you cannot drive because of your balance or vertigo, if you cannot watch the news because your eyesight is failing, or you feel some nausea now and then, et cetera, your life is not going to be what it used to be.

Please ask us for help, and we can give you some advice, especially if the circumstances are different. We may tell you to come to BioCare Hospital and Wellness Center so we can do some testing. After the testing, we can advise you on what to do next.

You might already have blood results from your doctor that you can email us before discussing your health with one of our doctors. With this information, we can advise you what your next step is. You may benefit from a two-week stay at BioCare Hospital, and you could heal a lot of the inflammation during your stay. You could lose a lot of extra fluid. Inflammation always means swelling. Our organs, nerves and lungs can swell, and when that swelling starts to go down, you're going to lose weight, and you're going to feel better. You're going to breathe easier, and you are going to start feeling normal once again.

The most important thing is that even if the problems are mild, you don't need to suffer from them for six months. It would be best if you shortened this as soon as possible by saying that you need help from us at BioCare Hospital and Wellness Center. You must understand that we can help you. You can ask us any questions about your health. You can plan this yourself, but without hesitancy that one of the best options you can have this to seek help for COVID renewal at BioCare Hospital and Wellness Center.

If you are concerned about long COVID or any other health issue, please call Bio Care Hospital for free and talk with one of our doctors. Please call toll-free at 1-800-262-0212.

Call BioCare Now: 1-800-262-0212

Pastor Lindsey Williams – At Bio Care Hospital – COVID and Supplements

This is part 10 of a series of 12 informative videos on how to cope with all the damage COVID brings. Where Pastor Lindsey Williams interviews Rodrigo Rodriguez, MD, founder of BioCare Hospital and Wellness Center.

Call BioCare Now: 1-800-262-0212

Website: International BioCare Hospital and Wellness Center

Pastor Lindsey Williams

Hi, this is Lindsey Williams. Standby for getting over COVID and supplements. It starts with a person who knows what they're doing, a doctor this well trusted, who has researched this subject and has helped many people get over their COVID.

Dr Rodrigo Rodriguez, Medical Director at BioCare Hospital and Wellness Center with over 30 years of experience in alternative health care for cancer and chronic degenerative diseases, has his brand of every supplement imaginable and necessary to survive COVID.

I could have never gotten over COVID without the proper supplements. If you don't realise that COVID could have damaged your heart, lungs, and eyes, call BioCare hospital at 800-262-0212 toll-free. Ask the doctors about the COVID renewal programme of BioCare Hospital and Wellness Center.

I needed help getting over COVID. I could not get over it on my own. I want to introduce you to a medical doctor who can help you with the supplements necessary for COVID renewal and tell you about the COVID renewal plan developed at BioCare Hospital and Wellness Center.

Dr Rodrigo Rodriguez, founder and administrator of BioCare Hospital, will you please tell us about COVID and supplements?

Dr Rodrigo Rodriguez

That's an excellent question because, of course, getting over a condition like this is not something we will overcome in one, two, or even three weeks. We're going to be feeling a lot better, and we're going to make a dramatic improvement. We're going to shorten the overall length of the problems that we're going to be facing. But not everything is going to be solved entirely.

The other is that many deficiencies may take a longer time to recover. At BioCare Hospital and Wellness Center, we have a full line of products that the doctor will prescribe.

You're going to be able to talk to your attending physician, one to one, and you're going to see them every single day. You're going to be asking questions every single day. We're going to be testing blood. We will test all those markers we have been talking about in the other videos in this series. We want to show you and guide you through the whole process.

When you go home, the BioCare Hospital and Wellness Center doctors will advise you to take the proper supplementation. Including vitamin D, Probiotics, and some form of fibre to help your intestinal tract. You will need to continue taking an anti-inflammatory and something to be supporting the whole process to continue your recovery in the right direction.

Not only am I going to prescribe the correct supplements, but I'm going to make sure you're going to be able to get our entirely legal supplements and products when you return to the United States. We will ship the supplements and products directly to your home.

We will not need to hide or disguise these products as everything is absolutely 100% legal. You will be happy and relieved that you can continue your COVID renewal programme at home, as we will give you 100% support.

You will be friendly with your attending physician, BioCare Hospital, and Wellness Center staff. I am proud that you can call us and ask for anyone by name. The average age of our employees at the hospital is 25 years. So chances are that if you ever need to return to BioCare Hospital and Wellness Center, you will find the same people. They will become life-long friends.

If you are concerned about long COVID or any other health issue, please call Bio Care Hospital for free and talk with one of our doctors. Please call toll-free at 1-800-262-0212.

