A few days ago Pastor Williams received an email from his elite friend. He sent him a lengthy article indicating that this is what we can expect in the next several months. The article is called “When Shale Goes Subprime”. It was sent to Pastor Williams by his Elite friend personally, not a Wall Street friend. “This is what is expected to happen in the eminent future.”

The second article Pastor Williams shared this week was an article entitled “Deflation Strikes the Eurozone.” It is an important article since Pastor Williams Elite friend warned us what would happen if the Eurozone crashes, and the Eurozone is already worried by announcing Quantitative Easing of 60 billion euros a month with a total of 1.08 trillion euros.

Tom Fyler, one of Pastor Williams' Wall Street friends has also contributed an article, this month it is entitled “Patience, Foresight, and Courage” and says we are already in a “crashing.”

In light of all that is happening – Everyone needs “Special Events Scheduled for 2015”

Pastor Williams' Wall Street friend today also said “As you have warned for quite some time, markets and economies are unraveling—now at a quickening pace. People tend to wait until the last minute to do something—so hopefully the 2015 newsletters can prompt people to act ASAP!

I remember quite some time ago that you warned to watch for currency wars. And such might serve as a mechanism to quickly deteriorate the global financial/monetary system. And perhaps usher in a global currency. What type of feedback have you received on the recent Swiss central back action? Some speculate that it is a bold escalation of an already “boiling” currencies manipulations or battles.”…

When Shale Goes Subprime

Dave Gonigam

The 5 Min. Forecast

And so it begins.

“U.S. Steel Corp. said it will idle plants in Ohio and Texas and lay off 756 workers,” reports this morning’s Wall Street Journal, “becoming one of the first big U.S. industrial casualties of the recent collapse in global oil prices. Both factories make steel pipe and tube for energy exploration and drilling.”

Most of the jobs are being cut in Lorain, Ohio. “What appeared just a few short weeks ago as being a productive year, [with new hires in December and extra turns going on] has most abruptly turned sour,” said a letter from the president of the union local.

Overnight Brent crude prices slipped below $50 a barrel. They’ve recovered a bit since. Ditto for West Texas Intermediate, $48.38 as we write.

“The oil collapse is going to cause far more pain than most people seem to realize,” ventures our Chris Mayer.

“If history is any guide, there will be no quick recovery. And the effects will go well beyond just oil stocks.

“The oil bust will sting banks that lent freely to the oil patch.” That’s what happened three decades ago. Oklahoma’s Penn Square Bank failed in 1982… which snowballed into the 1984 failure of Continental Illinois, the biggest U.S. bank bust up until the Panic of 2008. (Indeed, the modern bailout got its start with Continental Illinois, as The 5 chronicled last year.)

This time around, “the latest energy boom needed a lot of money to build out infrastructure and drill wells,” Chris explains. “Lenders happily funded these efforts. Such loans were often made assuming $80 oil. Many of these loans were riskier high-yield bonds, or junk bonds. A JPMorgan analyst estimated if oil stayed below $65 a barrel, then 40% of all energy junk bonds could wind up in default.

“Most oil companies have hedges in place for 2015, meaning they’ve locked in higher oil prices. But even conservative energy companies will see their hedges expire in 2016 and could run into trouble.”

Vulnerable banks identified by SNL Financial include Comerica… International Bancshares… and ViewPoint Financial. “This makes for a good list of stocks to avoid,” says Chris, “or at least be careful about.

“It’s not just loans to energy firms that bite back,” Chris goes on.

Again the ’80s are instructive: “Oil patch banks got stuck with real estate debt that the oil boom supported,” he explains. “The same thing could happen again. Hotels, retailers and homebuilders with energy exposure could all suffer. KB Home, for instance, generates 30% of its sales from Texas.

