safe haven

Gold Is A Safe Haven!

Now that the Elite have confirmed the financial crash for between September and December 2015 you have no other choice other than to secure your investments. You maybe have three months to protect yourself. But, it may come sooner – the bond market has already started to crash. Please take the advice of Pastor Williams and buy physical gold and silver. Gold and silver are safe havens within periods of economic uncertainty. As you know a global financial crash creates economic uncertainty. It is time to get out of paper and into tangible assets.

If you have an IRA you can rollover to physical gold and silver until economic stability resumes or if you can liquidate your IRA take physical possession of precious metals please do so. Please contact your financial advisor or local gold dealer to get the process moving. If you do not have a financial advisor or have personal dealings with a local gold dealer I can recommend a gold dealer that specialises in conversion of IRAs and 401ks into physical gold. I have recommended them since 2013 and I know they have helped many visitors to LindseyWilliams.net. The gold dealer I recommend is GoldCo and you can contact them toll-free at 1-877-414-1385 or visit their website. Leave your name and number and they will call you back. If you have over $10,000 in your IRA or 401k or have cash of more than $5,000 they can help you start the process. They are very good with those who are unfamiliar with buying precious metals.

The process of converting your paper IRA to physical gold takes a few weeks so it would be imperative that you start the process now. Remember, when the financial crash happens in September everyone will be running for the shelter of gold and silver. This may mean that if you leave it until later there may not be the physical metal available or have to pay much higher prices. Gold and silver are trading at low prices, so investing now will mean you will receive more gold and silver for your money. If you are worried about gold confiscation there is no need to panic. Pastor Williams already stated that his Elite friend said before that there would be no gold confiscation.

Some interesting news I’ve received from a friend regarding gold says “Don’t Dare Sell Your Gold”:

From Jeff Clark, Editor Big Gold – The Non-Dollar Report: The gold price may be stagnant, but forces behind the scenes are signalling that something big is brewing. A scan of recent headlines reveals a growing fervour for gold:

China Creates Gold Investment Fund for Central Banks. China announced a new international gold fund. More than 60 member countries have already invested. The fund expects to raise 100 billion yuan ($16 billion). It will develop gold-mining projects in the new Silk Road economic region.

China Could Send Gold Up at Least $200. Saxo Bank’s Steen Jakobsen says China’s multi-billion dollar Silk Road Initiative will prompt Beijing to pull money out of Europe and the United States for infrastructure investments elsewhere. This could send commodities higher and push Europe into recession. As a result, his 2015 price for gold is $1,425 to $1,450, more than $200 higher than its current level.

Red Kite Launches New Base and Precious Metals Fund. The fund has already deployed almost $1 billion in equity, loans and royalty streams into at least 17 junior mining firms. It hired a physical metals trade to handle the entire supply. The fund will likely fund underserved juniors that have struggled to get funding.

Texas Senate Passes Bill to Establish Bullion Depository for Gold and Silver Transactions. A bill to make gold and silver legal tender in Texas passed the state Senate by an overwhelming 29-2 vote. The bill essentially creates a way to transact in precious metals. It will allow citizens to deposit precious metals in the state depository and then use the electronic system to make payments to any other business or person who also holds an account.

Gold Smuggling in India at All-Time High. Customs agencies seized over 3,500 kilograms of gold (112,527 ounces) in 2014-2015, the largest stash ever confiscated in Indian history. The report says gold smuggling has grown by 900% in just two years. It also estimates that seizures could be less than 10% of actual smuggling.

Russia Boosts Gold Holdings as a Defence Against “Political Risks”. Dmitry Tulin, monetary policy manager at the Russian central bank, said the bank is increasing its gold holdings because “it is a 100% guarantee from legal and political risks.” Part of the motivation is certainly that their overseas assets could be frozen if sanctions over the Ukraine crisis tighten.

Austria Repatriates 110 Tonnes of Gold from UK. Austria is repatriating 110 tonnes (3.53 million ounces) of gold from the Bank of England. It eventually wants to have 50% of its holdings stored at home. The country has reportedly been transferring its official gold reserves from unallocated to allocated accounts in recent years, and also reduced its leased gold by 60%.

D.E. Shaw Buys $231 million of SPDR Gold Trust. D.E. Shaw & Company bought $231.07 million worth of SPDR Gold Trust (NYSE: GLD) last quarter. This is a new position for the company.

Canadian Fund Makes $700 Million Bet on Gold Trust. Canadian asset manager CI Investments purchased a whopping 6,117,900 shares of Gold Trust last quarter, worth $703.6 million. Gold Trust is now the single largest holding of the fund – bigger even than its position in Apple.

More Funds Increase Their Shares In Gold Trust. A Swiss investment bank increased its position in Gold Trust by 490%, to more than 4 million shares. Lazard Asset Management doubled its holding to over 2 million shares. Morgan Stanley increased its holding by 8.3%, and BlackRock Group added 167% more to its position.

Traders Buy Gold and Silver at Fastest Pace in More Than a Decade. Large speculators haven’t bought silver this aggressively since September 1997. Net speculative longs in gold also added over 45,000 contracts, the most since July 2005.

These news stories suggest the gold market is setting the table for its next major bull market… And it could be a biggie!

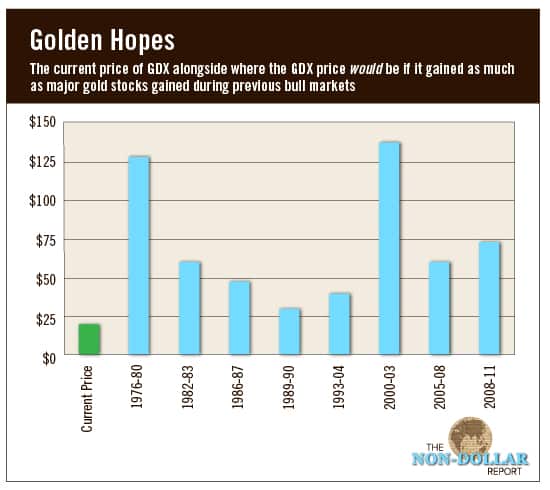

We measured every bull cycle of gold stocks and found there have been eight distinct upcycles since 1975.

We also discovered something exciting: Only one was less than a double. Even more enticing is that the biggest one – a 600% advance in the early 2000s – occurred just after a prolonged bear market. And our current bear market has been going longer than the last one.

To get a sense for the potential upside, we applied the percentage gain from each of those upcycles to the Market Vectors Gold Miners ETF (NYSE: GDX). Its price on June 1: $19.49

Clearly, the potential upside is large. No other sector is as depressed as the precious metals sector. So a return to anything close to some of the stronger past bull markets would deliver tremendous gains.

Pastor Williams has been telling you to buy physical gold and silver for many years. Throughout the last bull market as well as the current bear market. Please heed these warning signs. Get out of paper and get into physical gold and silver. Time is running out!