Call BioCare Now: 1-800-262-0212

Pastor Lindsey Williams – At Bio Care Hospital – Crossing The Border

This is part 10 of a series of 12 informative videos on how to cope with all the damage COVID brings. Where Pastor Lindsey Williams interviews Rodrigo Rodriguez, MD, founder of BioCare Hospital and Wellness Center.

Call BioCare Now: 1-800-262-0212

Website: International BioCare Hospital and Wellness Center

Pastor Lindsey Williams

Hey, this is Lindsey Williams. Standby for news of crossing the border into Mexico. I just did. It is probably the most accessible border to cross today—the border between the United States of America and Mexico.

You will have no problems coming into Mexico. We just merely drove across the border. Nobody stopped us, bothered us, and they did not go through our luggage, and it was also an effortless crossing from Mexico back into America. However, when crossing into Mexico, it is always advisable to have a passport.

People have heard that Tijuana and Mexico are not safe. That is not true at all. I would say that the streets of Tijuana are safer than Chicago, New York, San Francisco, Los Angeles Haven, and West Phoenix. My wife loves to take a stroll at night, and she walks the streets of Tijuana around BioCare Hospital and Wellness Center with no fear whatsoever. It's perfectly safe.

Going back into the United States of America is a little more complicated because they will stop you and ask for your passport. But it is perfectly safe.

Folks, please call 800-262-0212 if you have any doubts. You can ask the BioCare Hospital staff for the latest information about the border crossing.

Dr Rodriguez, please explain to us the Mexican border crossing to come to Bio Care Hospital and Wellness Centre.

Dr Rodrigo Rodriguez

That's an important question because we are just across the border from San Diego, California, and many people might be wondering how the situation is with the border.

During the pandemic in 2020, the border was officially closed for approximately 18 months. Even though it was closed, it was never closed for US citizens, residents, and medical reasons.

Despite being at the height of the pandemic, people could come across the border and go back without any problem. We suggested to everyone to use the ‘special medical line'. You will go through a medical line when crossing the border back to the United States; our drivers will want to take you very speedily through that border without any problems. It's a very speedy process for all our patients.

We have different types of transportation, which we provide at no cost. We'll meet you at the train or airport and drive you to the hospital. We will also take you to do some errands if necessary.

At the end of your stay at BioCare Hospital and Wellness Center, we will drive you back to your airport or point of departure.

All of our drivers are friendly and helpful people. They all speak English and can deal with any unexpected problems. We make sure everyone leaves happy.

Please go to YouTube and read the testimonials of people that have been to BioCare Hospital and Wellness Center, and you will see how easy and painless coming to the hospital is. You will also see how we take care of our patients.

We also have unlimited Wi-Fi and telephone coverage; one patient said they felt like they had never crossed the border.

If you are concerned about long COVID or any other health issue, please call Bio Care Hospital for free and talk with one of our doctors. Please call toll-free at 1-800-262-0212.

Call BioCare Now: 1-800-262-0212

Pastor Lindsey Williams – At Bio Care Hospital – COVID Recovery In Comfort

This is part 9 of a series of 12 informative videos on how to cope with all the damage COVID brings. Where Pastor Lindsey Williams interviews Rodrigo Rodriguez MD, founder of BioCare Hospital and Wellness Center.

Call BioCare Now: 1-800-262-0212

Website: International BioCare Hospital and Wellness Center

Lindsey Williams

Hey, this is Lindsey Williams. Standby for news of recovery from COVID in comfort. Where would you ever find comfort at a hospital? You can find comfort at BioCare Hospital and Wellness Center because it's like home. The numbers on the screen are 800-262-0212. Please give them a call and talk to them about COVID recovery renewal. Dr Rodriguez has developed a programme whereby a person can get over COVID. You don't have to suffer for months, and maybe even years. You don't have to wonder where COVID did the damage to your heart, your lungs and your eyes in other parts of your body.

Come here for COVID renewal and do it in comfort. What makes COVID so different in renewal here at BioCare? You have the choice. If you want to stay in an apartment, you can. If you are sick to the point that you need to be in a hospital with doctors and nurses 24 hours a day, seven days a week, always on call, you can stay in a complete hospital with an operating room approved. If you'd like to stay at BioCare Hospital as a family, you can rent a house on the premises at BioCare Hospital and Wellness Center. And then, for those who want super comfort, there is a five-star apartment. It is as lovely as a suite you could find in a hotel. And if you would like COVID recovery in complete comfort, choose the suite. So take your choice, Dr Rodriguez. Please tell us about the accommodations at BioCare Hospital for COVID recovery in comfort.