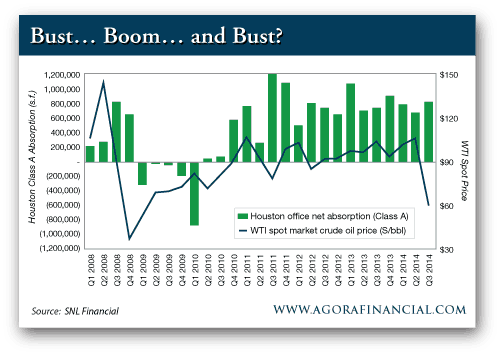

“Houston is at the center of this energy ecosystem. You can clearly see the impact of oil prices in its real estate statistics. Much like the tree rings of an oak, they mark the lean and flush years. Net absorption, for example, tells you how many square feet the market leases each year. The chart below gives you a look at office space. You can see the last time the price of oil fell a bunch — in 2008. Absorption went negative. Meaning the amount of empty space went up.

“Property companies with big exposure to Houston include: EastGroup Properties, Cousins Properties and Parkway Properties,” says Chris. “It’s going to be a tough 2015 for them unless oil makes a quick reversal.”

Footnote: Nearly 20% of the workers U.S. Steel is letting go are based in Houston.

It’s at this moment we pause to consider an uncomfortable thought: Perhaps the boom in America’s shale patch — a meaningful part of it, anyway — was a big hairball of malinvestment.

“Malinvestment”: Near as we can tell, this delicious English-language word was coined by the Austrian School economists of the 20th century — Mises, Hayek, Rothbard. Malinvestment is the flow of capital into places where no sane person would ordinarily put it — were it not for the stupidity of central bankers and their easy-money policies.

The Federal Reserve’s easy money delivered us the dot-com bubble in the late ’90s and the housing bubble of the mid-2000s. Malinvestment.

How much of the shale boom might have happened if the Federal Reserve hadn’t been keeping its thumb on interest rates the last six years? How much exploration and drilling took place simply because explorers and drillers could borrow cheaply?

Or to put it in more stark terms: Were $17-an-hour Wal-Mart greeters in North Dakota the embodiment of a newfound American prosperity… or a sign something was profoundly wrong?

We’re not prepared to say it’s an either-or proposition. No doubt good old American know-how played a role in the boom… and we won’t rule out connivance between Washington and the Saudi Arabian princes playing a role in the bust. But we’d be remiss to ignore the malinvestment question…

“The combination of easy money from the Fed with high oil prices (arguably caused by the former) led to massive malinvestment in the shale industry that now must be unwound,” asserts our acquaintance Erik Townsend — a hedge fund manager who trades oil futures.

Erik says much of the problem lies in the kind of trades shale producers used to hedge their production — called “three-way collars.”

If you want to dive into the details of how these trades work, check out today’s Overtime briefing, below. In the meantime, here’s the bottom line: “We needed $60 crude to hold to avoid an outright crisis in high-yield credit issued by shale drillers, and it didn’t. Now we’re going to have an outright bloodbath… I expect $40 Brent before this is over, and the risk of credit contagion on the scale of subprime mortgages is very real.”

Erik then picks up a theme we touched on Monday: “Shale drillers are going to lay down a LOT of rigs and stop drilling. This will lead to supply destruction. Then the price of oil will go to the moon and it will be time to restart the shale revolution.”

But the story doesn’t end there: “High-yield debt issues from shale drillers will have exactly the same connotation as ‘subprime-backed CDOs’ had in 2009,” Erik explains. “You won’t be able to sell the stuff for half what it’s worth just because of the stigma. Where’s the money going to come from to re-start the shale revolution?”

It won’t come from the banks; they’ll be too gun-shy to lend to the smaller players. So those smaller players will have to issue new shares if they want to raise money.

“That may occur in a significantly depressed equity environment compared with today,” says Erik. “The result — oil prices keep screaming higher, as the easy-money policies that enabled the last round of the shale ‘revolution’ aren’t there this time.”

What if the Federal Reserve resumes “quantitative easing” and steps on the monetary gas pedal? Erik won’t rule it out. “But investors who get nailed by the coming wave of high-yield defaults will still have the taste of blood in their mouths, and will still be reluctant to buy more debt issued by the shale patch.