Dr Rodrigo Rodriguez

When you come to BioCare Hospital, you have several choices depending on the level of care you require. If your condition requires a hospital room, you're going to get a hospital room. You're going to get the type of accommodation that's needed to face a critical condition. We are a complete hospital. You're not going to be playing games. You're not going to wonder if everything will get taken care of instantly. You will be in a full-service hospital.

But let's say you're on a different type of recovery level. You might stay in an apartment suite next to the hospital. Where together we communicate without leaving the premises, to the apartments, we have a whole house. We have groups of families that come together, stay together, and even cook some things. And I don't like them to cook too many things because to me food is thy medicine. So I wouldn't say I like to play many games with it. But if you need and want to do something, you will be able to do it.

We have a five-star suite with a full bathroom, jacuzzi tub, and everything you need. But that depends on the level of the needs of your medical needs. But you're going to be able to do many things. So people have had this chronic condition for months, and they come here, they can spend the time in their apartment and bring their spouses or one member of the family or a good friend to be with them, which is always comforting.

You have many choices to stay at BioCare Hospital and Wellness Center. Please give us a call. It costs you nothing.

If you are concerned about long COVID or any other health issue, please call Bio Care Hospital for free and talk with one of our doctors. Please call toll-free at 1-800-262-0212.

Call BioCare Now: 1-800-262-0212

Pastor Lindsey Williams – At Bio Care Hospital – Why Choose BioCare Hospital and Wellness Center

This is part 8 of a series of 12 informative videos on how to cope with all the damage COVID brings. Where Pastor Lindsey Williams interviews Rodrigo Rodriguez MD, founder of BioCare Hospital and Wellness Center.

Call BioCare Now: 1-800-262-0212

Website: International BioCare Hospital and Wellness Center

Lindsey Williams

Hi, this is Lindsey Williams. Standby for news as to how to best recover from COVID. It would be best if you had a professional place. You need a programme that's been developed especially for COVID Renewal. Just go to a hospital for the sake of COVID renewal. No, it takes an extraordinary place. And that place is BioCare Hospital and Wellness Centre. And that word Wellness Centre is so very accurate.

Please give them a call. The toll-free number is Bio Care Hospital and Wellness Centre on your screen. Right into the hospital at 1-800-262-0212 and ask for a special consultation with a doctor. They will gladly talk to you without charging you.

Over 40 years ago, a man, Dr Rodrigo Rodriguez, decided that he wanted a hospital where the patient was the most crucial part. He hand chose his doctors and his nurses and trained them for the job they were to do. I'm thinking of one exceptional nurse at BioCare Hospital who started in the laundry room, and Dr Rodriguez saw real potential in this young man and sent him to nursing school. He now is a nurse here at BioCare Hospital, fully trained, and has been here for 15 years.

These are the kinds of people that you'll find that BioCare, an atmosphere where a patient is a person, not a number, and I often say that BioCare Hospital is a place it must be experienced to believe it. I have never found a place like it. The first time I came here, I began advertising it on my website and telling everybody I could, and that's why I'm doing this video today to let you know that there is a hospital in the world where you will feel like you are at home.

When they serve you the food, you will think it is gourmet. That's correct. The food here at BioCare Hospital and Wellness Centre is like nothing I have ever known. The pride and joy of BioCare Hospital are their kitchens and its food. I want Dr Rodrigo Rodriguez to tell us about it personally. Dr Please tell us about the food and the kitchen at BioCare Hospital and Wellness Centre?

Dr Rodrigo Rodriguez

Well, you know, that's an excellent question and let me be a bit; I don't even know what word to use. But let me brag a little bit about it. Why would I choose BioCare? Because I honestly cannot tell you of any place with what you need to do this. Because you need to, you need a hospital. After all, you have to do blood testing. You will need to do X-rays.

After all, you need to do intravenous treatment because you need oxygen. Unlimited oxygen is not like getting a little bowl like this and getting oxygen for five minutes. Oxygen is a medicine. And I'm quoting you. Because I remember when you started taking the oxygen, you said I feel so much better. And you asked me whether oxygen is a medicine.

Yes. And I'm going to use that. I'm going to steal that phrase from you. Because it's perfect, oxygen can help heal many functions, particularly in this case. So all those things combined need a hospital. But then you need health support for the whole body, lifestyle, sleep, taking care of your general function, water and its quality food and its choices of anti-inflammatory foods, and avoiding pro-inflammatory things.