“This all sets up for a MAJOR resurgence of inflation a couple years down the pike, led by an oil price spike.”

Deflation Strikes the Eurozone

Brad Hoppmann

Uncommon Wisdom Daily

Folks in the Eurozone can stop wondering if deflation will strike their economies. Deflation isn’t coming. It’s here.

Today, Eurostat confirmed that consumer prices in the common currency area dropped 0.2% in 2014. With fuel prices still dropping, experts expect more of the same in 2015.

We’re all familiar with inflation. We don’t know as much about deflation. Today, we’ll look at the difference.

Inflation is easy to understand; it means prices are generally rising. There might be exceptions here and there, but the cost of most goods and services is going up.

Deflation is the opposite condition, in which prices are generally falling.

Both inflation and deflation are actually symptoms of an underlying disease. The real problems are fractional reserve banking and monetary manipulation. While those are interesting subjects, today I want to think about the way deflation “feels.“

People and businesses usually respond to economic incentives. If the price of something you want is rising, you will probably buy it as soon as possible. If the price is falling, you will more likely wait.

Those simple, individual decisions can add up to economic chaos. Under deflation, a country’s economy will halt. No one wants to buy anything, even if he has money.

Sellers respond to low demand by reducing prices, which cuts their own income and reduces overall spending even further. This vicious cycle is painful for everyone.

One group does benefit from deflation, though. Lenders can prosper because they are receiving debt payments in a currency with more spending power than the one they originally loaned.

On the other hand, borrowers with no money might fall behind on payments. In that case, the lender’s incentive is to foreclose and seize collateral as soon as possible, before it loses even more of its value.

Europe has been dealing with deflation in a small way for several years. Now, it’s getting worse. The European Central Bank apparently wants to respond with quantitative easing, much like the Federal Reserve’s bond-buying program that ended last year.

People can argue whether QE helped the American economy. Even if it did, it still took years to make a difference.

So good luck, Europe. You’re going to need it.

Patience, Foresight, and Courage

By Tom Fyler

EssentialsInvesting.com

January 22, 2014

The following are a few thoughts for investors to consider when planning investment strategies for 2015 and beyond.

For those that have questioned government and Federal Reserve policies and strategies—and the legitimacy of various market and asset valuations, now just might be the time that your sense, analysis and insights are bearing fruition. Your perspective and foresight–prudently considered, meticulously planned and timely executed—with the benefit of experience and knowledge, might just provide you with an advantage in the coming years to generous opportunities in the management of your wealth.

It is possibly “Game On” now as you seek and find discounted values in the midst of the “rubble” of broken economies, fiscally sense-less governments, and manipulated markets and assets to which the “chickens have come home to roost.”

Waiting for “The” or “A” Crash

Don’t wait—we are in a “crashing”. In most cases, a crash is not a single event but rather a series of substantial assets devaluations that over time, when we look back, are viewed as a crash. The most recent asset to “crash” or significantly decline is oil. It has devalued by more than 57% in six months. Natural gas has declined 44% since May 2014. Silver has declined by 66% since 2011. How about the declines of other commodities: copper down over 17% in six months; sugar down 38% in eight months; nickel down 35% in seven months. Various countries’ equities have declined significantly: Brazil minus 56% since 2010; emerging markets minus 23% since 2011; Russia minus 54% since February 2013; Mexico minus 45% since March 2013. Based on a trend of these and other asset devaluations, there is certainly the possibility that other assets will follow. (Historical results or trends are not necessarily an indicator of future performance. Some of the cited asset performance information is approximate. Cited performance data was derived from: Oil as represented by WTI Crude Oil–New York Mercantile Exchange [NYMEX] @CL.1; Natural Gas—NYMEX: NGG15; Silver–iShares Silver Trust symbol SLV; Copper–Exchange-Traded Note [ETN]: JJC; Sugar–ETN: SGG; Nickel–ETN: JJN; Brazil–Exchange-Traded Fund [ETF]: EWZ; Russia–ETF: ERUS; Mexico–Closed-End Fund: MXF.)

Buying REALLY Low

Conventional wisdom suggests that the best time to buy is when an asset’s value is low—i.e. “Buy Low, Sell High.” But an asset looks the worst when it is low. And the bottom is never known without or until the benefit of hindsight. So low may be low, but still not near a bottom. Investing in an asset when it is “ugly” in performance is a scary and a risky proposition for investors. So it takes courage and foresight to buy low. It also takes a measured and prudent plan when buying declining assets that is designed to help mitigate the risk of an uncertain asset bottom value. Such a strategy should be only used for an appropriate limited portion of an investment portfolio. And it normally takes time and patience for these assets to substantially appreciate. But the wait—in many historical instances, has been worth it more times than not. For example, the recent decline in oil price brings to mind a previous period when oil declined substantially in 2008 and 2009. As measured by the ETF: OIL, it hit a low in March 2009 and two years and one month later it had risen 66%. (Some investment strategies may not be appropriate for all investors. There is no guarantee that any investment strategy or plan will result in a gain and may result in a loss.)

Commodities Don’t Lie

The great characteristic of commodities is their valuation relationship to “supply and demand.” We all learned in school that as demand increases against low supply, the asset’s valuation will increase. And as demand decreases against high supply, the asset’s valuation will decrease. In the end, this dynamic more times than not will prevail. Thus, the trend or movement of the value of commodity assets will eventually be reflected in the trend or movement of the values in any goods or services underlayed or impacted by a commodity—which is virtually most goods and services. And it is of course goods and services that are produced or provided by companies, and the valuation of these goods and services—influenced by commodity valuations, that will eventually reflect these companies’ equity or stock valuations. Economies and equity markets rise and fall on commodity valuations. To the contrary, asset valuation strategies or policies such as Fed stimulus, stock buybacks, manipulation of interest rates, currency devaluations, excessive government spending and debt, are all manipulated asset valuation “lies.” Thus, the negative performance or trend of commodity valuations many times may serve as the “Canary in the Coal Mine” warning of other assets devaluations to come. Learn to be a “Commodities Whisperer”, or at least know one.

“Crash Strategy” Recommendations—Investment industry regulations do not allow specific investing strategies to be recommended in public information. Interest in strategies appropriate to personal circumstances and risk sensitivity, or any questions, may be directed to Tom Fyler at email address fyler@tiac.net.

Mr. Fyler is President of Commodities & Securities, Inc., a firm registered as a Commodity Trading Advisor with the Commodity Futures Trading Commission (CFTC) and a Member of the National Futures Association (NFA), and a Registered Investment Advisor. Mr. Fyler is also licensed in real estate.

Risk Disclosure: This communication is for informational purposes only and should not be construed as containing or providing specific investment or financial advice. Information provided in this communication should be understood as the analysis and/or opinion of the author. Readers should be aware that there is risk of loss of some or all funds when investing in stocks, bonds, mutual funds, ETFs, real estate, commodities and/or currencies, any of which may not be appropriate for all investors. Readers should consult directly with financial professionals for advice appropriate to personal financial circumstances.

10 STEPS TO AVOID THE CRASH

We have less than 9 months before September. We all need to prepare as much as possible so we can weather the coming storm. I wrote the FREE guide '10 Steps To Avoid The Crash' to help you survive and even thrive through the coming collapse, which is well under way. If you haven’t already downloaded a copy of the e-book, please do so because it covers ten steps you must carry out if you are to survive and even prosper during the collapse. It contains some great information relating to gold and how the gold market has been manipulated to stave off the crash of the American Dollar. This information is essential if you are considering buying gold and silver. The guide extensively talks about why you need to get out of debt, get out of paper assets as well as pay off your house mortgage. It also discusses why you need to store food, water and defensive equipment, why you need to get out of the city and purchase everything you need. The e-book also covers sorting out your medicine cabinet, which took many aspects of Pastor Williams’ DVD “Healing the Elite Way”, which is also essential viewing. Most importantly it talks about getting your spiritual house in order. Please print '10 Steps To Avoid The Crash' and share it with your friends and family.