I need to take care of your intestinal flora because your intestinal flora is critical to improving your immunity to fight back against the disease. And I need to make sure that everything is happening in the right way. You're going to need supplementation. And the same way, I was telling you that we test for inflammatory markers. We test for other products that are other essential ingredients of the whole picture, like vitamin D. I want to check what your vitamin D level is because it can be a highly anti-inflammatory substance. So I want to make sure you're not deficient. And I know that about 80% of the American population is deficient in vitamin D to some level.

So by measuring all these things, I have two things on the one hand, the technical assets, the technical advantages of being in a hospital, and the understanding of the biological support, that my buddy will need to overcome the whole situation.

Something I like to brag about also is our staff. I get so many compliments daily about how friendly and knowledgeable our team is that I cannot begin to tell you you have experienced it yourself. Because when you're taking care of people with an illness of any kind, you need two things. You need a good brain, and you need a very good heart. So compassion and skills should go hand in hand.

If you are concerned about long COVID or any other health issue, please call Bio Care Hospital for free and talk with one of our doctors. Please call toll-free at 1-800-262-0212.

Call BioCare Now: 1-800-262-0212

Pastor Lindsey Williams – At Bio Care Hospital – COVID Recovery at Bio Care

This is part 7 of a series of 12 informative videos on how to cope with all the damage COVID brings. Where Pastor Lindsey Williams interviews Rodrigo Rodriguez MD, founder of BioCare Hospital and Wellness Center.

Call BioCare Now: 1-800-262-0212

Website: International BioCare Hospital and Wellness Center

Pastor Lindsey Williams

Hi, this is Lindsay Williams, standby for news about COVID recovery. That's where I had my greatest problem. Yes, I did contract COVID. Afterwards, I could not get over it. Why? I had to get professional help because of what it might have done to my heart, my lungs, or some other part of my body. People don't realise how dangerous COVID is. Please give them a call. The toll-free number is Bio Care Hospital and Wellness Centre on your screen. Right into the hospital at 1-800-262-0212 and ask for a special consultation with a doctor. They will gladly talk to you without charging you. Where today do you find a doctor that cares? Like Bio Care Hospital? Who won't charge you by the minute for a consultation? Well, they did. They helped me through it. I came to Bio Care Hospital. I would have never gotten over COVID If I had not. And I asked Dr Rodrigo Rodriguez, the founder and medical director of Bio Care Hospital. Doctor, what is it that you can trace all diseases back to? Is any one thing that you can say somewhere based on what causes disease? He didn't hesitate for a moment. I said, Well, what is it? He said stress. We all had been under horrible stress due to a worldwide COVID outbreak, and then when you came in contact with it immediately. You contracted it as so many people did. So I would like to ask the professional himself, Dr Rodriguez. Dr Rodriguez, why should someone choose Bio Care Hospital for their COVID renewal?

Dr Rodrigo Rodriguez

Normally, when we have a patient that has had COVID, we do a complete physical examination of all medical history. We review things very carefully. We look at inflammatory levels. This is very important because I am telling you that one of the weak problems is inflammation. But fortunately, we can check what the level of inflammation is. If you don't do that, you're missing the whole point. You're trying to address just the symptom. You're not doing your work. You don't know your art. You don't understand what you're dealing with. We can measure those things. All you need is a blood sample to see the level of inflammatory markers, which is very accurate. They're going to take you by the hand and say this is what we must do. This is how intense we have to be. This is how careful we have to be. This is what sort of protection we have to give this particular person. If you don't do that, you're not doing your job once again. You don't know how to do it. So by doing that, I can tell, I think, I have to be very careful, and as those levels improve, then I can take a sigh of relief and say I think that what we're doing is working. I think that body is responding well. I think that person is going to be recovering and continue to recover. Then I can tell you. I told you repeatedly from the beginning that this would take time. Don't think about how I felt yesterday.

Please think of how I felt a week ago because these things slowly but surely improve. Surely you should be getting better and better, and if you do everything you must, that improvement will come, and you will be able to feel it. But you will feel it week to week, not day to day, because it takes time. But doing what we have done with you and what we're doing that Bio Care will speed the process. Some people have all the symptoms for months and months. I know people who have had a year since they recovered from COVID and still have serious problems, and I have many people who come back smiling, and you say, Doctor, you're right. I feel a lot better and becoming myself again.

If you are concerned about long COVID or any other health issue, please call Bio Care Hospital for free and talk with one of our doctors. Please call toll-free at 1-800-262-0212.