In Celebration of Lindsey Williams 01/12/36 – 01/23/23

“I have fought a good fight, I have finished my course, I have kept the faith.” – Lindsey Williams In Celebration of LINDSEY WILLIAMS January 12, 1936 – January 23, 2023 On Saturday, April 1, 2023, at FBC Fountain Hills dba Cornerstone Family Church in Fountain Hills, Arizona, there was a special Memorial service in celebration of […]

Pastor Lindsey Williams – At Bio Care Hospital – Getting Over COVID

This is part 11 of a series of 12 informative videos on how to cope with all the damage COVID brings. Where Pastor Lindsey Williams interviews Rodrigo Rodriguez, MD, founder of BioCare Hospital and Wellness Center. Call BioCare Now: 1-800-262-0212 Website: International BioCare Hospital and Wellness Center Pastor Lindsey Williams Hi, this is Lindsey Williams. […]

Pastor Lindsey Williams – At Bio Care Hospital – COVID and Supplements

This is part 10 of a series of 12 informative videos on how to cope with all the damage COVID brings. Where Pastor Lindsey Williams interviews Rodrigo Rodriguez, MD, founder of BioCare Hospital and Wellness Center. Call BioCare Now: 1-800-262-0212 Website: International BioCare Hospital and Wellness Center Pastor Lindsey Williams Hi, this is Lindsey Williams. […]

Not all the Elite may like this, but it appears this is Obama’s end game plan to crash crude down to $20 in the near term. I can hear the subprime fracking loans snapping on $20 @ barrel market. http://www.zerohedge.com/news/2015-03-30/20-oil-looms-iran-nuclear-deal-nears-deadline

I really do feel like we’re getting closer and closer to something big.

This AIIB bank is a huge change, closer and closer to the end of the dollar.

You know I’ve been anticipating a calamity for so long, I’ll probably be one of the last people to believe it’s actually happening. Just prepare and wait I guess.

IMF News – Christine Lagarde Chinese Yuan SDR Inclusion

https://www.youtube.com/watch?v=acYBJM4nq8U

IMF, LA GAURDE. “Seven years of plenty, seven years of want”. MC DONALDS Us dollar cup for $1.00 displays seven years full, seven years of STARVATION, on their cup design. Oligarch MC donalds declares, through their $1.00 any drink advertisement, that we do, or will (the masses) say, I (We be) LOVING IT, but WE, OBVIOUSLY, Do NOT!!!

Forbes article Mar 26, 2015, Feds lowers target for 2016, but ready to raise short term interest rates, first projected rate hike, possibly as early as May 1, 2015, (charted), more likely on June 17, 2015, 0.25, increments to 0.75 by end of year, 2 per cent, by 2016, definitely a must read. http://www.forbes.com/sites/advisor/2015/03/26/fed-lowers-target-for-2016-but-ready-to-start-raising-rates-this-year/

They’re bluffing. The economic data from retail sales to durable goods to real estate to global trade is already weak on top of a strong dollar- no way they’ll raise unless they really are ready to blow the system.

http://www.zerohedge.com/news/2015-03-25/us-hegemony-dollar-dominance-are-officially-dead-china-scores-overwhelming-victory-b

Looks like another prediction is about to come true for LW: http://www.zerohedge.com/news/2015-03-25/armed-us-weapons-yemen-rebels-advance-president-saudi-arabia-prepares-war

I wonder what the next step will be now this major step towards de-dollarization is in the history books.

http://www.zerohedge.com/news/2015-03-22/washington-blinks-will-seek-partnership-china-led-development-bank

Walid Shoebat is a Palestinian born ex PLO muslim who has converted and become a Christian. After being challenged on his beliefs, he put aside a year to study and compare the Bible with the koran. This brought him the light of truth causing his conversion to Christianity. Because his native language is arabic and the koran being written in arabic, it gave him a unique and clear insight into a window which western minds haven’t yet seen. He is now teaching and speaking throughout the U.S. including to muslims stating the anti-christ is here and is islam. He says the anti-christ figurehead/leader will rise out of Turkey:

https://www.youtube.com/watch?v=Zhp7Qaj5NSU

Additional link regarding Walid Shoebat’s teaching:

https://www.youtube.com/watch?v=p5JEpxHqEIg

Ezekiel 8:14

Then he brought me to the door of the gate of the Lord’s house which was toward the north; and, behold, there sat women weeping for Tammuz.

Interesting? all this talk of blood moons and such I thought this was of note maybe. The first of Tammuz on the Hebrew calendar starts the evening of June 17. Hmm the FOMC meeting announcement is when? oh 1400 on Wednesday 17 of June.

Are the Elite now covering themselves and joining the Chinese version of the IMF/WB? http://www.zerohedge.com/news/2015-03-19/de-dollarization-accelerates-more-washingtons-allies-defect-china-led-bank

http://www.zerohedge.com/news/2015-03-20/us-cold-ally-japan-considers-joining-china-led-bank

Rumors about FED interest rise in June…

http://fortune.com/2015/03/17/federal-reserve-interest-rate-hike/

Every people, every CHURCH, should stock up on food, NOW !

TRADE WARS!!!

Please listen! Every being, every living soul, on this planet, must understand, the importance of having food on their table! You have been starved, replenished, according to your currency, and warned, NOW, everyone must prepare, even so called RICH nations, for the inevitable, STARVATION, that will result, especially, USED TO BE RICH, western markets THAT ARE NOW DRY and will not produce fruit! EVERYONE, EVERY NATION, MUST GET SERIOUS ABOUT HAVING FOOD! !! AND HOW YOU ARE GOING TO GET IT!!! The time is coming when you will soon be cut off! PREPARE!

read Amos 8:11 in a king james bible. The famine in the end time is not for bread and water buy for hearing the word of GOD.

There are more and more visions being received by people from our Lord confirming His return is very very close. A vision received a few days ago by a reverend:

https://www.youtube.com/watch?v=oyIPotTL0yQ

People will drag themselves out of bed day after day to make a little money to save what they can then ignore all things financial while handing it over to a financial institution (banks) which have a proven track record of lies corruption crime witholding funds etc yet they put the hard earned money into their hands and watch football instead of taking any interest in anything financial lol… CAN IT BE ANY MORE STUPID???? IGNORANCE IS NO DEFENCE!!! THEY ARE ALL MAD!!!

Lindsey

So is the elite trying to put someone that they approve? This isnot only on this site but even cnbc hada article on this.

http://www.allnewspipeline.com/Coup_v_Putin_The_Big_Blood.php

Also is the kingdom getting ready to go? Are the elite getting ready to take oil price up.

https://ca.news.yahoo.com/u-embassy-saudi-arabia-heightened-security-223602772.html

These are two very interesting thingss considering the Debt limit Monday, elections on tuesday, Fed meeting on wednesday, and once in 100,000 year event over the north pole. The third solar eclipse in the tetrad yes has never happebed before. Not only is this the first solar eclipse over the north pole but it happens on the first day of the Jewish spiritual year Nisan 1.

1 John 5:1-7

News that the Chinese economy is cracking. Analysts in this discussion advised the key risk to the Chinese economy is bank failure and their debt problem 1:05:00:

https://www.youtube.com/watch?v=C2SStFt-k_A

It seems the elite have commenced broadcasting more fervently their forewarning of collapse to the masses through various media channels so they adhere to their ‘code of ethics’ that Pastor has talked about.

Well then if people don’t listen they shoulder some of the blame. If the person who is about to stab you comes at you with a knife warning you “i’m gonna stab you” and you carry on watching tv laughing about it thinking it aint gonna happen… when they get stabbed the aggressor is committing the crime but the stupidity of the idiot who just sat there has to be taken into account in the final analysis. The elite are telling us all through the zombiebox (tv news etc)… you just cannot help people who wont be helped. Stay awake.